- Major U.S. banks’ 4Q14 earnings results big disappointment

- Release of reserves built up during crisis years have been big tailwind

- Financials’ path of least resistance down medium-term, though oversold near-term

Investors were genuinely disappointed last week as all four major U.S. banks – BAC, C, JPM, and WFC – as well as GS reported their 4Q14. The stocks reacted poorly post-release of earnings.

Bank earnings have been aided for several years by improving loan quality. ‘Loans and leases 90 days or more past due’ stood at $79.4 in 3Q14 (courtesy of FDIC). This has progressively come down from $143.7bn in 1Q10. Similarly, ‘loans and leases 30-89 days or more past due’ was $66.3bn, vs. $159.3bn in 4Q08.

This has obviously enabled banks to set aside less on building cushions for loans that could go bad as well as give them more flexibility in releasing the reserves they set aside previously.

In 4Q14, C released $441n in loan loss reserves. Reserve release was $660mn for BAC. WFC released $250mn from the allowance for credit losses. And JPM reduced $251mn in the allowance for loan losses.

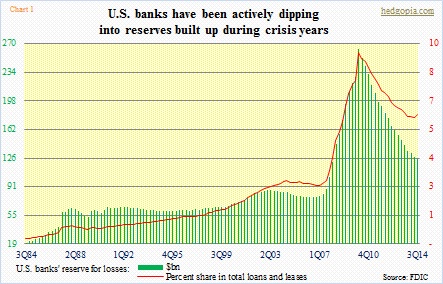

The trend is visible in Chart 1. As of 3Q14, reserve for losses for U.S. banks was $125.3bn – the lowest since 1Q08. These reserves had risen all the way to $263.2bn by 1Q10 and have since gone down. Apparently they have helped banks’ results.

The more the release, the smaller the pool. Math is simple.

The risk going forward of course is when these banks (1) start adding to their loan loss provisions, and/or (2) slow their reserve releases. Looking at Chart 1 again, banks are more likely to continue to milk this cow for now. Loan balances are growing, but not going gangbusters (grew 3.4 percent in 3Q14 year-over-year). As a result, reserves as a share of loan balances in 3Q14 was 6.2 percent, much higher than where it stood pre-financial crisis.

While dipping into the reserve cookie jar has helped banks’ results, this anything but assures quality. If there are other problems, they will surface sooner or later. This was evident in 4Q14 reports.

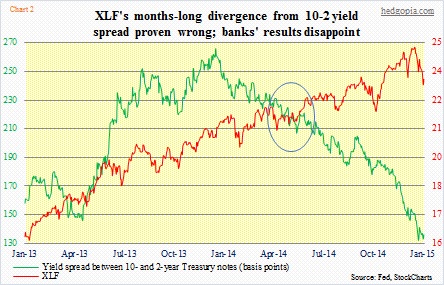

Banks have been hurt by narrow spreads, among others. The consensus continues to believe that the Fed would hike this year even though long bonds are not buying it. As a matter of fact, bonds may very well be warning that the U.S. economy would not be able to handle higher short rates. As a result, spreads have narrowed. Financials are not bothered by this. Stocks have diverged from yield spread between 10- and two-year notes for seven months now (blue oval in Chart 2).

There are signs financials have begun a process of catching up with the narrowing spread. In the near-term, though, they [represented by XLF (23.49) in the chart] are oversold and ripe for a bounce. Intermediate-term, the path of least resistance remains down for this group.