The S&P 500 – a stone’s throw away from a fresh high – has gone sideways the past two weeks at just under 4800. Thursday’s CPI-induced selloff was bought. Persistently lowered 4Q23 earnings estimates can act as a tailwind for imminent breakout. What the bulls do not want to see unfold is this being used as an opportunity to lock in profit.

From last October’s low of 4104 through Thursday’s intraday high of 4798, the S&P 500 was up just under 17 percent. The large cap index is within spitting distance of the January 2022 all-time high of 4819 (Chart 1). For the past two weeks, it has essentially gone sideways just under 4800, with an intraday drop on the 5th to 4682. A breakout is probable. It is only then that the bulls will have a shot at the peak of two years ago.

Other major indices such as the Nasdaq 100 and the Dow Industrials already rallied to new highs. The S&P 500 is taking time to do so. It is probably only a matter of time before that happens, considering the current trend of using positive news to push markets higher even as negative news is treated to buy the dips.

This was particularly evident on Thursday when December’s consumer price index was released. The bulls were getting ready for the recent disinflation trend to continue. They began the week pushing the S&P 500 higher by 1.5 percent on Monday.

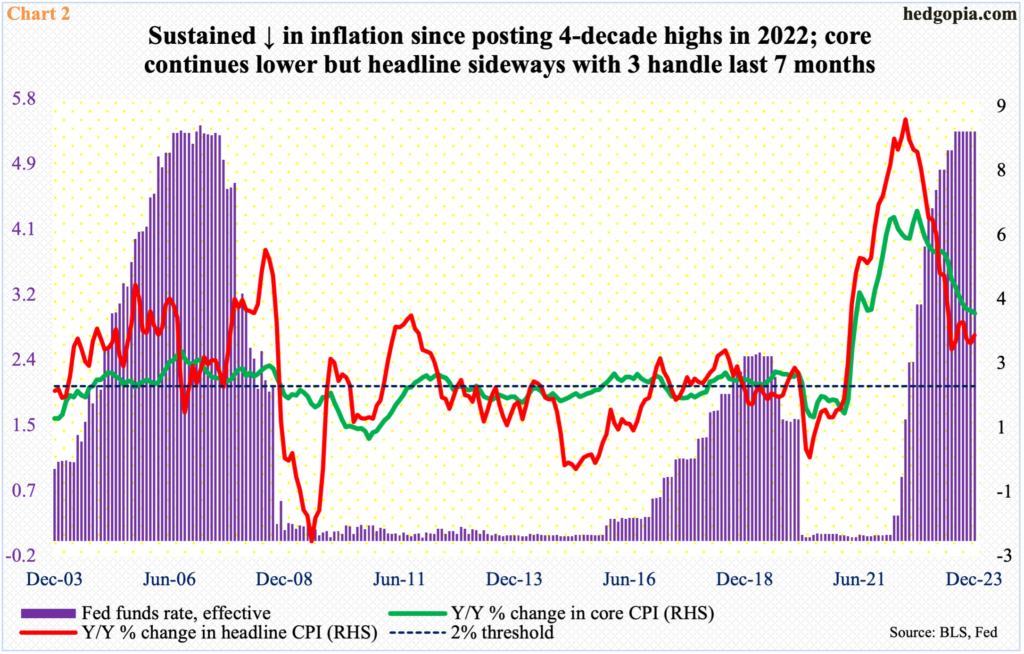

Come Thursday, inflation came in a tad hotter than expected. From November, both headline and core rose 0.3 percent. From a year ago, they respectively increased 3.4 percent and 3.9 percent, having peaked in 2022 at 9.1 percent (June) and 6.6 percent (September). For the core, this was the first sub-four reading y/y since May 2021; the headline, however, was at a three-month high (Chart 2).

In reaction, for fear this will have implications for when the Federal Reserve would begin to lower the fed funds rate, both stocks and bonds were sold initially, with the S&P 500 losing 0.9 percent and the 10-year treasury yield rising four basis points intraday; but when it was all said and done, the S&P 500 rallied to finish the session down 0.07 percent, even as the 10-year lost five basis points to 3.98 percent. In the S&P 500 (4780), bids showed up at shorter-term moving averages, with the 10-and 20-day at 4747 and 4744 respectively. A cross-down between the averages was averted, with investor optimism very high that this will continue to be the case in the weeks ahead.

The 4Q23 earnings season will begin in earnest later this morning as the top four banks will report their results.

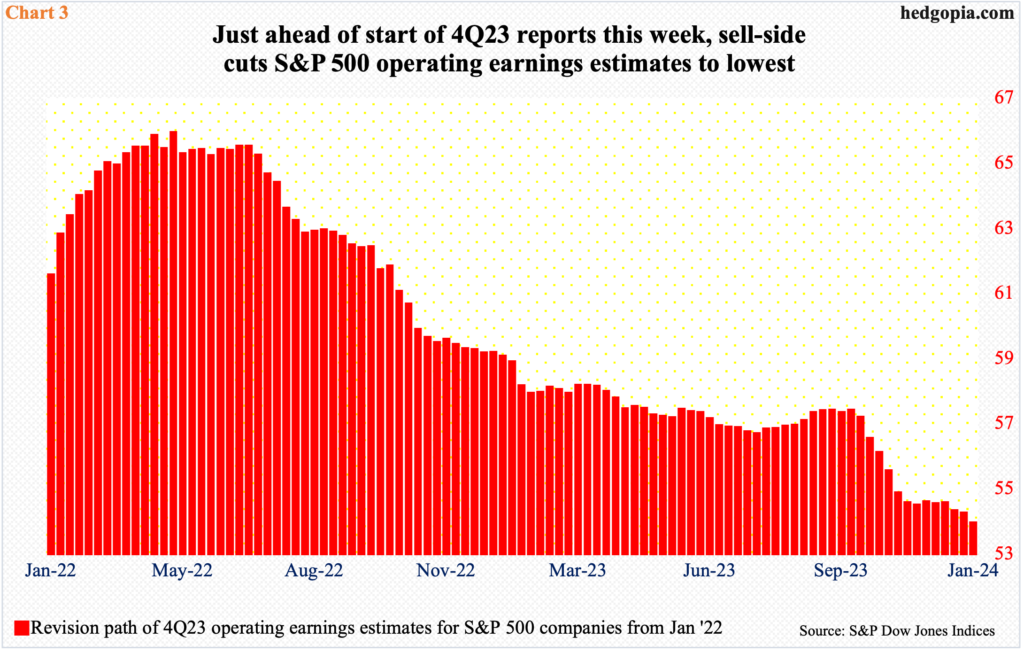

Ahead of this, the sell-side customarily has lowered the bar – perhaps enough for S&P 500 companies to comfortably jump over. As of Wednesday last week, they are expected to earn $53.92 in operations. When the quarter began a little over three months ago, the sell-side had penciled in $57.38, meaning the numbers were revised lower throughout the quarter. For that matter, in fact, these analysts were expecting $65.91 in April 2022 (Chart 3).

The banks are no exception in this downward revision trend. Only a month ago, JP Morgan (JPM), Bank of America (BAC), Wells Fargo (WFC) and Citigroup (C) were expected to ring up $3.62, $0.74, $1.22 and $1.06 in the December quarter, in that order. Going into this morning’s reports, this has been lowered to $3.36, $0.63, $1.17 and $0.79. This obviously gives the companies an opportunity to meet/beat expectations. The bulls are hoping this should be enough to push the S&P 500 to fresh highs. Hence the constant bids underneath and the two-week sideways move – not to mention the massive rally since the late-October lows. What they do not want to have happen is a breakout followed by an avalanche of offers as profit-taking kicks in.

Thanks for reading!