In November, margin debt was up four percent m/m, even as the S&P 500 jumped 8.9 percent. The latter is up another 4.7 percent December-to-date. How margin debt behaves this month will be telling. Equity bulls will need investor willingness to take on credit make an aggressive comeback if the November-December momentum in stocks is to sustain itself next year.

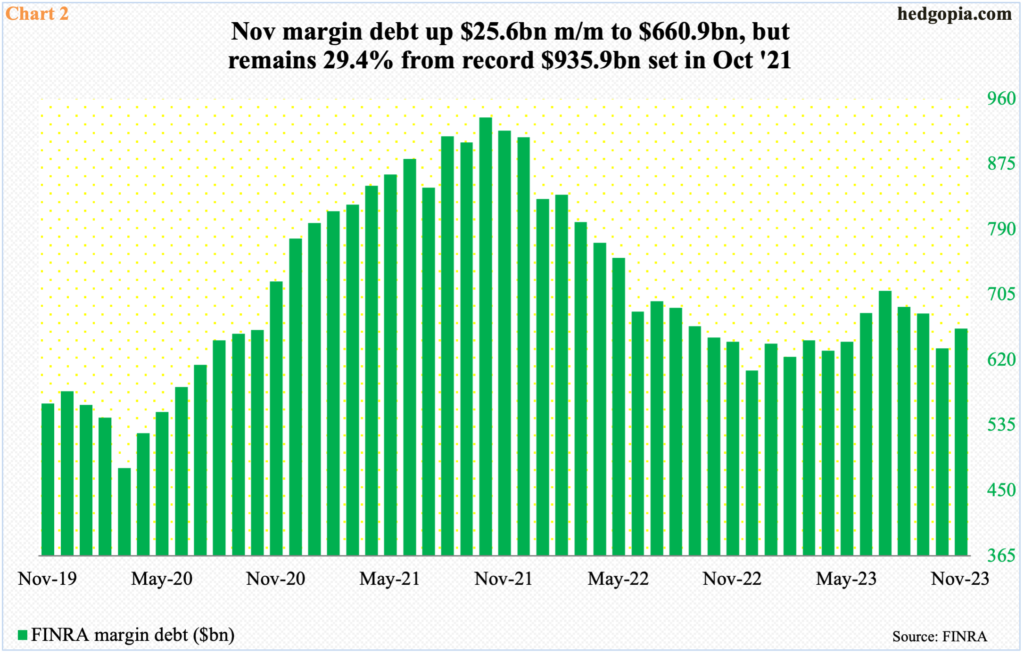

FINRA margin debt was up $25.6 billion month-over-month in November to $660.9 billion. This was the first monthly increase in four, having peaked at $709.8 billion in July.

In the first 11 months this year, margin debt rose 8.9 percent, or by $54.2 billion. Directionally, this is in line with the S&P 500, which rallied 19 percent through November. The index bottomed in October and jumped 8.9 percent in November. So, this too is in line with the November rise in margin debt.

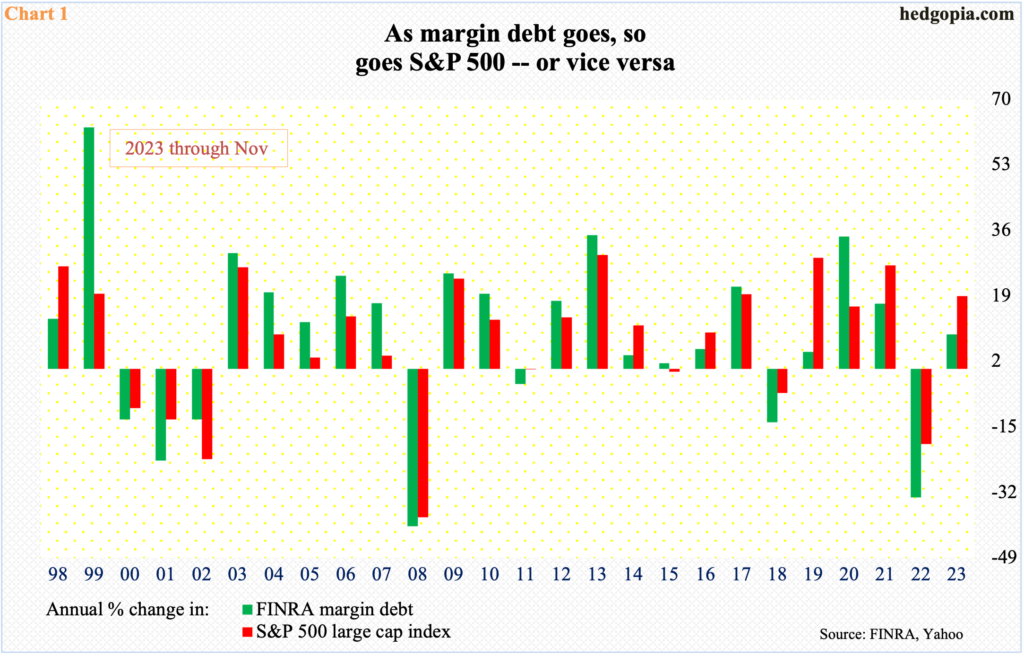

The large cap index and margin debt correlate well historically (Chart 1). This relationship has been maintained. This is good news for equity bulls, with a caveat.

At the end of November, the S&P 500 was 5.5 percent from its record high posted in January last year when it tagged 4819, while margin debt was 29.4 percent from its record set in October 2021 when it printed $935.9 billion (Chart 2). Measured by the willingness to take on leverage, longs were nowhere near how they felt 26 months ago.

Secondly, with one session to go this year, the S&P 500 is up another 4.7 percent in December. At Thursday’s close, the large cap index was merely 0.7 percent from the January 2022 peak. December’s margin debt is obviously not out yet, but once the numbers are out, it has a potential to be a tell. Margin debt needs to pick up steam this month. This will have signaled that November’s jump in the S&P 500 has changed the mindset of investors and that they are now more willing to take on credit. This is a must if equity bulls are to maintain the positive momentum witnessed in November and December. Else, this will only mean profit-taking is being deferred for next year for tax reasons.

Thanks for reading!