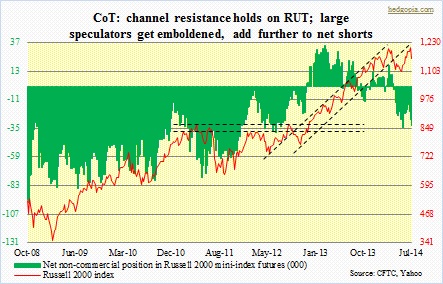

The Russell 2000 Small Cap Index fell four percent last week. In the futures market, large speculators could not have ridden it better. They have been net short since early April – by both cutting longs and raising shorts – and have been gradually adding to bearish positions. Last week, they added more – now net short 33k contracts. Odds are decent that they will be proven right again.

Technically, medium-term, there is much more to go on the downside before the overbought conditions the index is in are unwound. Near-term, since its July 1st intra-day high of 1213.55, it has rather quickly shed five percent, hence is now oversold. It is near/approaching some important moving-average support, which should hold, at least for the time being. A bounce here is possible, and, should that materialize, we are probably looking at a two-percent rally. Failure to carve out a rally when the index is trading near such an important support would obviously point to inherent weakness. This would probably mean the medium-term overbought conditions the index is in will be quickly unwound. We shall see. Small-caps had a harrowing, two-and-a-half-month, 11-percent decline beginning early April, and have acted tentative since mid-May even as they have managed to rally all the way back to those early-April highs. There is potentially a double top in formation. The 1080-1100 level therefore is crucial. Importantly, when the index gets there, it would have dropped nine percent from its highs. So that level is unlikely to give in that easy. Nevertheless, given that investors are no longer gung-ho about previously super-hot small-caps, sooner or later that support should break.

Technically, medium-term, there is much more to go on the downside before the overbought conditions the index is in are unwound. Near-term, since its July 1st intra-day high of 1213.55, it has rather quickly shed five percent, hence is now oversold. It is near/approaching some important moving-average support, which should hold, at least for the time being. A bounce here is possible, and, should that materialize, we are probably looking at a two-percent rally. Failure to carve out a rally when the index is trading near such an important support would obviously point to inherent weakness. This would probably mean the medium-term overbought conditions the index is in will be quickly unwound. We shall see. Small-caps had a harrowing, two-and-a-half-month, 11-percent decline beginning early April, and have acted tentative since mid-May even as they have managed to rally all the way back to those early-April highs. There is potentially a double top in formation. The 1080-1100 level therefore is crucial. Importantly, when the index gets there, it would have dropped nine percent from its highs. So that level is unlikely to give in that easy. Nevertheless, given that investors are no longer gung-ho about previously super-hot small-caps, sooner or later that support should break.