An overbought market that increasingly looked fatigued used Thursday’s NVDA-ignited early pop as an opportunity to lock in gains. After this intraday reversal, bulls are running out of catalysts – for now.

On the 15th (this month) when April’s softer-than-expected consumer price index was reported, the S&P 500 staged a breakout. The large cap index peaked at 5265 on March 28th, having struggled to break out of 5260s in three sessions over seven around that peak.

Subsequently, the index declined 5.9 percent through April 19th before resuming the uptrend. Seven sessions ago, equity bulls used the CPI report to break out of 5260s, followed by six sessions of congestion around 5320s. Another breakout seemed imminent.

Come Thursday, the S&P 500 did indeed break out, egged on by Nvidia’s (NVDA) April-quarter blockbuster results. In the very first minute, the index recorded a new intraday high of 5342 and that was it! Sellers showed up in droves. When it was all said and done, the index ended the session down 0.7 percent – for an intraday swing of 1.6 percent from the session high. The session closed at 5268 – once again right at 5260s (Chart 1).

Odds favor 5260s gets breached in the sessions ahead. The daily has been in overbought territory for a while now, with the weekly now extended as well. There is a message here in Thursday’s bearish engulfing candle – encompassing all the six candles post-CPI breakout – which is that things are way extended and that bulls are itching to lock in gains.

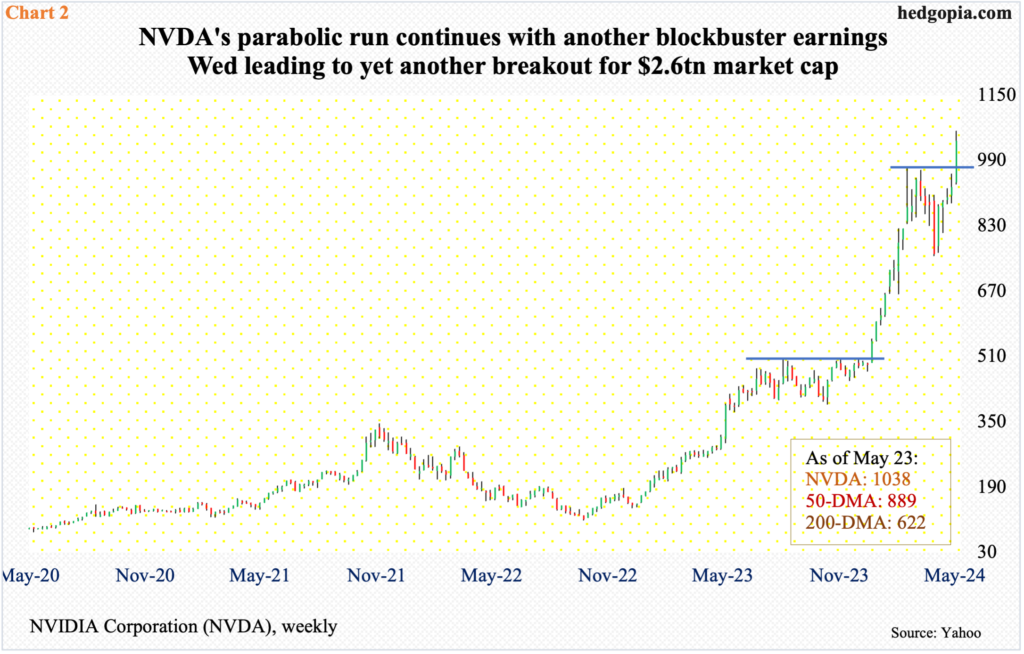

Interestingly, NVDA, which set off the pre-market frenzy to begin with, pretty much held on to most of its gains. Yes, it closed substantially below its session high of $1,063 but jumped 9.3 percent to close Thursday at $1,038. It now boasts a market cap of $2.6 trillion. Only Microsoft (MSFT) at $3.2 trillion and Apple (AAPL) at $2.9 trillion are larger than the chip company in terms of market cap.

NVDA’s parabolic ascent began early this year (Chart 2). Its prior high of $974 was posted on March 8th, followed by 11 weeks of sideways move, with a low of $756 on April 19th. Thursday, it broke out, with a weekly gain of 12.2 percent with Friday’s session remaining.

Curiously, NVDA with a weight of 6.5 percent was unable to save the Nasdaq 100, which finished down 0.4 percent to 18623. The tech-heavy index too posted a new all-time high of 18908 but only to reverse hard to end with a massive bearish engulfing candle (not shown here); nearest support lies at 18300s.

Thursday’s reversal in both the S&P 500 and Nasdaq 100 – and others – is the latest shot across the bulls’ bow. Amidst all the record highs, there have been divergences all along – RSI, for instance. Momentum will swing the bears’ way should tech bulls fail to defend 18300s on the Nasdaq 100. In the S&P 500, once 5260s is compromised, the 50-day moving average lies at 5170, which is a must-save.

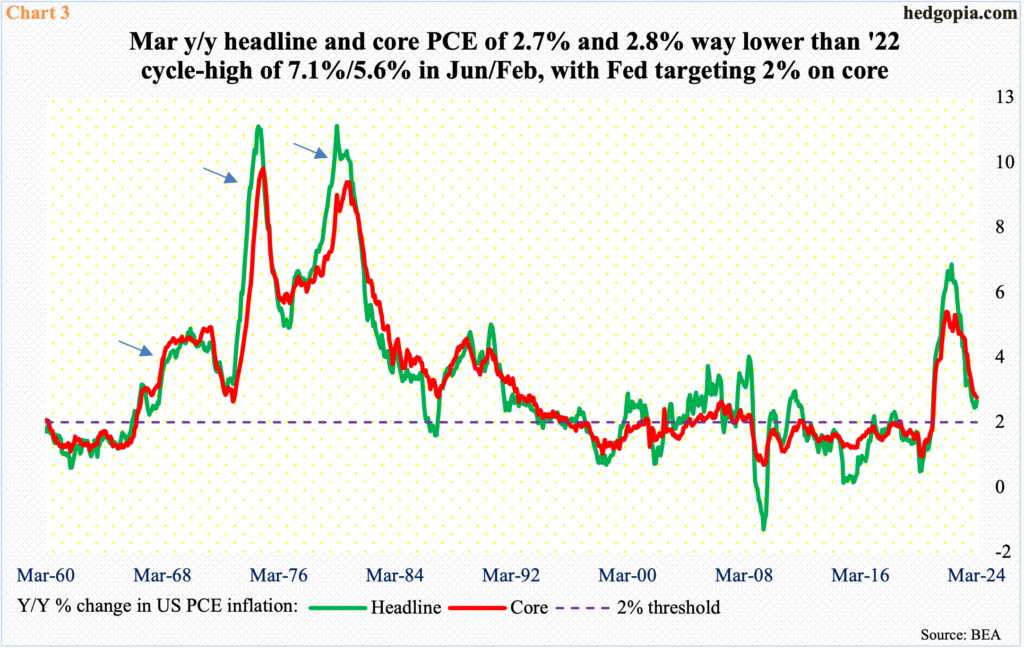

Next Friday brings the PCE (personal consumption expenditures) price index for April. In March, headline and core PCE grew 2.7 percent and 2.8 percent from a year ago. Core PCE, which is the Federal Reserve’s favorite, is still above the central bank’s two percent objective but is meaningfully lower from the four-decade highs of 2022 when headline and core PCE were growing at a rate of 7.1 percent and 5.6 percent, in that order (Chart 3).

If April’s PCE comes in lower than expected and the indices still fail to react, then we know these indices are in a mood to seriously unwind the overbought condition they are in.

Thanks for reading!