The S&P just published operating earnings estimates for S&P 500 companies for 2017, and it is an eye-catcher.

Depending on one’s bias, reaction can range from ‘yee-haw’ to ‘not again’.

The consensus expects a whopping $141.11.

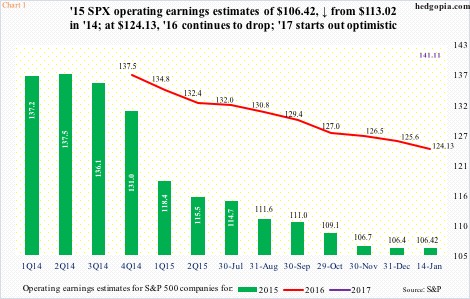

To put things into perspective, with 4Q15 currently being reported, 2015 estimates are down to $106.42. Actual operating earnings last year were $113.02. Next year, they are expected to rise a healthy 16-plus percent, and nearly 14 percent the year after (Chart 1).

All good, except these estimates have shown a tendency to paint a rosy picture out of the starting blocks, only to get revised downward as time passes.

Take 2015, for example. At the end of the second quarter of 2014, estimates were $137.50, before coming under persistent downward pressure. They are now nearly 23 percent lower.

Similarly, as early as February last year, 2016 was expected to bring in $137.50; as of January 14th, they stood at $124.13. Even to meet these lowered 2016 estimates, a lot of things have to go right, not the least of which is acceleration in the U.S. economy and stability/rise in crude-oil price.

That is assuming a lot, particularly considering the economy is only six months from completing its seventh year of expansion, and that, should data permit, the Fed is itching to continue to tighten.

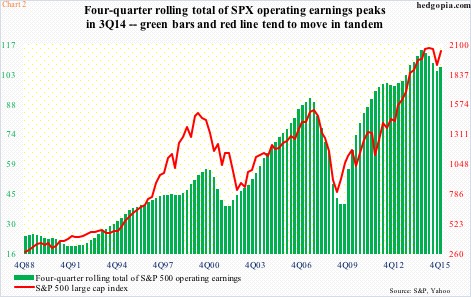

The cycle is long in the tooth, and it is vividly seen in Chart 2. The green bars represent the four-quarter rolling total of S&P 500 operating earnings, and it peaked at $114.51 in 3Q14, dropping by 4Q15 to $106.42.

Incidentally, U.S. corporate profits adjusted for inventory valuation and depreciation peaked in 3Q14 as well – at $2.16 trillion. By 3Q15, they had dropped to $2.05 trillion – down 5.1 percent year-over-year. This was the largest y/y decrease since 1Q09. The red line in Chart 3 is not headed the right direction.

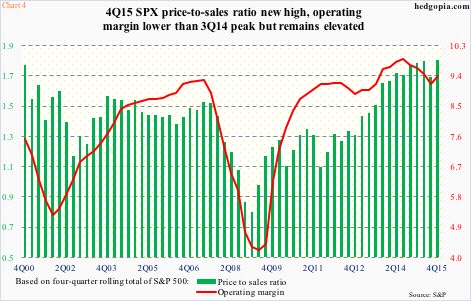

With earnings momentum in deceleration and operating margin having peaked in 3Q14 (Chart 4), it is prudent not to take 2016/2017 estimates at face value. Particularly so considering the elevated price-to-sales ratio. As of 4Q15, it stood at a record 1.81. This compares with 1.52 in 2Q07 and 1.77 in 4Q00.

When may this not matter? If sales accelerate. In other words, if the GDP accelerates. The consensus currently expects real GDP to decelerate to 2.4-percent growth in 2017 from this year’s expected 2.5 percent.

There is the rub.

As is the case with earnings, consensus GDP forecast has tended to start out optimistic, only to get progressively revised downward. Toward the end of 2014, the economy this year was expected to grow 2.9 percent, which has now been cut to two percent. Things are decelerating… the economy grew 2.4 percent in 2014.

Customarily, the consensus expects things to reaccelerate this year, but likely meets the customary fate – downward revision.

Thanks for reading!