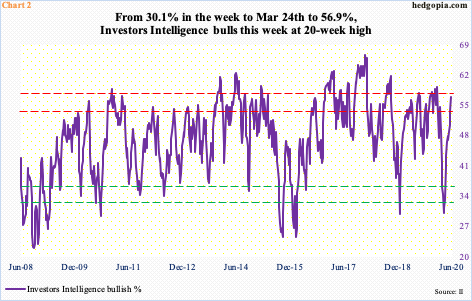

Small-caps are clinging on to major support. The closest the Russell 2000 came in testing major resistance just north of 1600 was Monday when it rallied to 1537.62 intraday. The next couple of sessions, sellers came out in droves. The index is right at 1450s-60s support, with real risks of a breach. Things have evolved this way even as Investors Intelligence bulls this week rose to a 20-week high.

Last Friday, the Russell 2000 small cap index broke out of 1450s-60s. Hopes were raised that it would then go on to test major resistance just north of 1600. This level has proven to be an important price point going back to January 2018 and was lost in late February. Monday, the index did tag 1537.62 intraday, and that was it. The air came out, with sellers overwhelming buyers in the next few sessions. Wednesday, it closed at 1467.39 – right at the aforementioned support.

If last Friday’s breakout was genuine, small-cap bulls need to be able to step up and defend the level. But at this point in time odds are stacked up against them. Wednesday, the Russell 2000 lost the 200-day moving average (1480.97). Shorter-term averages – 10- and 20-day (between 1389 and 1454) – are intact, but because the daily in particular is way overbought, the path of least resistance in the sessions ahead is a move down toward 1330s (Chart 1). Right underneath lies the 50-day at 1289.56.

Typically, investors tend to gravitate toward small-caps when they are in a mood to take on risk. This week’s action in the Russell 2000 comes against the backdrop of persistently rising bullish sentiment. Several metrics, including options-related, are at frothy levels (more on this here).

Investors Intelligence bulls are not quite out-and-out giddy yet, but at 56.9 percent this week things are frothy enough (Chart 2). As a matter of fact, in the week to February 18th, a day before the rug was pulled out from under US stocks, their count was 54.7 percent. But they were a lot higher in the week to January 21st at 59.4 percent.

This week, bears were 20.6 percent, down 3.1 percentage points week-over-week, versus 18.9 percent in the week to February 18th. Ideally, there is room for bears to head lower and for bulls to strengthen, before the pendulum swings dangerously bullish.

That said, with small-caps acting the way they are, it is possible bulls begin to pull in their horns right here.

Thanks for reading!