- Energy stocks correlate with oil price; former holding up better in current decline

- Sector job cuts mediocre; oil and extraction hourly earnings another high in Feb

- Companies acting as if bottom is in for oil; investors buying into this optimism

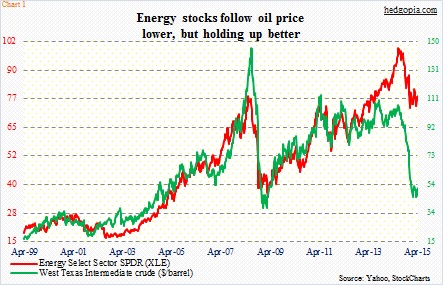

Energy stocks correlate with the price of crude. No surprise there. The past nine months have been no exception. Although it does feel like these stocks are holding up better than the collapse in the price of West Texas Intermediate (Chart 1).

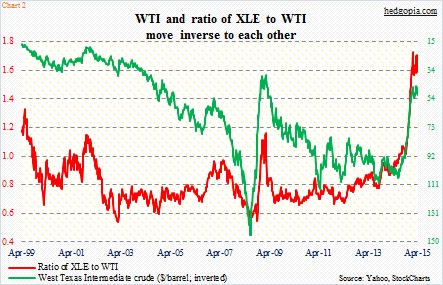

Chart 2 takes a ratio of XLE, the energy ETF, to WTI crude, and reveals a rather interesting phenomenon. Which is that the ratio moves inverse to the price of crude. (The right axis is inverted in the chart.) In other words, the rate of change in stocks is not in lockstep with the drop in crude.

A whole host of reasons could be playing a role here.

One, conventional wisdom tells us that as the price of crude drops, it will in turn stimulate demand. In real world, it is not always this simple. Nonetheless, should that happen, energy companies – those that survive – will benefit. In this scenario, stocks may be beginning to price that in. Two, earnings estimates for energy companies have been massively cut. As early as three months ago, earnings were expected to drop 20 percent this year; now, it is minus 56 percent (courtesy of FactSet). It is possible markets are now betting the worst of the downward revision is done, and that should there be any revision going forward it will be to the upside. And three – kind of a corollary of point two – the price of crude is done going down, and in due course will be a lot higher.

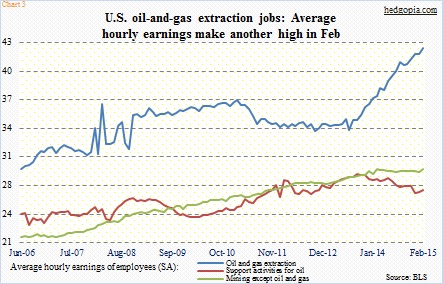

Is that the reason why average hourly earnings in oil and gas-related jobs are holding up so well (Chart 3)? In fact, oil and gas extraction made another high in February ($42.40); earnings for oil support activities ticked up as well in the month ($27).

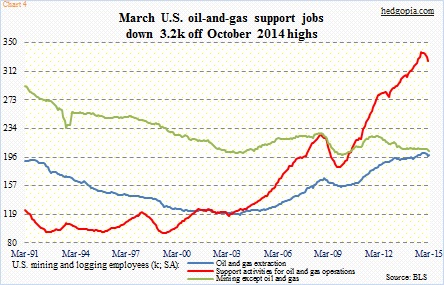

This is taking place even as the number of energy jobs is on the decline. Not a whole lot, but the trend is down. In March, oil-and-gas-extraction employees numbered 198.3k, down from a high of 201.5k in October last year. Support-activity employees totaled 325.6k in February, versus 337.6k last September (Chart 4). However, in a big scheme of things, these job cuts have been mediocre. The past five years, both the red and blue lines – particularly the former – have had a very steep rise.

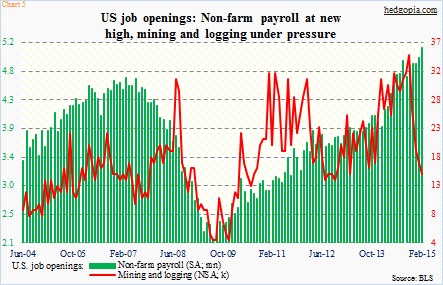

Companies do not seem willing to let go of them. This is also evident in Chart 5. Job openings in mining and logging began to come under pressure last October even as nationally they continued to move up, but the monthly rate of decline has softened in recent months. Further, 1Q job-cut announcements in energy have totaled 37.8k, the bulk of which came in January and February; March was only 1.3k (courtesy of Challenger, Gray & Christmas).

The message is clear. Energy companies are acting confident that oil is not going any lower and are telegraphing as such. Royal Dutch Shell’s planned mega-takeover of British rival BG Group is an example. Investors have bought into this optimism.

This is counterintuitive given the collapse in the price of crude, but it is what it is. Only time will tell if this optimism pans out.