US stocks are trying to stabilize after a decent drawdown. How things evolve will depend a lot on how margin debt, money-market fund assets and foreigners’ purchases evolve in the weeks/months to come.

After a seven-session, 7.8-percent decline intraday between the 3rd and 11th this month, the S&P 500 large cap index (2740.69) continues to try to stabilize. Tuesday, the intraday low of 2710.51 nine sessions ago was breached as the index fell all the way to 2691.43 but the intraday swoosh down was used as an opportunity to buy (Chart 1).

Tuesday’s low also tagged the daily lower Bollinger band. The daily chart is extremely oversold. Odds continue to favor a relief rally. Last week, rally attempts were denied at horizontal resistance at 2800. This also represents the underside of a broken trend line from February 2016. Before this, the 200-day moving average lies at 2768.27.

October-to-date, the index is down six percent. This follows a very good August (up three percent) and decent September (up 0.4 percent). Year-to-date, the S&P 500 is now only up 2.5 percent – was up as much as 10 percent at its peak of 2940.91 reached on September 21.

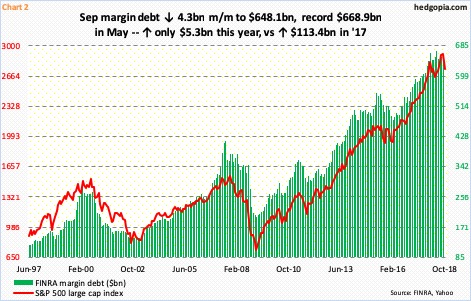

The performance this year pales in comparison to last year’s, when the S&P 500 jumped 19.4 percent. In 2017, margin debt fully cooperated. FINRA margin debt went from $529.4 billion to $642.8 billion – up a huge $113.4 billion. In the first nine months this year, margin debt is only up $5.3 billion. The two tend to move in unison (Chart 2).

In September, margin debt fell $4.3 billion to $648.1 billion. It peaked in May this year at $668.9 billion, nearly flattish to January’s $665.7 billion. The S&P 500 made an important high in that month before quickly dropping 10-plus percent. Stocks have gotten addicted to margin debt, and need this what is now a mild headwind to turn into a tailwind for a sustained move higher.

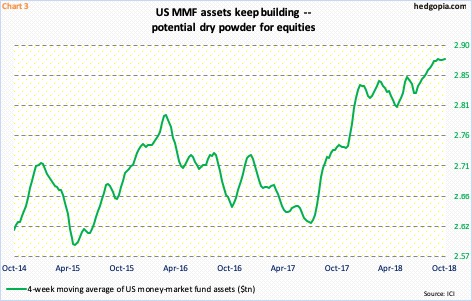

Interestingly, at least until Wednesday last week, another potential source of tailwind continued to play cautious. The S&P 500 made that initial low on the 11th (Chart 1). In the week ended October 10, US money-market fund assets were $2.89 trillion. This was the highest since April 2010. In the following week, these assets fell a tad to $2.87 trillion. This week’s data will be published later today, and can be telling as to how things might evolve in the weeks/months to come.

Chart 3 calculates a four-week moving average of these assets, and as can be seen, the green line has continued higher for a while. Equity bulls would obviously want to see a reversal of this trend. In an ideal scenario, this can act as dry powder. At least the bulls hope so.

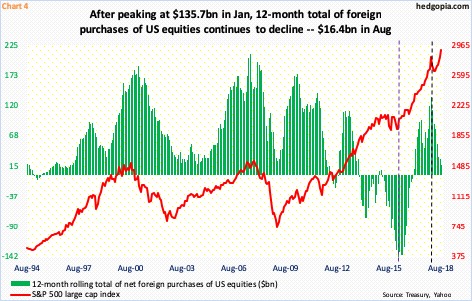

This is particularly important as foreigners – another source of funds – are yet to warm up to US stocks. On a 12-month rolling total basis in August, they purchased $16.4 billion worth. As early as January, net purchases were $135.7 billon, before reversing lower. Once again, the S&P 500 reached a major high in that month (black vertical dashed line in Chart 4). Importantly, back in February 2016 when the S&P 500 reached a major low the green bars reversed higher (violet vertical dashed line). In that month, foreigners sold $145.3 billion in US stocks. So, their activity is worth watching. At least until August, they were playing cautious.

Would that change now that the S&P 500 has had a decent drawdown this month? Time will tell. How this metric – along with margin debt and money-market fund assets, among others – behave will decide if stocks are in the process of hammering out a decent bottom or are on their way to once again fail at resistance.

Thanks for reading!