- Revised 2Q14 U.S. GDP estimates revived hopes of capX revival

- U.S. corporates have continued to disappoint as relates to adding capital

- NFIB capX plans in September show why that is not likely to change anytime soon

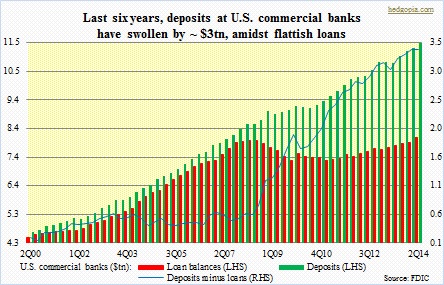

When the preliminary estimates of 2Q14 U.S. GDP were published early September, numbers relating to business capital spending were revised higher, reviving hopes of capX revival. This followed earlier discussion on this blog of the relationships among corporate yields, manufacturing and business capX, putting forth a view that if correlation among these variables held then capX was set to rise. Back then, data was pointing to softening in the PMI until year-end followed by a pickup next year. This blog has had a less optimistic view on this topic. The inaugural blog back in April argued that escape-velocity proponents were setting themselves up for disappointment. With the recognition that the crosscurrents at play in the U.S. economy are simply too strong, hence the need to also have an open mind. Job creation has been healthy particularly this year. So who knows if capX is next?  Then came September. We discussed Tuesday as to why Microchip’s 3Q14 earnings warning had the potential to become a canary in the coal (semi?) mine. Now we learn that retail sales were weaker than expected in the month. True, this is a volatile data series with monthly swings, nevertheless data was weaker than expected. Ebbs and flows have been the hallmark of this post-financial crisis recovery. Things have shown improvement in fits and starts. On Tuesday, we got one more data confirming this trend. The chart above shows how U.S. small businesses are planning for the future as relates to compensation and capX. The September survey was not something capX-revival-is-just-around-the-corner proponents would have liked to see. National Federation of Independent Business capX plans dropped five points to a 20-month low, matching June’s 22. Their capX plans have gone sideways the past two years, bouncing up and down along the way. Interestingly, comp plans in contrast have risen from nine to 15 during the period. The gap between comp and capX plans continued to widen, continuing to raise hopes that faster earnings growth awaits U.S. employees. No such luck when it comes to capX, however.

Then came September. We discussed Tuesday as to why Microchip’s 3Q14 earnings warning had the potential to become a canary in the coal (semi?) mine. Now we learn that retail sales were weaker than expected in the month. True, this is a volatile data series with monthly swings, nevertheless data was weaker than expected. Ebbs and flows have been the hallmark of this post-financial crisis recovery. Things have shown improvement in fits and starts. On Tuesday, we got one more data confirming this trend. The chart above shows how U.S. small businesses are planning for the future as relates to compensation and capX. The September survey was not something capX-revival-is-just-around-the-corner proponents would have liked to see. National Federation of Independent Business capX plans dropped five points to a 20-month low, matching June’s 22. Their capX plans have gone sideways the past two years, bouncing up and down along the way. Interestingly, comp plans in contrast have risen from nine to 15 during the period. The gap between comp and capX plans continued to widen, continuing to raise hopes that faster earnings growth awaits U.S. employees. No such luck when it comes to capX, however.

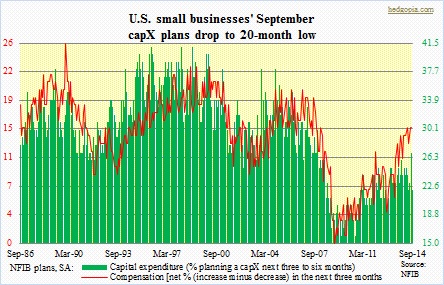

The problem is the chart below. It shows deposits at U.S. commercial banks versus loan balances, and it is a problematic picture. Deposits are surging, loans are not. There is not enough demand for the latter.