Even as the major US equity indices have rallied into crucial resistance, the share of stocks above their 50-day is at/near levels where risks of reversal are very high.

Stocks have come a long way the past three months.

The Nasdaq Composite, for instance, dropped 37.8 percent from its record high 16212 reached in November 2021 to October 13 last year when it hit 10089. From that low, the index rallied 14.7 percent in the next couple of months before once again coming under pressure. Toward the end of last month and early this month, the lows of October and November held. The subsequent rally has now reached a crucial stage.

On Tuesday, the Composite inched up 0.1 percent to 11095, having ticked 11145 intraday, kissing dual resistance – horizontal from last May and falling trendline from December 2021 (Chart 1). The daily is already extended. Even if tech bulls manage to push through the resistance, just above lies another straight-line resistance at 11500s, which just about lines up with the 200-day moving average at 11617.

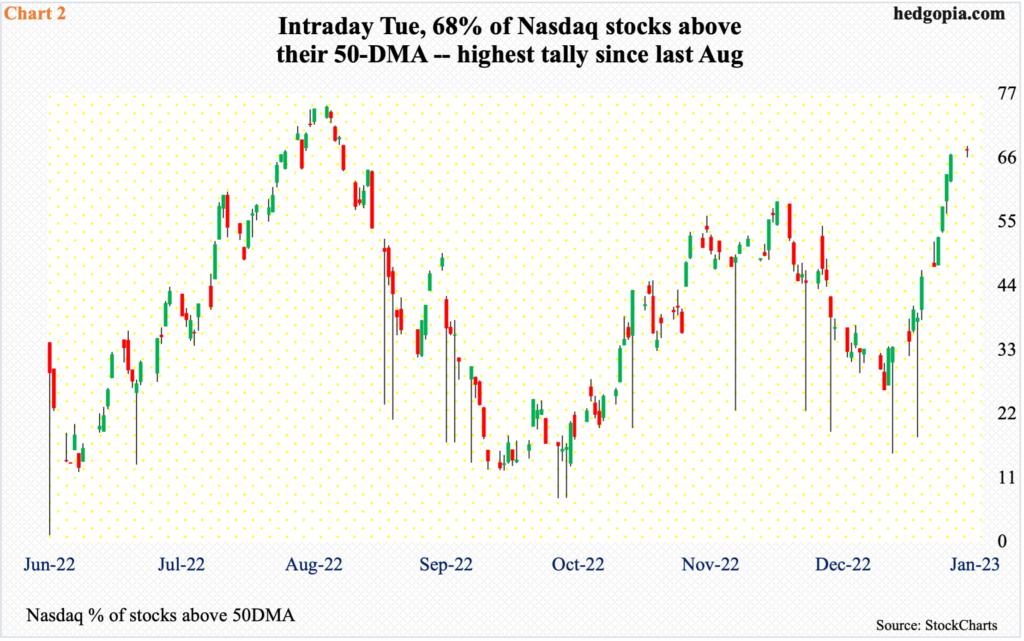

Concurrently, the share of Nasdaq stocks above their 50-day hit the highest level since last August (Chart 2). Tuesday’s intraday high of 68.1 percent came in a doji session and followed 11 up sessions out of the last 12.

Back then – that is, last August – the metric peaked on the 15th at 75 percent and proceeded to bottom at 7.5 percent on October 10. It so happens the Nasdaq Composite peaked on August 16 and proceeded to make a lower low – past the lows of June – before bottoming on October 13.

The point is, the share of Nasdaq stocks above their 50-day is very high, and the metric could reverse any time.

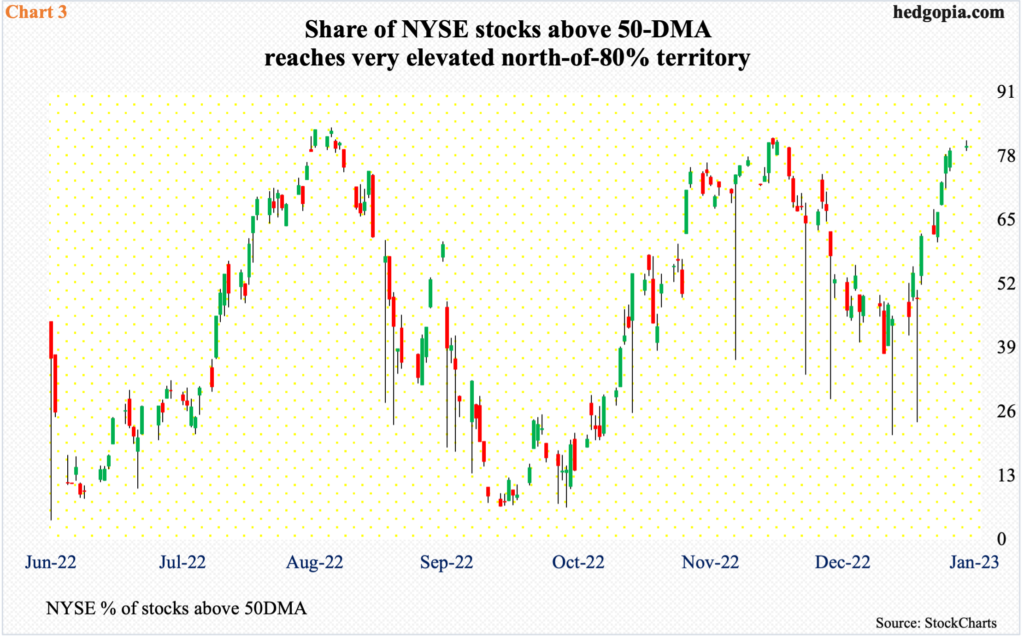

A similar metric on the NYSE Composite, in fact, is north of 80 percent (Chart 3). Intraday Tuesday, 81.3 percent of the constituent stocks were above their 50-day, with a close of 80.1 percent; it too formed a doji in the session. There have been times in the past that this metric has gone north of 90 percent, but 80 percent already represents an extended territory. Once this level is hit, reversal risks go up significantly.

Thanks for reading!