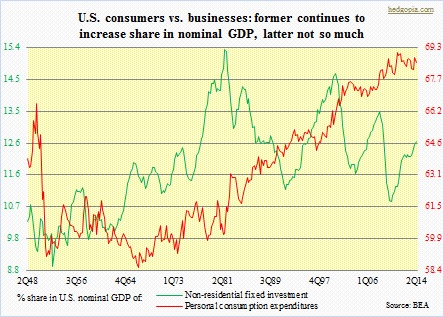

The revised 2Q14 GDP numbers last week have rekindled hopes of a corporate capital spending revival in the U.S. It was the second estimate (preliminary), so there is one more revision to go. Nevertheless, several inputs related to corporate spending were revised higher – real investment in structures such as office buildings rose 9.4 percent, up from advance estimate of 5.3 percent, and equipment spending increased 10.7 percent, versus prior seven percent. Overall, non-residential fixed investment contributed 1.03 percent toward the 4.2 percent growth in real GDP, up from 0.2 percent in the prior quarter; after the 1.23 percent in 4Q13, this is the second highest contribution in the last 10 quarters. Encouraging, but one look at the accompanying chart, and it is easy to see what a laggard corporate capX has been in the current cycle. As a share of nominal GDP, non-residential fixed investment bottomed at 10.9 percent in 1Q10 and by 2Q14 had risen to 12.6 percent – a cycle high. Compared with past cycles, though, the capX recovery has been acutely sub-par. Back in 3Q00, the share of non-residential fixed investment peaked at 14.6 percent, followed by another peak lower of 13.5 percent in 1Q08. Now, we are at 12.6 percent.

The revised 2Q14 GDP numbers last week have rekindled hopes of a corporate capital spending revival in the U.S. It was the second estimate (preliminary), so there is one more revision to go. Nevertheless, several inputs related to corporate spending were revised higher – real investment in structures such as office buildings rose 9.4 percent, up from advance estimate of 5.3 percent, and equipment spending increased 10.7 percent, versus prior seven percent. Overall, non-residential fixed investment contributed 1.03 percent toward the 4.2 percent growth in real GDP, up from 0.2 percent in the prior quarter; after the 1.23 percent in 4Q13, this is the second highest contribution in the last 10 quarters. Encouraging, but one look at the accompanying chart, and it is easy to see what a laggard corporate capX has been in the current cycle. As a share of nominal GDP, non-residential fixed investment bottomed at 10.9 percent in 1Q10 and by 2Q14 had risen to 12.6 percent – a cycle high. Compared with past cycles, though, the capX recovery has been acutely sub-par. Back in 3Q00, the share of non-residential fixed investment peaked at 14.6 percent, followed by another peak lower of 13.5 percent in 1Q08. Now, we are at 12.6 percent.

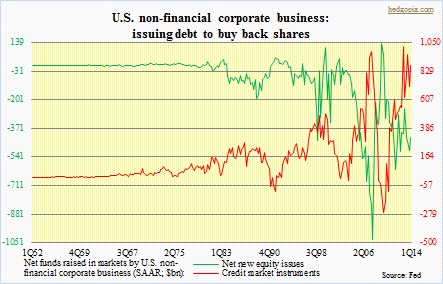

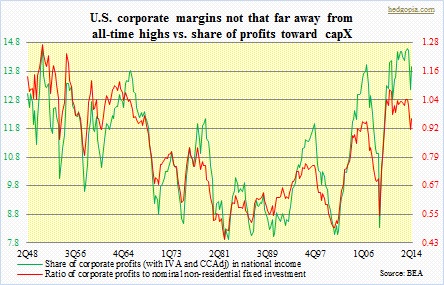

This blog is not suggesting that the 12.6-percent number is a cycle peak. As a matter of fact, as discussed two weeks ago, some signs are indeed pointing to impending firmness in capital spending. One of the relationships cited in that piece was between corporate yields and manufacturing, showing how year-over-year change in the former has an impact on the latter several quarters later. Back then, Moody’s Baa yields at the end of July was 4.73 percent. At the end of August, at 4.58 percent, they were even lower. If the two maintain their correlation, then manufacturing is likely to strengthen next year. The caveat is that for the next few months until year-end, based on this correlation the PMI is likely to weaken (please click on link above to see chart). Another was the correlation between manufacturing PMI and new orders for non-defense capital goods ex-aircraft, and how the former tends to lead the latter by about six to eight months. These are positive data points as far as capX prospects are concerned. Importantly, for this scenario to pan out, corporations will probably have to divert funds toward capital stock, away from stock buybacks/dividends. They cannot have it both ways.

This blog is not suggesting that the 12.6-percent number is a cycle peak. As a matter of fact, as discussed two weeks ago, some signs are indeed pointing to impending firmness in capital spending. One of the relationships cited in that piece was between corporate yields and manufacturing, showing how year-over-year change in the former has an impact on the latter several quarters later. Back then, Moody’s Baa yields at the end of July was 4.73 percent. At the end of August, at 4.58 percent, they were even lower. If the two maintain their correlation, then manufacturing is likely to strengthen next year. The caveat is that for the next few months until year-end, based on this correlation the PMI is likely to weaken (please click on link above to see chart). Another was the correlation between manufacturing PMI and new orders for non-defense capital goods ex-aircraft, and how the former tends to lead the latter by about six to eight months. These are positive data points as far as capX prospects are concerned. Importantly, for this scenario to pan out, corporations will probably have to divert funds toward capital stock, away from stock buybacks/dividends. They cannot have it both ways.

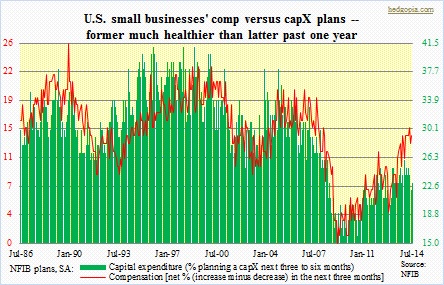

Yes, profits (pre-tax) are healthy – grew eight percent in 2Q14 sequentially to $2.1tn (at a seasonally adjusted annual rate) but inched lower y/y. At 14 percent, margins are already near all-time highs, hence probably do not leave much room for expansion. And leverage is on the rise. Corporations are taking advantage of the low-rate environment. Year-to-date, debt issuance is on track for $1tn – for a third straight record year. A good chunk of that goes toward refinancing existing debt, which is prudent as it helps the income statement, and toward share buybacks. Proportionately less goes toward capX. So anytime capX-related data gain strength, there is an instant rise in optimism that this may be the beginning of a trend. Until we see some other data that sends a conflicting signal. The chart below is one such. In it, small businesses’ plans for compensation and capX are pitted against each other. Directionally, they track each other well. Although going back a year, or 13 months to be precise, ‘comp plans’ has more than doubled, even as ‘capX plans’ has gone sideways. This could suggest several possibilities. One, there is budding pressure on wages, hence corporations’ hesitancy toward aggressively raising capX. Two, when it is all said and done, wages will follow capX lower, and corporations will continue to buy back shares. Three, although both track each other well, corporations are having to sacrifice one for the other as they are also aggressively buying back shares. Four, capX will eventually follow ‘comp plans’ higher, and that share buybacks will dwindle. The latter scenario also brings into focus the afore-mentioned correlation between corporate yields and manufacturing, which is pointing to softening in PMI until year-end and then a pickup. Fingers crossed.