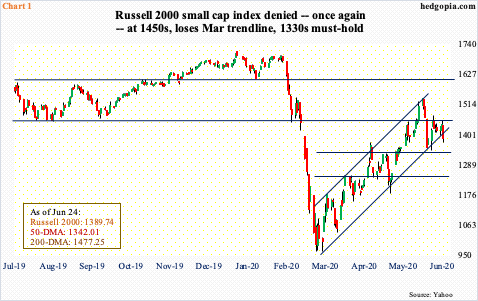

Once again, bulls were denied at 1450s on the Russell 2000 (1390). They have had massive gains since the March low, even as earnings estimates continue lower. A test of 1330s is the path of least resistance, followed by 1250s.

Once again, small-cap bulls were denied at 1450s. Tuesday, the Russell 2000 small cap index (1389.74) tagged 1454.12 intraday before sellers showed up. This level has acted like a magnet for both bulls and bears for nearly three years now.

In early March, selling accelerated after the index pierced through 1450s, ultimately bottoming at 966.22 on the 18th that month. The rally that followed peaked at 1537.62 on June 8th. On its way there, it hesitated at 1450s in late May. The subsequent breakout was short-lived.

The June 8th high also kissed the upper end of an ascending channel from the March low. Last week, it tested the lower band as well as horizontal support at 1330s. Since then, 1450s has been tested three times, including this week – all to no effect.

As things stand, a test of 1330s is the path of least resistance in the sessions ahead. The 50-day moving average (1342.01) lies there as well. A break of this support opens the door to a test of 1250s (Chart 1). Right here and now, risk-reward odds are beginning to favor bears.

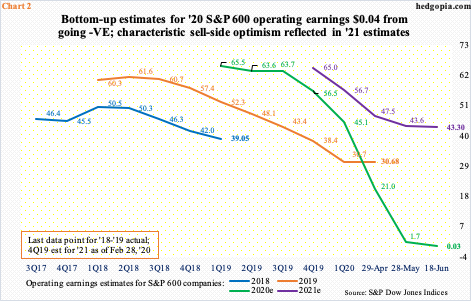

The Russell 2000 is beginning to act this way even as earnings estimates continue downward particularly for this year. With the massive rally in small-caps since the March low, investors seem torn between focusing on this year’s earnings that are this close to going negative and buying into next year’s optimism.

As of the 18th, this year’s operating earnings estimates for S&P 600 companies are $0.03. For next year, the sell-side expects $43.30. It is customary for these analysts to exude optimism at the beginning and then progressively lower estimates as time passes.

For this year, in February last year, $67.63 was expected (Chart 2). Even for next year, estimates were $64.96 in February this year, which have been meaningfully cut down but remain elevated. Even for bulls, it is hard to take these estimates at face value given the prevailing downward revision trend.

With this as a background, considering the massive paper profit since the March low, the urge to lock in gains can progressively rise.

Thanks for reading!