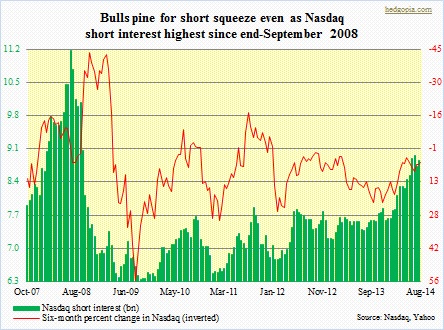

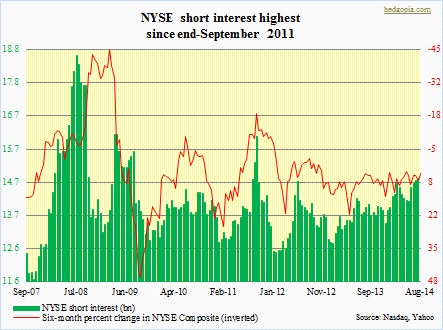

We so often hear or read that stocks climb a wall of worry. Anytime the balance tilts one way, odds grow that it then tilts the other way. Short interest can serve as an example. If too many market participants are negative on market prospects and bet accordingly, then a question arises, who is left to be bearish? Although this is not always this black and white. There is plenty of grey in between. One look at the adjacent chart, and the one below, we see that leading up to the July 2008 peak – both on the Nasdaq Composite and on the NYSE Composite – short interest already looked elevated. In normal circumstances, this already had the potential to act as fodder for a short squeeze. But things continued to deteriorate fundamentally, accompanied by persistent increase in short interest. The collective mind of the market was thinking ahead. In the end, shorts had the last laugh. As Mark Twain would say, “history does not repeat itself, but it does rhyme.” Or does it?

We so often hear or read that stocks climb a wall of worry. Anytime the balance tilts one way, odds grow that it then tilts the other way. Short interest can serve as an example. If too many market participants are negative on market prospects and bet accordingly, then a question arises, who is left to be bearish? Although this is not always this black and white. There is plenty of grey in between. One look at the adjacent chart, and the one below, we see that leading up to the July 2008 peak – both on the Nasdaq Composite and on the NYSE Composite – short interest already looked elevated. In normal circumstances, this already had the potential to act as fodder for a short squeeze. But things continued to deteriorate fundamentally, accompanied by persistent increase in short interest. The collective mind of the market was thinking ahead. In the end, shorts had the last laugh. As Mark Twain would say, “history does not repeat itself, but it does rhyme.” Or does it?

Throughout this year, short interest has persistently risen, and it really looks elevated. Year-to-date, short interest on the Nasdaq has increased by 1.3bn to 8.85bn, and by 1.4bn to 14.81bn on the NYSE. One thing is for sure. If not for this increase, and the resultant selling pressure, prices would probably be much higher. Bulls obviously have been trying to force a squeeze, but they have not had much success so far. Yes, it is possible some short-covering took place yesterday as stops probably got taken out. But in the big scheme of things, a serious squeeze is anything but. But what if the bear thesis never plays out? What could potentially go wrong by the way? Just to name a few – from credit-induced implosion in China to faster-than-expected tightening by the Fed to Act Two of euro-zone unraveling to deterioration in geo-politics, particularly between Russia and Ukraine, to pure-and-simple ‘the sky may fall’. Alternatively, equities may just fall under their own weight, as the balance has tilted in bulls’ favor for simply too long. Barring this, and provided the global economy does not fall off track, bears either face the risk of a squeeze or they just have to contend with shallow corrections as they are forced to cover.

Throughout this year, short interest has persistently risen, and it really looks elevated. Year-to-date, short interest on the Nasdaq has increased by 1.3bn to 8.85bn, and by 1.4bn to 14.81bn on the NYSE. One thing is for sure. If not for this increase, and the resultant selling pressure, prices would probably be much higher. Bulls obviously have been trying to force a squeeze, but they have not had much success so far. Yes, it is possible some short-covering took place yesterday as stops probably got taken out. But in the big scheme of things, a serious squeeze is anything but. But what if the bear thesis never plays out? What could potentially go wrong by the way? Just to name a few – from credit-induced implosion in China to faster-than-expected tightening by the Fed to Act Two of euro-zone unraveling to deterioration in geo-politics, particularly between Russia and Ukraine, to pure-and-simple ‘the sky may fall’. Alternatively, equities may just fall under their own weight, as the balance has tilted in bulls’ favor for simply too long. Barring this, and provided the global economy does not fall off track, bears either face the risk of a squeeze or they just have to contend with shallow corrections as they are forced to cover.