- For second week running, hedge funds stayed net long VIX futures

- Three times since 2009 when this has happened, equities have gone on to rally

- Ideal scenario: SPX goes lower and successfully tests 1900, just in time for year-end rally

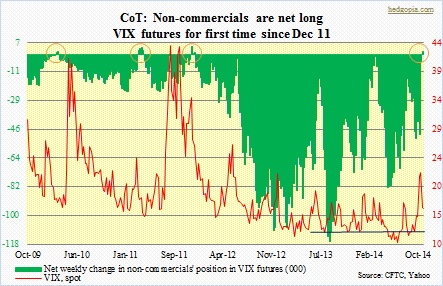

The adjacent chart was posted on October 28th. The related blog discussed how on October 21st large speculators switched into net longs VIX futures. This was the first time in nearly three years that they had been net long. In and of itself, from the perspective of spot VIX this should have been a bullish development, and by default negative for stocks. But as it turns out, at least going by three other occasions in the current bull market, this was more of a contrarian signal. As these traders went net long futures (brown-circled in the chart), spot VIX continued to roll over. Most recently, spot VIX peaked on October 15th and by the time these futures traders went net long, the volatility index was already on its way down. In all four instances, spot VIX peaked prior to the week in which non-commercials went net long. And in all three prior instances, as spot VIX peaked and came under more pressure, stocks went on to rally for at least a couple of months.

The adjacent chart was posted on October 28th. The related blog discussed how on October 21st large speculators switched into net longs VIX futures. This was the first time in nearly three years that they had been net long. In and of itself, from the perspective of spot VIX this should have been a bullish development, and by default negative for stocks. But as it turns out, at least going by three other occasions in the current bull market, this was more of a contrarian signal. As these traders went net long futures (brown-circled in the chart), spot VIX continued to roll over. Most recently, spot VIX peaked on October 15th and by the time these futures traders went net long, the volatility index was already on its way down. In all four instances, spot VIX peaked prior to the week in which non-commercials went net long. And in all three prior instances, as spot VIX peaked and came under more pressure, stocks went on to rally for at least a couple of months.

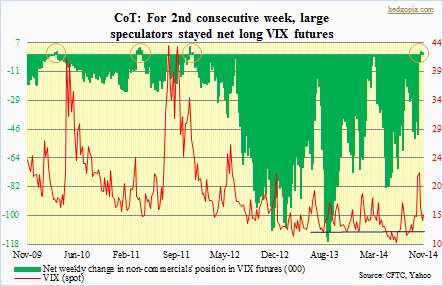

Here we are, a week later. The S&P 500 has gone on to notch another record high, and the VIX is lower (holding up well, though). The adjacent is an updated chart. Non-commercials cut back a little from the week before but remain net long. If both spot VIX and stocks follow the pattern established on the prior three occasions, then stocks are headed higher. After all, seasonality is in favor of stocks. And even though the Fed has ended QE, it has not stopped jawboning the market the moment equities come under some selling pressure. Be that as it may, things are not always this simple. Versus now and then, circumstances are different. Objectives are different. The Fed did not have as bloated a balance sheet then as it does now. The U.S. economy, in its sixth year of recovery, was not as mature, nor was the equity bull market. Between these confusing pros and cons, here is an ideal scenario. The S&P 500 goes lower from here and successfully tests the 1900 support. That would in turn lay a good foundation for an election-year, end-of-year rally. As discussed yesterday, spot VIX is indeed giving out signs that it wants to go lower near-term.

Here we are, a week later. The S&P 500 has gone on to notch another record high, and the VIX is lower (holding up well, though). The adjacent is an updated chart. Non-commercials cut back a little from the week before but remain net long. If both spot VIX and stocks follow the pattern established on the prior three occasions, then stocks are headed higher. After all, seasonality is in favor of stocks. And even though the Fed has ended QE, it has not stopped jawboning the market the moment equities come under some selling pressure. Be that as it may, things are not always this simple. Versus now and then, circumstances are different. Objectives are different. The Fed did not have as bloated a balance sheet then as it does now. The U.S. economy, in its sixth year of recovery, was not as mature, nor was the equity bull market. Between these confusing pros and cons, here is an ideal scenario. The S&P 500 goes lower from here and successfully tests the 1900 support. That would in turn lay a good foundation for an election-year, end-of-year rally. As discussed yesterday, spot VIX is indeed giving out signs that it wants to go lower near-term.