- As company with 80k customer base, Microchip’s Friday 3Q14 warning caught majority by surprise

- Commentary from other tech outfits suggest things slowed down in September

- Too soon to say it is trend in making, but deserves close watch

Did things suddenly decelerate in September in the tech land? How bad was it? And how bad could it get?

That is the question on the minds of investors given the spate of earnings warnings the past couple of weeks. Such warnings in fact did not limit themselves to just within tech. We saw some in retail. Some in industrials. In recent weeks, macro data out of Germany, an exports power house, has consistently disappointed. As relates to company warnings, while it could just be a case of excessive optimism on the part of the Street, as well as the companies themselves, there are some worrying signs deserving of attention.

Friday morning, MCHP not only spooked semi investors but probably the whole tech sector as well as stocks in general, saying September-quarter results will fall short of expectations – its own as well as the Street’s. In a big scheme of things, this is not a big deal. The company is not even a “bellwether”, along the lines of INTC or TXN or BRCM. It is an $8bn market-cap company, and makes microcontrollers, which are nowhere near in sophistication as are processors, the kind designed by INTC. This line of thinking is a 60k-feet view. Zoom in, and we get a different picture. First, September is usually a strong month for MCHP, and was not this time around. The company primarily put the blame on China, as CY3Q is traditionally the strongest in that nation. And it was not this year. Second, MCHP reports sales on a sell-through basis, not sell-in. The former accounts for sales from distribution, the latter when it is shipped into the channel. Hence if MCHP is seeing weakness now, its sell-in peers will do so with a lag, not CY3Q. Third, MCHP has over 80k customers. Users of these microcontrollers are as diverse as autos, household appliances, medical devices, and other embedded systems. Historically, MCHP has been a leading indicator for semi cycle booms and busts.

Friday morning, MCHP not only spooked semi investors but probably the whole tech sector as well as stocks in general, saying September-quarter results will fall short of expectations – its own as well as the Street’s. In a big scheme of things, this is not a big deal. The company is not even a “bellwether”, along the lines of INTC or TXN or BRCM. It is an $8bn market-cap company, and makes microcontrollers, which are nowhere near in sophistication as are processors, the kind designed by INTC. This line of thinking is a 60k-feet view. Zoom in, and we get a different picture. First, September is usually a strong month for MCHP, and was not this time around. The company primarily put the blame on China, as CY3Q is traditionally the strongest in that nation. And it was not this year. Second, MCHP reports sales on a sell-through basis, not sell-in. The former accounts for sales from distribution, the latter when it is shipped into the channel. Hence if MCHP is seeing weakness now, its sell-in peers will do so with a lag, not CY3Q. Third, MCHP has over 80k customers. Users of these microcontrollers are as diverse as autos, household appliances, medical devices, and other embedded systems. Historically, MCHP has been a leading indicator for semi cycle booms and busts.

Other chipmakers to have lowered September-quarter expectations include OIIM, ISSI, CREE, EZCH, and MXL. And over in Taiwan, Mediatek struggled to hit the low end of its CY3Q guidance. Once again, in a big scheme of things, this is too small a group to form an opinion on the whole group. Besides, others are doing just fine. Samsung had a poor September quarter, but its DRAM sales held up. INTC has been optimistic about PC demand trends. Of course, bears can always argue – with some validity – that DRAM is benefiting from a shrinking supplier base and PCs from transition to Win 7, as Windows XP support expired in April. In 3Q, year-over-year PC numbers showed a semblance of stability – only shrank 0.5 percent (Gartner) and 1.7 percent (IDC) – but the aforementioned Windows transition could be playing a role here. In networking, JNPR followed RVBD in cutting its outlook for Q3 growth, citing a slowing in spending by carriers, especially in North America. ATEN is another outfit warning it would miss 3Q expectations. All this has come on the heels of ADTN’s recent indication that its enterprise business was weak.

Other chipmakers to have lowered September-quarter expectations include OIIM, ISSI, CREE, EZCH, and MXL. And over in Taiwan, Mediatek struggled to hit the low end of its CY3Q guidance. Once again, in a big scheme of things, this is too small a group to form an opinion on the whole group. Besides, others are doing just fine. Samsung had a poor September quarter, but its DRAM sales held up. INTC has been optimistic about PC demand trends. Of course, bears can always argue – with some validity – that DRAM is benefiting from a shrinking supplier base and PCs from transition to Win 7, as Windows XP support expired in April. In 3Q, year-over-year PC numbers showed a semblance of stability – only shrank 0.5 percent (Gartner) and 1.7 percent (IDC) – but the aforementioned Windows transition could be playing a role here. In networking, JNPR followed RVBD in cutting its outlook for Q3 growth, citing a slowing in spending by carriers, especially in North America. ATEN is another outfit warning it would miss 3Q expectations. All this has come on the heels of ADTN’s recent indication that its enterprise business was weak.

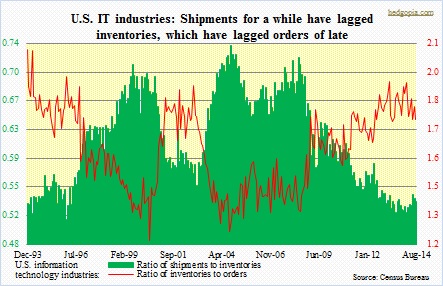

As sales expectations are not met, inventory piles up. This would not only impact future orders, but comes with a risk of snowballing into something bigger. In the chart above, we see that in the category Information Technology Industries, U.S. shipments have lagged inventories for a while now. The good thing is, the latter is not that out of line. Not yet anyway. These numbers are as of August. If indeed September saw a change in trend, then the ratio of inventories to orders – sideways for a while now – will begin to move up. This will particularly be the case as orders get cancelled. This is just a scenario based on a few data points, but definitely something worth watching!