The S&P 500 is sitting on crucial support, a decisive break of which could send bears into panic, and that could set up a decent opportunity for a counter-trend rally.

The S&P 500 is hanging by a thread. Down 2.8 percent this week through Wednesday, it is sitting right on crucial support.

On January 24, after dropping 12.4 percent from the January 4 record high of 4819, the large cap index staged a hammer reversal at 4223. The subsequent rally peaked at 4590s, which was tagged in two different sessions by the 9th (this month) and was rejected both times; bears aggressively defended the 61.8-percent Fibonacci retracement of the January 4-24 decline.

They are staring at another opportunity. The S&P 500 closed Tuesday at the neckline of a potential head-and-shoulders formation. The pattern is not very clean, but a decisive break could eventually open the door toward 3600 (Chart 1).

Even if the neckline is breached, it is improbable the index heads toward 3600 in a straight line. Conditions are getting oversold. Sentiment has taken a hit, although not panicky just yet.

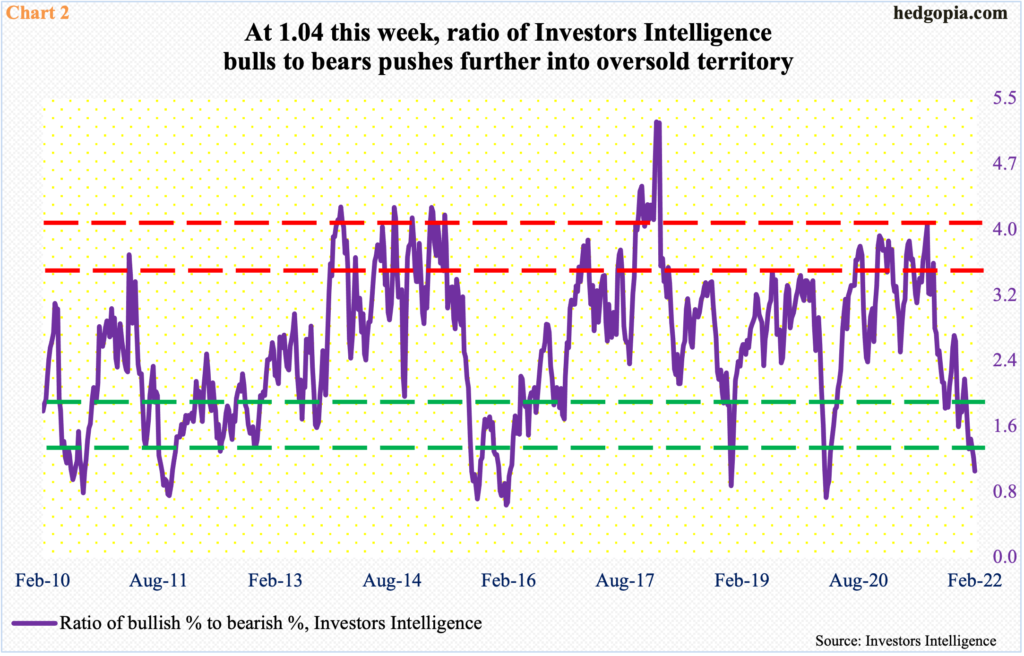

This week, Investors Intelligence bulls slid 1.5 percentage points week-over-week to 32.2 percent. This was the sixth consecutive week of bulls in the 30s. Bears, in the meantime, increased 3.1 percentage points w/w to 31 percent. The resulting ratio of 1.04 pushed the metric further into oversold territory. In March 2020, when US stocks put in major lows, the ratio fell as low as 0.72 and remained sub-one for three weeks; bears’ count jumped as high as 41.7 percent in the week to March 24, which was when the S&P 500 bottomed.

Bears currently are nowhere near as panicky. A breach of the neckline in Chart 1 could lead to more neutrals jumping on the bearish bandwagon. That could set up for a decent reflex rally.

Thanks for reading!