Unlike in the past when equities have shown a strong correlation with each other, increasingly they are marching to the tunes of different drummers.

Consider the DJI. It has flat-lined for five months now, and it feels like it is itching to push higher. A breakout here in all probability will be followed by more technical buying; if nothing else, stops will be taken out. Of course, it is debatable if that breakout would be used as an opportunity to unload or would act as strong support for the next leg higher. Odds are rising a breakout – should there be one – would be sold.

The SPX, on the other hand, does not act as strong, but is holding its own. It has gone sideways for two months now, and is near its all-time highs. Typically, it is only a matter of time before that resistance is taken out. But this is not one of those typical times. There is an ongoing shift from growth into value, and that is helping both indices. The Nasdaq is the total opposite of the two. Incidentally, as old as this bull market is, an aggressive shift away from momentum and growth at this stage of the game is indicative of investor nervousness currently palpable.

The SPX, on the other hand, does not act as strong, but is holding its own. It has gone sideways for two months now, and is near its all-time highs. Typically, it is only a matter of time before that resistance is taken out. But this is not one of those typical times. There is an ongoing shift from growth into value, and that is helping both indices. The Nasdaq is the total opposite of the two. Incidentally, as old as this bull market is, an aggressive shift away from momentum and growth at this stage of the game is indicative of investor nervousness currently palpable.

The tech-heavy index acts very poor. In the five weeks beginning early March, it quickly shed 10 percent, has recovered some of that loss, but is still down about seven percent. The RUT is the same way – down 10 percent, and trying to stage a rally currently. So depending on which index one looks at, some are overbought, others are oversold and yet others are about in the middle.

In the mid- to long-term, conditions are way overbought, and they need to be unwound. Near-term, though, the overall direction will probably be decided by which of the major indices is able to lead and whether or not that would influence the others. Either the Nasdaq/RUT rally and bring the SPX/DJI along for the ride. In this scenario, the latter two will soon register new highs. Or, the SPX/DJI once again struggle at the resistance, and the Nasdaq/RUT weaken further.

Plenty of confusion!

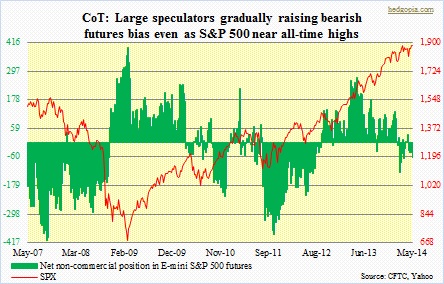

Nowhere is this probably more evident than in the latest Commitment of Traders futures report. As the first chart shows, non-commercials have continued to add to their overall bearish bias on the SPX by both cutting longs and adding shorts. They were net long throughout 2013, and went net short toward the end of January. This is probably just the beginning of a trend.

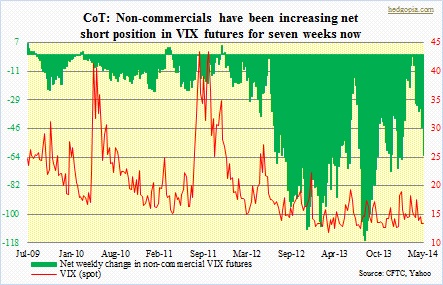

Over at the VIX, the message is slightly different, although it could be very short-term in nature. It should be noted that it continues to bounce up and down along the bottom end of its range, and a move higher from here has always created problem for equities. Currently though, large speculators the last eight weeks have consistently added to their net short position. They have done so by adding shorts, while keeping their longs flat. So the message is not universally bearish, nevertheless runs in contrast with what is coming out of the SPX.

Over at the VIX, the message is slightly different, although it could be very short-term in nature. It should be noted that it continues to bounce up and down along the bottom end of its range, and a move higher from here has always created problem for equities. Currently though, large speculators the last eight weeks have consistently added to their net short position. They have done so by adding shorts, while keeping their longs flat. So the message is not universally bearish, nevertheless runs in contrast with what is coming out of the SPX.

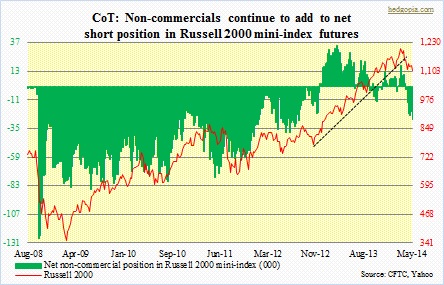

The VIX message is also not consistent with what is being broadcast out of the RUT pit. Non-commercials began to go net short at the beginning of April, and the buildup has continued, though at a modest pace. Once again, it increasingly feels like it is a trend change. The late-2012 trendline has been broken on the RUT. We can take solace in the fact that that same trendline is so far intact on the Nasdaq, but it is just a matter of time before that is broken and the heretofore-stable SPX/DJI get infected.