Since bottoming early last month through last week’s high, The Nasdaq rallied more than 10 percent. Shorts contributed, as short interest dropped 1.1 percent last month. Short interest remains elevated. Bulls are eyeing a squeeze. For that, they need to at least decisively defend the breakout from seven sessions ago.

On October 3, after coming under pressure for a couple of weeks, the Nasdaq Composite lost the 200-day intraday but only to see bulls aggressively defend the average, which also approximated horizontal support at 7650. At 7700 back then, the average has now risen to 7901. From that bottom through last Thursday’s intraday high of 8483.16, the index rallied north of 10 percent, recapturing the 50-day in the process; the average, too, is rising.

Seven sessions ago, the Nasdaq (8464.28) surpassed the prior high of 8339.64 from July 26, followed by sideways action in the past six (Chart 1). The consolidation hence could lead to either another mini-breakout or to unwinding of overbought conditions, particularly daily. At this point in time, shorts could end up playing a role in this.

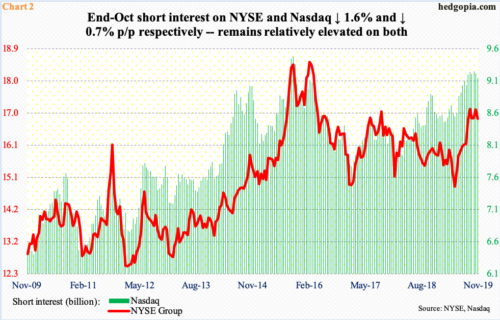

At the end of October, Nasdaq short interest fell 0.7 percent period-over-period to 9.1 billion shares. Over on the NYSE, it dropped 1.7 percent p/p to 16.8 billion (Chart 2).

On the Nasdaq in particular, short interest declined 1.1 percent in October. To reiterate, the index bottomed early last month before rallying strongly. Short interest remains elevated. The end-September total was at a four-year high.

If bulls prevail, short interest has a long way to go on the downside. It is possible it dropped more this month, as the July high was taken out on Nov 1. Or, shorts could be waiting to see what transpires when the breakout is retested (indigo horizontal line in Chart 1). This also approximates a trend line from last December. A decisive defense of this dual support, followed by a new high, could lead more shorts to leave. A test of bulls’ mettle lies ahead.

Thanks for reading!