US corporations continue to aggressively issue debt in the bond market. Even amidst this supply, demand remains good. Both LQD and HYG are near their record highs. Besides the Fed essentially acting as a backstop, corporate boards are probably also eyeing an economy that is ready to get back to normal next year.

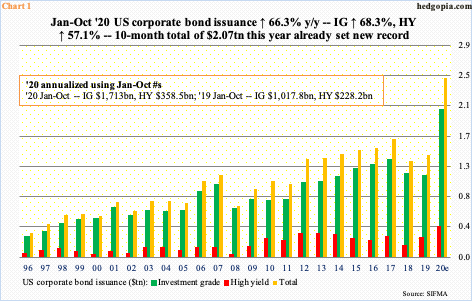

US corporations continue to issue bond at a frenzied pace. With two months to go this year, issuance already set a record. Through October, they have issued $2.07 trillion worth, well past the prior annual record of $1.64 trillion from 2017 (Chart 1). In fact, last year’s total was eclipsed in August itself – that is, in the first eight months. Such has been the enthusiasm among corporate boards to lever up this year.

If the 10-month pace holds up in November and December, issuance is on course for $2.49 trillion this year, up from $1.42 trillion in all of last year. Of the 10-month total, investment-grade accounted for $1.71 trillion, versus $1.14 trillion in all of last year, and high-yield $358.5 billion, versus $279 billion last year.

Rates are low, and corporations are taking advantage. Besides, the Fed started buying investment-grade corporate bonds in March and junk bonds in April. Investors have treated this as a backstop by the central bank.

Demand is solid.

In August, LQD (iShares iBoxx Investment Grade Corporate Bond ETF) posted a new intraday high of $138.48. Wednesday’s closing price of $135.06 is not that far away.

Similarly, HYG (iShares iBoxx High Yield Corporate Bond ETF) closed Wednesday at $85.73, within striking distance of the record high $86.90 that was reached on Monday.

As a matter of fact, HYG has broken out of nine-month resistance just north of $85 (Chart 2).

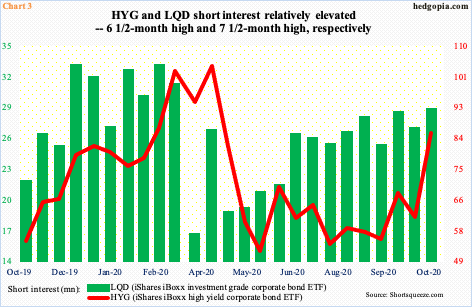

Month-to-date, HYG is up 2.6 percent. It is possible short squeeze played a role. End-October, short interest shot up 38.4 percent period-over-period to 85.6 million, which is the highest since mid-April (Chart 3).

LQD’s short interest has gone more or less sideways the last two and a half months, although at the end of October it was the highest since mid-March.

If HYG shorts got squeezed post-$85 breakout, then that level is worth watching. A retest is probably just a matter of time, and bulls need to be able to defend it. Even better if a retest attracts a new set of buyers. Post-Pfizer news early this week, there is a lot of talk around impending mass vaccination in the US next year. Investor willingness to own junk bonds at this stage can be taken to mean an economy that is expected to begin to get back to normal next year.

Thanks for reading!