Leading into this week’s 3Q reports from five tech heavyweights, the Nasdaq 100 has not made much progress the last couple of weeks. These results will have repercussions for other market cap-weighted indices, such as the S&P 500, where both bulls and bears defended their positions last week.

The Nasdaq 100 has now rallied for seven straights weeks, but not a whole lot of progress has been made the last couple of weeks, closing at 20272 three weeks ago, 20324 two weeks ago and 20352 last week. A spinning top formed on the weekly the last two weeks.

Importantly, at Friday’s high (20553), the tech-heavy index was merely 0.67 percent from the all-time high of 20691 posted on July 10 but reversed hard as the session progressed to end the week up 0.14 percent; the session produced a gravestone doji – right at the daily upper Bollinger band and not too far away from its July high (Chart 1).

This rather tentative looking action is unfolding even as the leading tech outfits get ready to report their September quarter.

From tech earnings’ perspective, this week is big. Google parent Alphabet (GOOG) reports on the 29th, Microsoft (MSFT) and Facebook parent Meta (META) on the 30th, and Apple (AAPL) and Amazon (AMZN) on the 31st. Nvidia (NVDA) is on an off quarter and will report its October quarter on November 27.

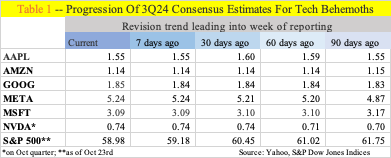

Interestingly, going back three months, the sell-side’s estimates for these five companies are holding their own – sideways to slightly up – even as estimates for S&P 500 companies have gone from $61.75 three months ago to $58.98 (Table 1).

This is a positive from the perspective of tech earnings, but this could very well be in these stocks. Of the five, AAPL and META posted a new high this month, while GOOG, MSFT and AMZN are all down from their July highs.

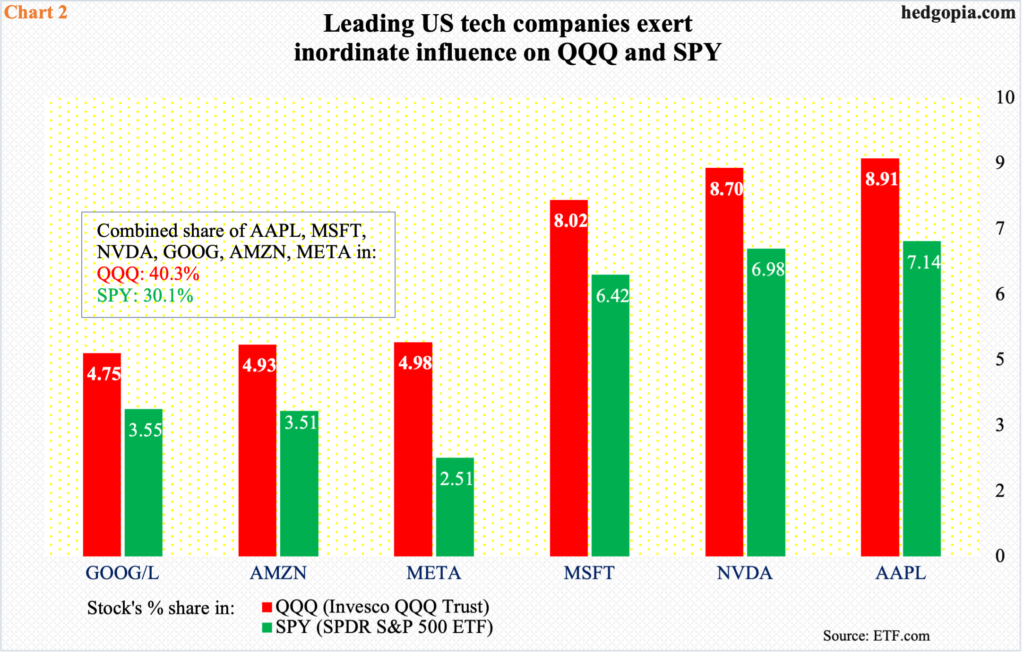

These companies matter. Combined, they have a market cap of north of $12 trillion. Throw in NVDA, which is worth $3.5 trillion, and we are talking an ordinate amount of influence they exert on market cap-weighted indices, such as the Nasdaq 100.

The combined share of these six companies (including NVDA) in QQQ (Invesco QQQ Trust) is 40.3 percent. In SPY (SPDR S&P 500 ETF), this amounts to 30.1 percent (Chart 2). This is massive and can easily tip the scale. How investors/traders react to the results from the five reporting this week will reverberate through the stock market.

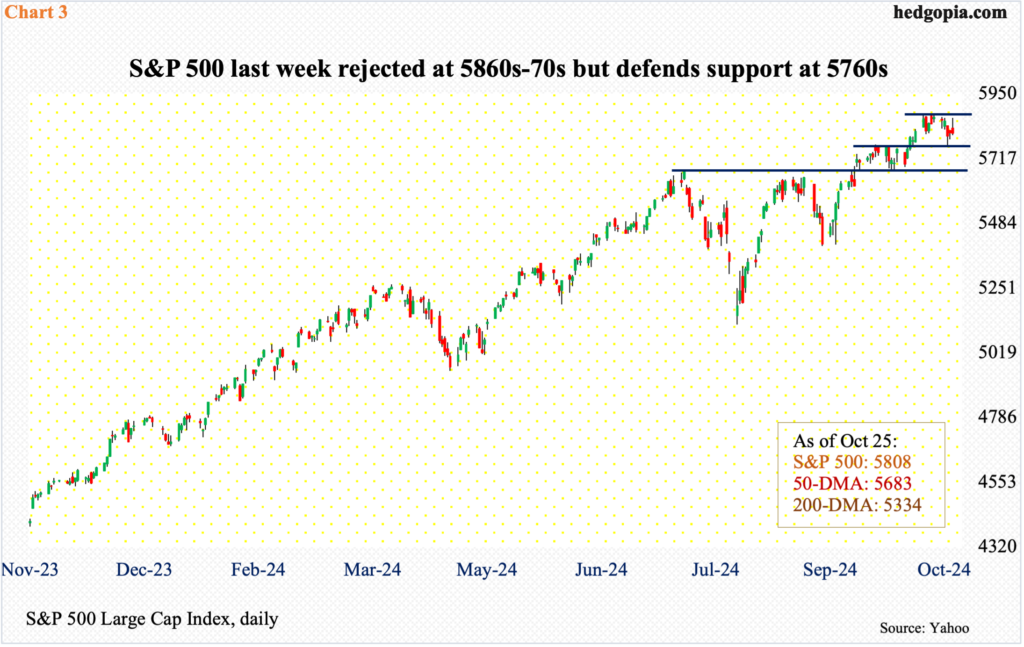

Going into this event, the S&P 500 suffered its first down week in seven last week, giving back one percent. In the end, the week offered something for bulls and bears alike.

Last Friday, the large cap index rose as high as 5863 within the first hour but reversed to close at 5808; at the session high, it would have ended essentially unchanged for the week, but bears showed up in droves at 5860s-70s, which has provided stiff resistance for nearly two weeks now. Bulls, however, can take solace in the fact that earlier on Wednesday they were able to defend horizontal support at 5760s (Chart 3).

Unless the tech heavyweights throw it out of the park this week – unlikely given how these stocks are trading – odds favor 5760s support gets tested again this week. A breach will open the door toward 5670s, which is a make-or-break.

Thanks for reading!