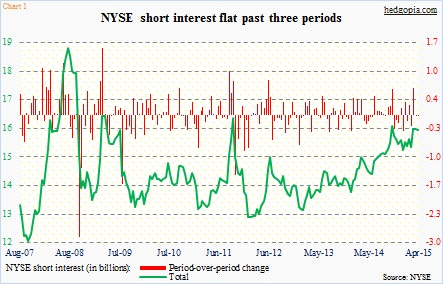

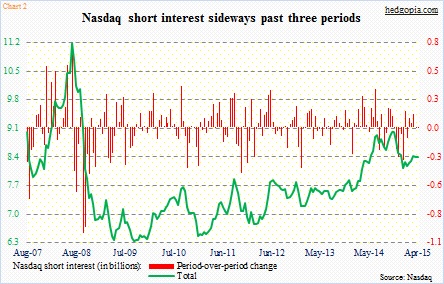

For the past three periods, short interest on both the NYSE and Nasdaq has essentially gone sideways.

As of mid-April, NYSE short interest has gone from 15.69 billion to 15.68 billion to 15.66 billion (Chart 1), and on the Nasdaq from 8.42 billion to 8.41 billion to 8.4 billion (Chart 2).

During the period (between March 13th and April 15th), the NYSE rallied 3.9 percent, and the Nasdaq 2.9 percent. Despite the rally, both indices still traded within a range, probably emboldening shorts to stay put.

Indices only broke out last week. This likely caused a squeeze. We will find out when numbers for the latest period are reported.

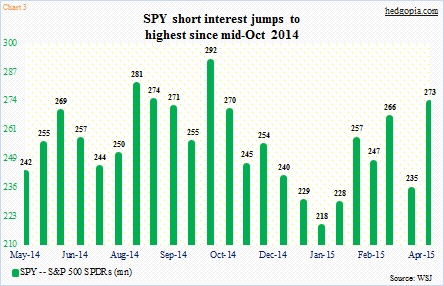

If last week’s breakouts were primarily a result of shorts giving up and covering, then bulls quickly need new sources of funds. They are hoping this will come from reopening of the buyback window. Should that happen, there is fuel in the tank.

In the latest period, short interest on SPY jumped 16 percent, to 273.4 million (Chart 3). This is the highest since mid-October (292 million). Back then, stocks nearly gave up 10 percent before rallying hard, squeezing the shorts. Bulls are hoping for a repeat, but ultimately it comes down to if new funds are forthcoming. One crucial difference between mid-October and now is that back then stocks were already down so much technical conditions were in gross overbought territory. Not so now. As a matter of fact, it is the opposite. Conditions are overbought, or getting there fast. So unless corporations put their pedal to the buyback metal, shorts may just have the last laugh.