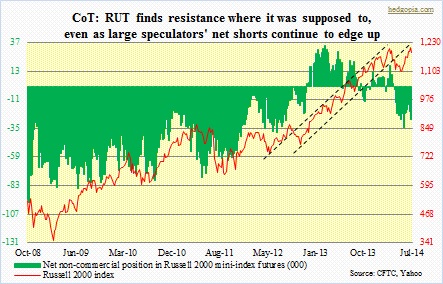

As suggested last week, the Russell 2000 Small Cap Index has met with resistance. The index seems to be putting in a top, at least in the near-term. To refresh, late-February/early March, previously hot, momentum-packed groups such as small-caps, biotechs, and solar began to weaken. Within a space of between two and two and a half months, TAN (solar) lost 28 percent, IBB (biotech) 25 percent, and IWM (small-cap) 11 percent. In the rally that followed in April/May, IBB is struggling to test its late-February highs, and TAN is substantially away from its early-March highs. RUT/IWM have managed to test their early-March highs – unsuccessfully so far. In the month-and-a-half-long advance that began mid-May, RUT not only quickly took care of its short-term oversold conditions but has since managed to stay overbought, raising hopes of bullish-leaning investors/traders that risk-on is back on. But here is the thing. First, as a result of the recent stubborn rally, even medium-term technicals have now been pushed into overbought territory. Secondly, selling came exactly where it was supposed to. Back in March as the index came under pressure, it fell out of a channel, and when that happens, a weak rally attempt will be repelled at the bottom end of that channel. That is exactly how things have transpired so far. The 1.7-percent drop yesterday is a sign that longs are cutting back even as shorts are getting active.

As suggested last week, the Russell 2000 Small Cap Index has met with resistance. The index seems to be putting in a top, at least in the near-term. To refresh, late-February/early March, previously hot, momentum-packed groups such as small-caps, biotechs, and solar began to weaken. Within a space of between two and two and a half months, TAN (solar) lost 28 percent, IBB (biotech) 25 percent, and IWM (small-cap) 11 percent. In the rally that followed in April/May, IBB is struggling to test its late-February highs, and TAN is substantially away from its early-March highs. RUT/IWM have managed to test their early-March highs – unsuccessfully so far. In the month-and-a-half-long advance that began mid-May, RUT not only quickly took care of its short-term oversold conditions but has since managed to stay overbought, raising hopes of bullish-leaning investors/traders that risk-on is back on. But here is the thing. First, as a result of the recent stubborn rally, even medium-term technicals have now been pushed into overbought territory. Secondly, selling came exactly where it was supposed to. Back in March as the index came under pressure, it fell out of a channel, and when that happens, a weak rally attempt will be repelled at the bottom end of that channel. That is exactly how things have transpired so far. The 1.7-percent drop yesterday is a sign that longs are cutting back even as shorts are getting active.

It is probably still too soon to aggressively go short, but a small position probably does not hurt. So far at least, large speculators have proven to be prudent in this regard. They were never swayed by the six-week, mid-May rally, as they have continued to maintain net-short exposure, and added more in the latest week, to minus 28k contracts. Having said that, longs have not totally given up, having added 13k in the past month. But shorts are getting more aggressive – adding 19k contracts during the period. As a result, net shorts have gradually gone up. Also, as a percent of open interest, non-commercials make up 20 percent, vs. 13 percent at the start of 2013. Technicals are way overbought, and at least in the near-term, RUT’s path of least resistance is down. Much longer-term, there is solid support at 850 or thereabouts. That is a 30 percent decline from the high last week. It is hard to visualize that kind of a decline any time soon. A lot of things have to go wrong – especially on the macro front – for that eventuality. For now, some kind of pressure can be expected, and one way to play this scenario is though options – by selling August 16, 2014 IWM 118 calls for $2.35 each.