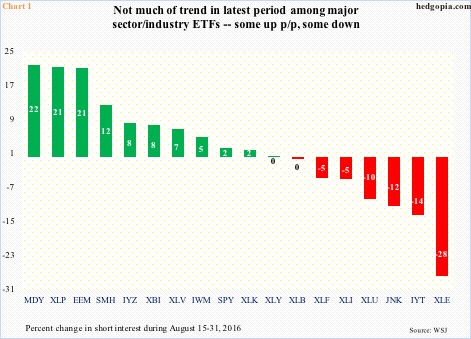

In the August 15-31 period, there was not much of a trend among major industry/sector ETFs, with nearly half down period-over-period and half up (Chart 1). The real story, however, lies in how short interest changed on an index level.

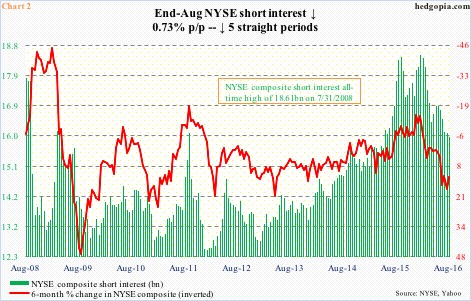

On the NYSE composite, short interest fell 0.73 percent p/p, even as the index was down 0.86 percent. Short interest has dropped for five straight periods on the NYSE (Chart 2).

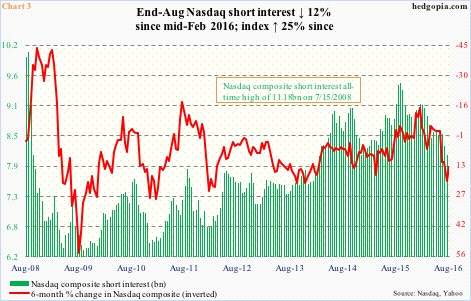

On the Nasdaq composite, it is the same trend. Short interest fell 1.6 percent between August 15 and 31. This was the fourth consecutive p/p decline. Shorts cut holdings in the latest period even as the index fell 0.93 percent.

At least going by how shorts were positioning themselves by the end of August, they were not anticipating the September 9th 2.5-percent sell-off in the Nasdaq composite. If anything, they were probably anticipating a breakout from the consolidation the index had been under since August 5.

In the August 15-31 period, Nasdaq short interest stood at just below eight billion (Chart 3). This is the first time since the end of February 2014 short interest dropped below that mark.

The bull-market peak in Nasdaq short interest was recorded at 9.48 billion at the end of September last year (Chart 3), coinciding with a bottom in the index. Later, short interest again peaked at 9.08 billion in the middle of February this year, once again coinciding with a bottom in the index; by the end of August, short interest was down 12 percent, with the index up north of 25 percent from that low.

Evidently, equity bulls owe a lot to shorts and their pessimism.

In this regard, in the latest reporting period, a drop in both the Nasdaq composite and the associated short interest is not what the bulls would like to see. Shorts have been dead right about bad fundamentals, but the so-called Fed put has persistently denied them of making a killing. They have been fighting it nonetheless. Bulls would want this to continue, which would mean a consistent source of squeeze … fight the wall of worry, so to speak.

But the recent trend of decline in short interest in the midst of sideways to down market is not conducive to the bullish case.

Thanks for reading!