On Tuesday last week, Bloomberg carried an article on slowdown in stock buybacks in the U.S. TrimTabs data show that in the first seven months this year, buybacks totaled $376.5 billion, down 21 percent from $478.4 billion in the corresponding period last year.

Data from S&P Dow Jones Indices also point toward similar deceleration.

With 90 percent of the data in for S&P 500 companies, Howard Silverblatt points out that 2Q16 is running 21 percent behind 1Q16. Buybacks were $161.4 billion in 1Q16 – the highest since $171.9 billion in 3Q07.

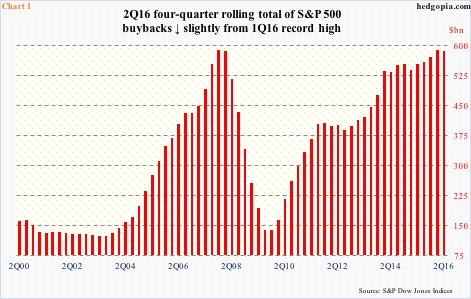

On a four-quarter tolling total basis, 2Q16 buybacks were $585 billion. (To be clear, this could change as all the data are not in yet, but is probably right directionally.) The all-time high of $589.4 billion was recorded in 1Q16, nudging past the prior high of $589.1 billion in 4Q07 (Chart 1).

The important thing is the trend. This was the first quarter-over-quarter decline since 2Q14. Buybacks remain highly elevated, and have been a major tailwind for stocks. A trend change would be a big development. Is it?

Odds are decent that it is.

The S&P Dow Jones Indices data also point out that cash & equivalents for S&P 500 companies excluding financials, utilities and transportation is set to make another record in 2Q16; 1Q16 was $1.35 trillion. (These three sectors are excluded as they tend to maintain high cash reserves as part of their normal operating process.)

From the buyback perspective, besides cash, there are two other important variables: corporate earnings and debt issuance.

Corporate profits adjusted for inventory and depreciation inched up 0.3 percent quarter-over-quarter in 1Q16 to a seasonally adjusted annual rate of $1.9 trillion. Profits peaked at $2.16 trillion in 3Q14, and have decelerated since. (2Q16 data will be published this Friday.)

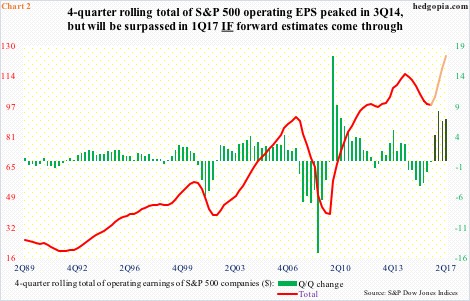

The trend is similar with operating earnings of S&P 500 companies. The four-quarter rolling total peaked in 3Q14 at $114.51, and were $98.31 in 2Q16. The deceleration is sharp.

That said, forward estimates continue to remain elevated. If they come through, the 3Q14 peak will be surpassed in 1Q17. In Chart 2, 3Q16-2Q17 are colored differently. Once again, if these estimates are realized, earnings would have improved massively. The prevailing trend, however, casts doubt on this rosy scenario.

For at least a couple of years, earnings estimates have come under sharp downward revision. Back in 2Q14, 2015 was expected to earn $137.50 out of operations. When it was all said and done, it brought in $100.45. In 4Q14, 2016 consensus was $137.50, which has now been slashed to $110.76. In the middle of January this year, 2017 started out as $141.11 – now $132.83.

Therein lies the rub – 2017 estimates have a ton of optimism built in, and it is hard to bet money on expectations that the projected spike on the right side of Chart 2 will get realized.

This scenario does not bode well for continuation of the current trend in buybacks. In 1Q16, buybacks and dividends combined constituted 123.3 percent of operating earnings of S&P 500 companies (not shown here). This was the third straight quarter this happened, and in four out of the last five quarters. Companies are stretching it.

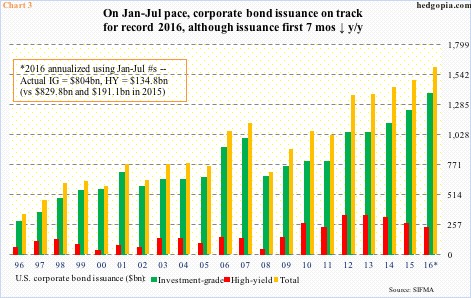

It is no secret that companies have been making use of the low rate environment and issuing debt to buy back stock. The issuance trend has decelerated since 2014 in high-yield, but investment-grade and total have grown since 2009 (Chart 3).

In the first seven months this year, total issuance totaled $939 billion. Annualized, 2016 is on course for yet another record. However, issuance this year is down eight percent from the corresponding period last year, so annualizing the seven-month total probably does not give us the right picture.

The trend in debt issuance is in deceleration, and this could impact the trend in stock buybacks. The 2Q16 q/q drop in Chart 1 is probably not an aberration.

Thanks for reading!