Tech is on fire. In less than two months, the Nasdaq is up north of 12 percent, and up nearly 40 percent in 11 months. Bears, who for a while now have doubted the sustainability of this move, have helped, and may continue to do so in the right circumstances for bulls.

Year-to-date, the Nasdaq Composite (8647.93) is up just over 30 percent, and up just under 40 percent since the lows of last December (arrow in Chart 1). The most recent rally began early October (blue arrow) when the index successfully tested the 200-day moving average, rallying north of 12 percent from that low.

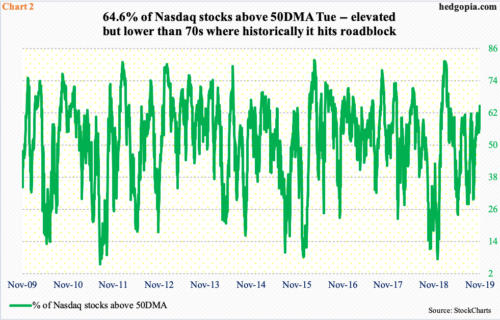

Participation is decent. Tuesday, 64.6 percent of Nasdaq stocks were above their 50-day – an eight-month high. Early October, this had gone down to 29.6 percent. Several times in the past, this metric has shown a tendency to peak in low 70s. In the right circumstances for bulls, this can continue to push higher. At least they hope so.

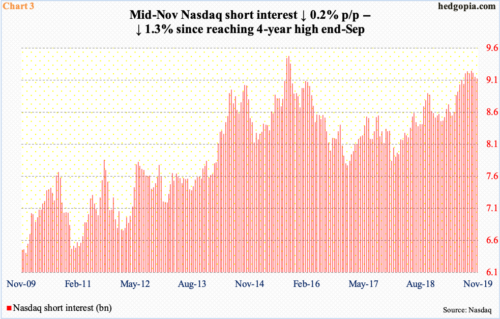

All along – in fact, for a while now – bears have doubted the sustainability of the rally. Most recently, Nasdaq short interest bottomed at 8.55 billion shares at the end of April. In the next five months (that is, as of end-September), this had risen to 9.25 billion – a four-year high. Since then, short interest fell in all three periods (data is published twice a month), for a cumulative decline of 1.3 percent, to 9.13 billion. As mentioned earlier, the index rallied strongly in the last couple of months. Some level of squeeze has occurred. This is what bulls were – and are – hoping for, and given how elevated short interest is, there is room for more if they had their way.

The index has just about gone parabolic since early October. Several metrics are extended, with the daily RSI just under 73 on Tuesday. But this in and of itself does not mean unwinding of overbought conditions should begin right here and now. Overbought can remain overbought longer than shorts in particular are ready for. The index continues to trade above shorter-term averages. The last time it traded under the 10-day was seven weeks ago. This is the disadvantage shorts face right now. Until momentum shifts their way, squeeze risks remain.

Thanks for reading!