- Stagnant wages thorn in U.S. recovery’s side

- WMT, TJX, AET, SBUX, GAP have announced plans to hike wages

- Be careful what we wish for, given elevated valuation and risk of margin compression?

One of the things that have been a sore disappointment in the current U.S. recovery has been the lack of progress on the wage front. Of course, we also see hesitancy on the part of corporations to aggressively expand capital expenditures. And there is this whole escape-velocity optimism that quarter after quarter comes up short.

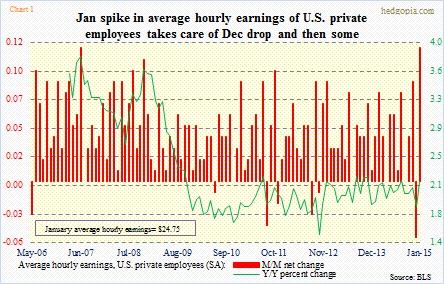

Staying with the wage theme, the year-over-year change in average hourly earnings of U.S. private employees has struggled to sustain above 2.3 percent throughout this recovery (Chart 1). There was a bit of a scare in December as for the first time since October 2012 earnings dropped month-over-month. But a 12-cent spike in January took care of that. But in the big scheme of things progress remains stagnant. Real average hourly earnings have essentially gone sideways since the Great Depression ended.

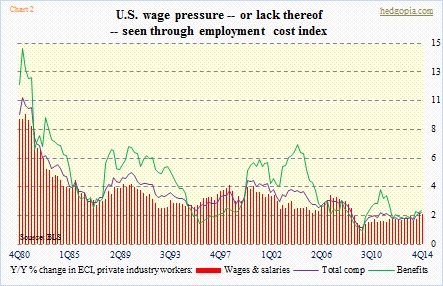

The picture slightly gets better if we focus on the employment cost index, which includes both benefits, and wages and salaries. Total comp was up 2.3 percent y/y in both 3Q and 4Q of 2014, for a third consecutive two-percent-plus increase. Nonetheless, the trend remains down (Chart 2). Total comp has trended lower since 3Q00. For what it is worth, the Fed views the ECI as a more reliable indicator of wage pressures.

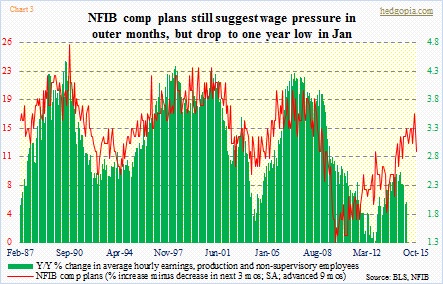

The lack of upward pressure on wages deviates from an economy operating at a 5.7 percent unemployment rate. In the past, this would probably have been enough to push up wages. That is what the National Federation of Independent Business survey has been telegraphing as well. The percentage of members expecting higher comp in the next three months had been on the upswing until January, which saw a sharp move downward. The red line in Chart 3 remains substantially below prior recoveries, nevertheless has tended to lead change in average hourly earnings.

But it has not yet happened.

With that as a background, here is some good news. We are beginning to hear some major companies announce plans to raise wages.

Last week, WMT said it would increase the wages of 500,000 employees to at least $9/hour from April. (The Federal minimum is $7.25/hour.) The retailer was probably responding to GAP’s wage hike one year ago. In February last year, the San Francisco-based retailer raised its minimum to $9, and promised to lift it to $10 this year. WMT’s announcement probably also forced TJX, which plans to increase its minimum to $9 in June and to $10 in 2016. We cannot forget SBUX, which in October last year, unveiled plans to raise pay for baristas and shift supervisors. Specifics were not available, but it said it would go into effect in January.

The point is, we are beginning to see a company here a company there begin to move. Right now for the most part this is only happening in retail, which tend to fall in the low-paying camp to begin with. Outside retail, there is AET, which said in January that, starting April, around 12 percent of its domestic work force will see a raise to a floor of $16/hour, primarily employees in customer service and billing-related jobs. Would that force AET peers to follow suit?

We shall see. But for sustained upward pressure on wages, that is what needs to happen. Companies need to feel the pressure to attract and retain the best talent, which only happens when availability of that pool is shrinking. Are we there yet? The unemployment rate says yes we are. Several other metrics, including the civilian participation rate, say no we are not.

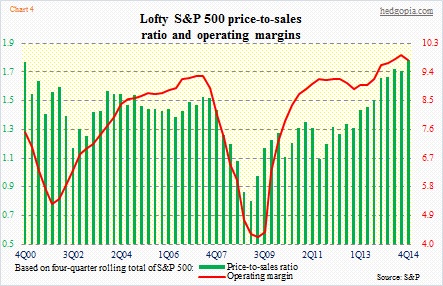

While this debate can continue for a while, investors need to keep an eye out for Chart 4. One of the reasons why corporate margins have held up so well is precisely because U.S. labor has been the price taker, not the setter. If and when that changes, that will have margin repercussions for corporations. Both the red line and the green bars are near/at historical highs – former is hard to sustain and latter points to elevated valuation.