Despite a down day in stocks in general, financials had a lot of oomph yesterday.

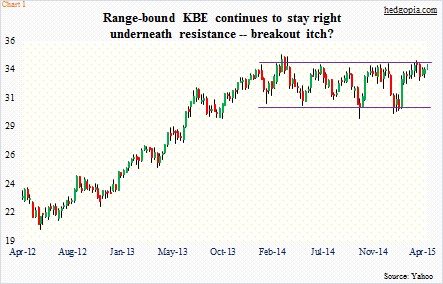

KBE continues to hug the upper end of the one-plus-year range it is in (Chart 1), as if the ETF wants to break through resistance. XLF has lagged a little bit, but yesterday did find support at its 50-day moving average.

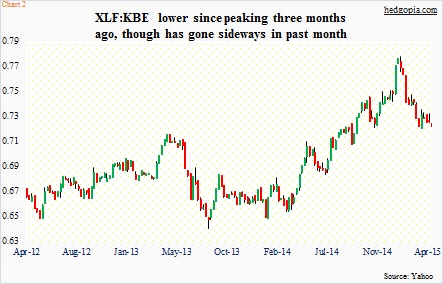

In fact, the ratio of XLF to KBE peaked in the third week of January and has been under pressure since, although it has gone sideways in the past month or so (Chart 2). (A possible reason for this divergence as well as their composition was discussed in a prior post.)

Financials’ resiliency yesterday could prove important due to a couple of reasons.

One, this is a heavy week with nearly all the majors reporting their 1Q. JPM and WFC report later this morning, BAC on Wednesday, and C and GS on Thursday.

Secondly, Jefferies, which merged with LUK in 2012, already reported its 1Q. Its quarter ends in February, so numbers came out mid-March. As was the case with its 4Q, numbers were anything but impressive. It was a slow quarter “with a tepid fixed income trading market and fewer new issues in leveraged finance capital markets.”

Jefferies’ fixed-income revenue dropped 56 percent year-over-year, and investment banking 34 percent.

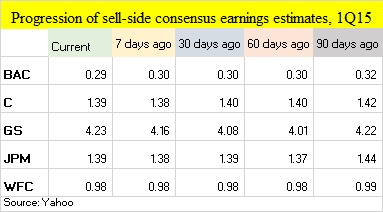

It is possible the sell-side has already accounted for this. In the past month, of the major five in the adjacent table, except for GS, estimates are flat to slightly down.

Since Jefferies reported on the 17th (March), only two stocks are up – GS and JPM. WFC, BAC and C are down. So maybe we are reading too much into yesterday’s action. But at the same time, as the old saying goes, price trumps everything. Until it does not.

It may have something to do with earnings. Or the fact that yesterday MS slapped an overweight rating on financials –for the first time in seven years. Or simply because investors/traders thought GE Capital’s decision to sell assets is an opportunity for banks to purchase loans.

Whatever it is, there is a lot riding on that rectangle resistance on KBE. A convincing breakout will be a tell.