The 10-year T-yield has rallied to the upper end of a symmetrical triangle. A sustained breakout can have massive repercussions, as this may be a signal that bond vigilantes are finally demanding higher yields in the face of soaring federal debt/interest payments.

With a couple of sessions to go, the 10-year treasury yield is up 16 basis points this week to 4.62 percent. If these gains hold, this will be the second up week in a row after bond bears (on price) defended horizontal support at 4.3s three weeks ago (Chart 1).

The rates rallied big on Tuesday and Wednesday, propelled by a softer-than-expected auction for five-year treasury notes.

With this, the 10-year has now rallied to the upper trendline of a symmetrical triangle. This pattern represents a period of consolidation before either a breakout or a breakdown occurs. The upper trendline formed when the 10-year peaked last October at five percent (4.997 percent, to be exact), while the lower trendline goes back to the following December at 3.79 percent.

Earlier, the 10-year touched 3.25 percent in April 2023, 2.53 percent in August 2022, 1.13 percent in July 2021 and 0.4 percent in March 2020. The prevailing trend hence is up.

The low of 4.32 percent on the 16th (this month) was also a defense of the 200-day moving average. The rates are now above the 50-day as well. With the latest move, the daily is now in overbought territory, although the weekly – although overbought – seems to want to reverse higher. A sustained breakout will be a massive development in the bond world.

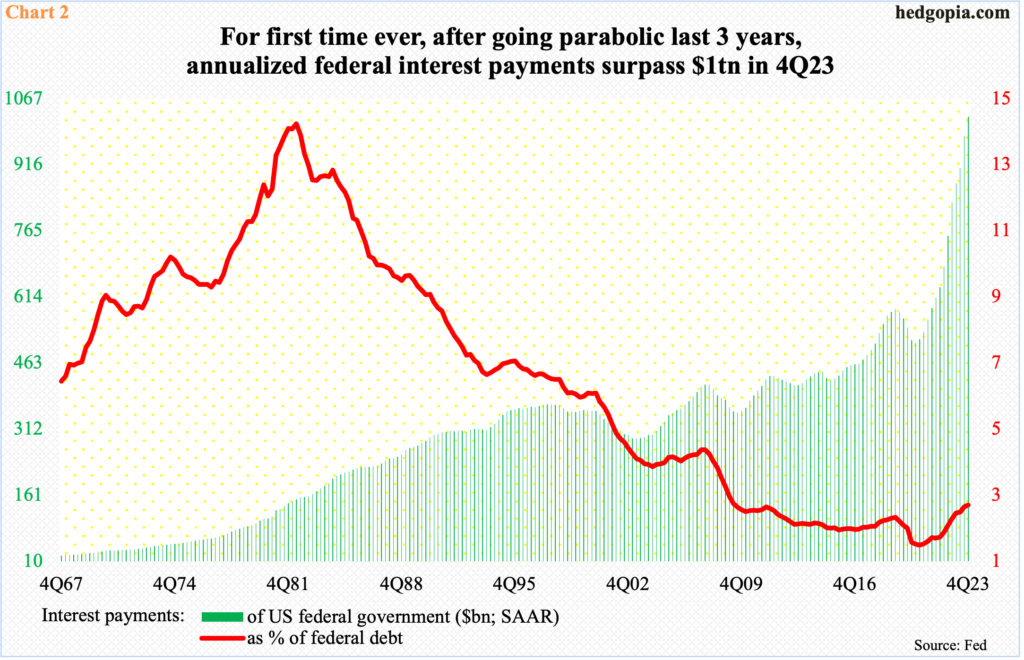

In this scenario, the big question is, if bond vigilantes are finally paying attention to Chart 2, which highlights the soaring interest payments of the federal government. In 4Q23, for the first time ever, these payments – at a seasonally adjusted annual rate – surpassed $1 trillion.

In three years, interest payments have gone vertical to more than double. This occurred because (1) federal debt is growing by leaps and bounds, and (2) interest rates have gone up since March 2022.

At the end of the fourth quarter, federal debt was $34 trillion, which has now hit $34.8 trillion – and growing. The debt load has doubled in a decade. This was manageable when the Federal Reserve kept interest rates ultra-low. But, in response to upward price and wage pressures, the central bank began to raise the fed funds rate in March 2022. Back then, these benchmark rates were left languished between zero and 25 basis points. Now, they are in a range of 525 basis points to 550 basis points, with the last hike occurring last July.

Persistent strength in jobs and sticky inflation have stopped the Fed from cutting rates. Late last year or early this year, futures traders were expecting up to seven 25-basis-point cuts this year; this has now dwindled to one.

Higher rates mean higher interest payments, with the federal government continuing to run a budget deficit even at a time of decent economic growth. Thus far, the bond market has not revolted, demanding higher yields. It will at some point, as the red ink continues and as debt continues to accumulate.

Hence the significance of how the 10-year behaves in the weeks ahead. It is too soon to say if this week’s auction marks the beginning of a revolt, but whenever that day is, these things do not come with a warning.

Thanks for reading!