The Nasdaq rallied to yet another record high Tuesday. It is up over 16 percent since early October. Shorts are leaving, but not in droves. Since the end of September, Nasdaq short interest is down 1.8 percent, and remains elevated. This is a potential tailwind for longs.

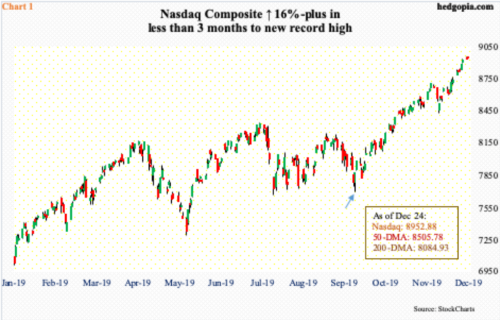

Tech bulls are on a rampage – sort of. With four sessions left this month, the Nasdaq Composite is up 3.3 percent. This will be a fourth consecutive positive month. For the year, the index is up 35 percent. As a matter of fact, in less than three months since early October (arrow in Chart 1), it has rallied in excess of 16 percent.

Conditions are extended, but momentum is yet to break. The daily RSI, for instance, closed Tuesday at 78.2, and the weekly at 73.7, with the monthly just a point from printing 70. In a true ‘momentum begets momentum’ fashion, the daily for the last several sessions has rallied all along the upper Bollinger band. Major moving averages, including short-term, are all rising.

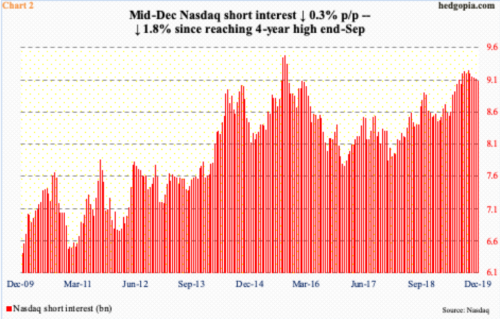

In this environment, shorts face a dilemma. Should they cover, add to their holdings or stay put? Leading up to the end-September high of 9.25 billion shares – a four-year high – Nasdaq short interest persistently rose (Chart 2). Shorts obviously were not convinced the rally was for real. Since that high, short interest has dropped in every period, for a cumulative drop of 1.8 percent, which in the big scheme of things is not that much.

In a perfect scenario for longs, the red bars continue lower, and this should nothing but act as one of the sources of tailwind. The longer bears are unable to poke a hole in the prevailing momentum, the pressure to cover rises. Even if this scenario were not to unfold in its entirety, the advantage bulls have is the elevated nature of short interest. Because they have been wrong for so long, it is possible shorts at least for the time being will be interested in quickly taking advantage of drops – particularly near support.

Thanks for reading!