For the last five years, the S&P 500 index has bounced up and down within a channel. Technicals have been in gross overbought territory for a while now. The last time the index had a 10-percent correction was two years ago. The last time the RSI dipped below 50 was in November 2012. The bull market itself has lasted more than five years. And on and on. On one hand, the relentless nature of the rally speaks of the prevailing investor conviction, on the other it has also helped build up excesses. In normal circumstances, such excesses are/can be taken care of at/near important technical levels, when sellers come out of the woodwork and/or buyers decide to wait for better opportunities, etc. From a longer-term perspective, such pauses tend to breathe a fresh lease of life into the prevailing trend. So the S&P 500 index approaching the upper end of the channel it is in could/should have been taken as an opportunity to correct these excesses. That is not how things have unfolded. So far at least.

For the last five years, the S&P 500 index has bounced up and down within a channel. Technicals have been in gross overbought territory for a while now. The last time the index had a 10-percent correction was two years ago. The last time the RSI dipped below 50 was in November 2012. The bull market itself has lasted more than five years. And on and on. On one hand, the relentless nature of the rally speaks of the prevailing investor conviction, on the other it has also helped build up excesses. In normal circumstances, such excesses are/can be taken care of at/near important technical levels, when sellers come out of the woodwork and/or buyers decide to wait for better opportunities, etc. From a longer-term perspective, such pauses tend to breathe a fresh lease of life into the prevailing trend. So the S&P 500 index approaching the upper end of the channel it is in could/should have been taken as an opportunity to correct these excesses. That is not how things have unfolded. So far at least.

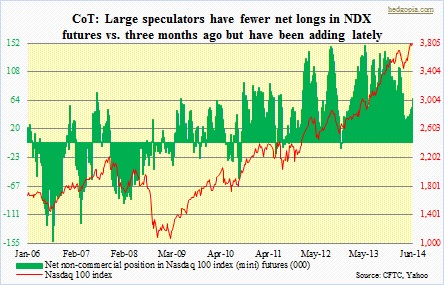

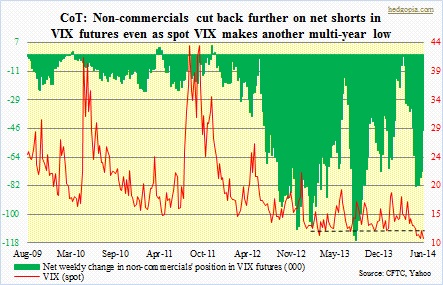

As a matter of fact, it can be argued that the S&P 500 index just broke out of the channel. If it is a genuine breakout, this has/will have major significance from the viewpoint of long-term health of the current bull market. Two things need consideration. First, it is too soon to say if it is genuine. Second, what might be causing this? Has central-bank activism been so powerful as to influence the two most important emotions market participants have – greed and fear? Currently – for the most part anyway – only greed is at play. The other emotion – fear – is missing in action. Nowhere is this more evident than in the VIX (spot), which last week made another seven-year low. If there is any fear among market participants, it is that of not wanting to miss out on a rally. In the futures market, large speculators have further added to their net longs in NDX futures. First of all, kudos to this group, as for the last five weeks they could not have ridden the NDX rally any better – having increased longs and cutting shorts on time.

As a matter of fact, it can be argued that the S&P 500 index just broke out of the channel. If it is a genuine breakout, this has/will have major significance from the viewpoint of long-term health of the current bull market. Two things need consideration. First, it is too soon to say if it is genuine. Second, what might be causing this? Has central-bank activism been so powerful as to influence the two most important emotions market participants have – greed and fear? Currently – for the most part anyway – only greed is at play. The other emotion – fear – is missing in action. Nowhere is this more evident than in the VIX (spot), which last week made another seven-year low. If there is any fear among market participants, it is that of not wanting to miss out on a rally. In the futures market, large speculators have further added to their net longs in NDX futures. First of all, kudos to this group, as for the last five weeks they could not have ridden the NDX rally any better – having increased longs and cutting shorts on time.

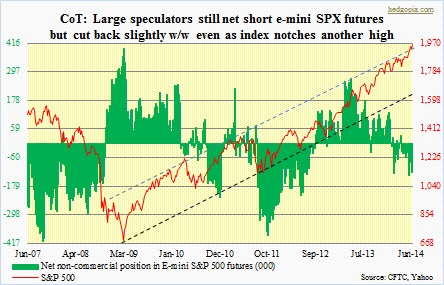

Secondly, as the chart on top shows, if the channel breakout on the SPX is real, the NDX is bound to tag along, regardless the latter lags or leads its larger brethren. Importantly, these futures positions do not reflect the equity rally on Wednesday post-FOMC decision last week, so it is possible the makeup is totally different; the CFTC only reports positions as of each Tuesday. Given how equities reacted to how/what Janet Yellen said that day, in all probability futures traders have added longs/cut shorts. In the latest week, large speculators already added more longs than shorts in e-mini S&P 500 futures. One reason why this blogger is not completely sold on the idea of convincing S&P 500 breakout (out of the channel) is how the VIX is acting, or failing to act. Can it go any lower? Absolutely. As a matter of fact, back in December 2006 it broke 10 and traded down to 9.39, followed by the mother of all rallies in which the so-called ‘fear index’ peaked at 89.53 in October 2008. So a test of that sub-10 low is always a possibility. The caveat, of course, is that large speculators the past four weeks have been gradually reducing their net shorts in VIX futures. They did that with a little bit more aggression in the latest week – now net short 48k, down from net short 82k a month ago.

Secondly, as the chart on top shows, if the channel breakout on the SPX is real, the NDX is bound to tag along, regardless the latter lags or leads its larger brethren. Importantly, these futures positions do not reflect the equity rally on Wednesday post-FOMC decision last week, so it is possible the makeup is totally different; the CFTC only reports positions as of each Tuesday. Given how equities reacted to how/what Janet Yellen said that day, in all probability futures traders have added longs/cut shorts. In the latest week, large speculators already added more longs than shorts in e-mini S&P 500 futures. One reason why this blogger is not completely sold on the idea of convincing S&P 500 breakout (out of the channel) is how the VIX is acting, or failing to act. Can it go any lower? Absolutely. As a matter of fact, back in December 2006 it broke 10 and traded down to 9.39, followed by the mother of all rallies in which the so-called ‘fear index’ peaked at 89.53 in October 2008. So a test of that sub-10 low is always a possibility. The caveat, of course, is that large speculators the past four weeks have been gradually reducing their net shorts in VIX futures. They did that with a little bit more aggression in the latest week – now net short 48k, down from net short 82k a month ago.