US stocks continue to make fresh highs, with the leaders doing all the heavy lifting. Tech is the leading sector, and it leads by a mile. At some point, this lop-sided leadership becomes more of a risk than a reward.

It is top-heavy. Increasingly so.

The biggest companies in the S&P 500 large cap index are getting bigger. By the end of last year, the top 10 companies together commanded a market cap of $6.08 trillion. Of this, Apple (AAPL) and Microsoft (MSFT) ended the year in the $1 trillion category – $1.23 trillion and $1.20 trillion respectively, for a 4.6 percent and 4.5 percent of the index market cap of $26.8 trillion. Amazon (AMZN) finished third with $769.6 billion.

The data comes courtesy of S&P Dow Jones Indices, which treats Alphabet A (GOOGL) and Alphabet C (GOOG) separately. If treated together, they would have taken the third spot with a market cap of $800.9 billion.

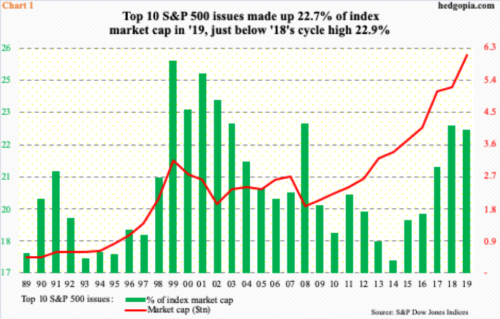

On an absolute basis, the top 10 finished last year with a record total, but not as a share of the total market cap. They made up 22.7 percent, down a little from the cycle high 22.9 percent in 2018. In 2014, the top 10 only accounted for 17.5 percent, so they have come a long way.

At some point, this metric will have become so top-heavy it will begin to fall under its own weight. Are we at that stage? Bulls would say no, citing history. In 2008, the green bars in Chart 1 rose as high as 23 percent before tumbling – and much higher 25.5 percent in 1999.

Tech’s dominance in this is obvious. As a matter of fact, the top five are all tech – Alphabet (GOOG/L) and Facebook (FB) being the other two. As a sector, tech last year comprised 23.2 percent of the S&P 500 market cap. Post-Great Recession, this is the second highest, with the highest 23.8 percent recorded in 2017 (Chart 2). This is elevated. Health care, which last year accounted for 14.2 percent for a second spot, was not even close. Financials were third with 13 percent.

Nothing says the likes of AAPL and MSFT cannot continue on the current trajectory, doing all the heavy-lifting. In a risk-on environment, tech’s leadership is viewed favorably – rightly so. But this metric is also worth a close watch. At some point, their lopsided leadership becomes more of a risk than a reward.

Thanks for reading!