US trade deficit continues its uptrend. Deficit with China in particular is front and center. Trade talks with that nation are ongoing. November’s report, out Wednesday, did nothing to soothe tensions.

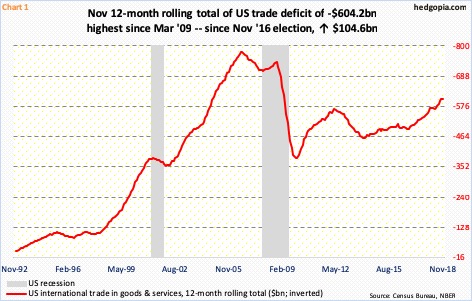

In general, the monthly trade data put out by the Census Bureau does not elicit that big a response from traders – not at a level the monthly employment report does anyway. The US runs a deficit, and this has been going on for a long time (Chart 1). Markets do not expect this to ameliorate anytime soon.

That said, right here and now, there is a slight twist to this. Markets may still not trade on this series, but there is an added interest, if nothing else just to try to gauge how this might impact the ongoing trade talks between the US and China.

In November, the US suffered $49.3 billion in trade deficit, for a total $604.2 billion in the last 12 months. This was the highest 12-month total since March 2009. In the current cycle, the red ink has grown since bottoming at $383.2 billion in January 2010. The all-time high was recorded in September 2006 at $778.2 billion.

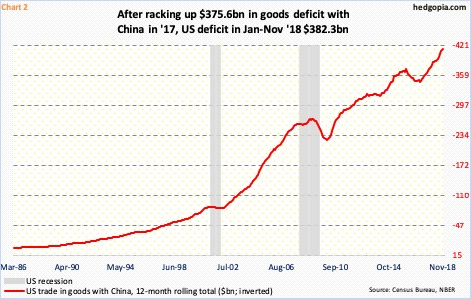

Not so with China.

In November, US trade deficit with that nation was $37.9 billion, a five-month low, but on a 12-month running total basis it stood at $413.2 billion – a new record (Chart 2).

Last year, China ran a surplus of $375.6 billion. With one month to go, 2018 already totaled $382.3 billion. If December at least runs a monthly January-November average of $34.8 billion, 2018 would have at least grown 9.1 percent over 2017. This would be the fastest pace in eight years. Just since November 2016, when Donald Trump was elected president, US trade deficit with China has gone up by $66 billion.

The trend is worsening, and it is at the front and center of the ongoing trade talks between the US and China. In the long run, even if these talks resolve in favor of the US and its deficit with the Asian nation begins to drop, the composition of US deficit may change but the overall direction may not. A reduction in US deficit with China may very well be offset by an increase with that of, let us say, Vietnam.

Near term, US equities have moved up a lot since late December in expectation of a trade resolution. If there is no deal, or if there is one but markets perceive it as a disappointment, it is probably a no-brainer. Conditions are overbought, and unwinding can last a while. Since December 26, the S&P 500 large cap index has rallied nearly 17 percent. In just about a straight line! It is currently testing the 200-day moving average, and the daily in particular is way extended, with receding volume – not a good combination.

Thus the need to be on the lookout for if weakness develops here. Given the rally in the past six weeks, even if a trade deal is hammered out, a ‘buy the rumor, sell the news’ scenario is entirely possible.

Thanks for reading!