The Nasdaq Composite is down 23 percent from its record high last November. Shorts have done exceedingly well, as short interest rose to a fresh high mid-April. Both the Composite, and the Nasdaq 100, closed Tuesday at a crucial level. If longs manage to put their foot down, short-covering can act as a decent tailwind.

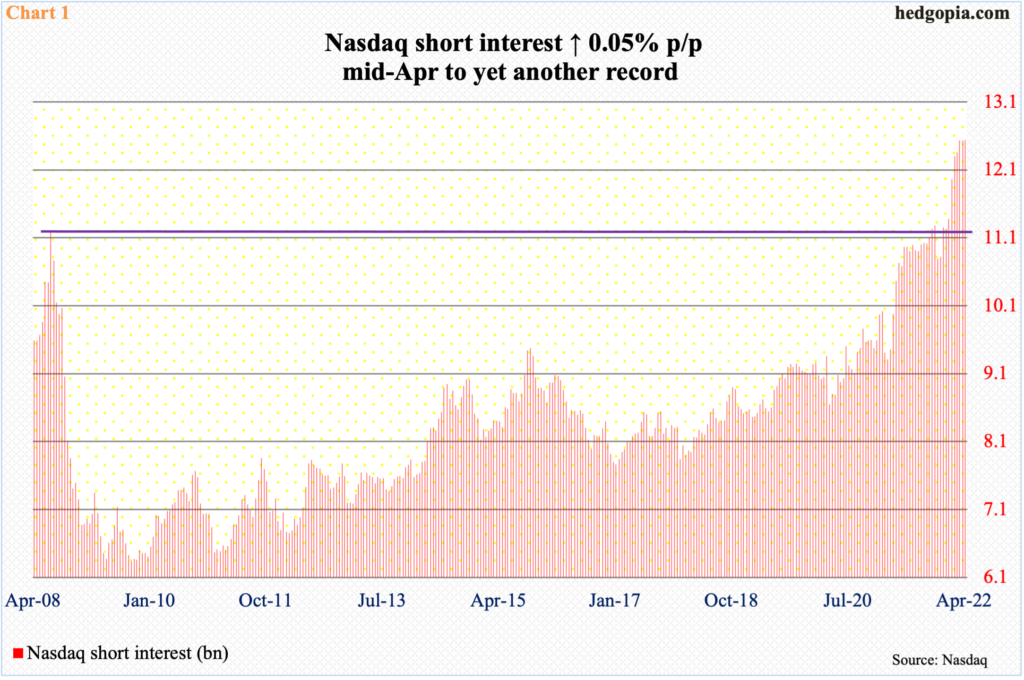

Shorts, with record short interest on the Nasdaq Composite, are making a killing. Mid-April, they were sitting on 12.5 billion shares, up a tad period-over-period to a fresh record (Chart 1). Since then, the index is down 6.4 percent.

As we can see, shorts have been adding to their bearish bets for a while now.

Mid-July 2008, Nasdaq short interest rose to 11.2 billion before coming under sustained pressure and bottoming end-September 2009. That mid-July 2008 high was not surpassed until mid-October last year. Between then and now, short interest has gone up another 11.7 percent. The Nasdaq, as well as the Nasdaq 100, peaked last November. Through Tuesday, they were respectively down 23 percent and 22.4 percent.

Shorts could not have asked for more. If things go their way, more profit could be in store. At the same time, in the right circumstances for tech bulls, short-covering odds have gone up.

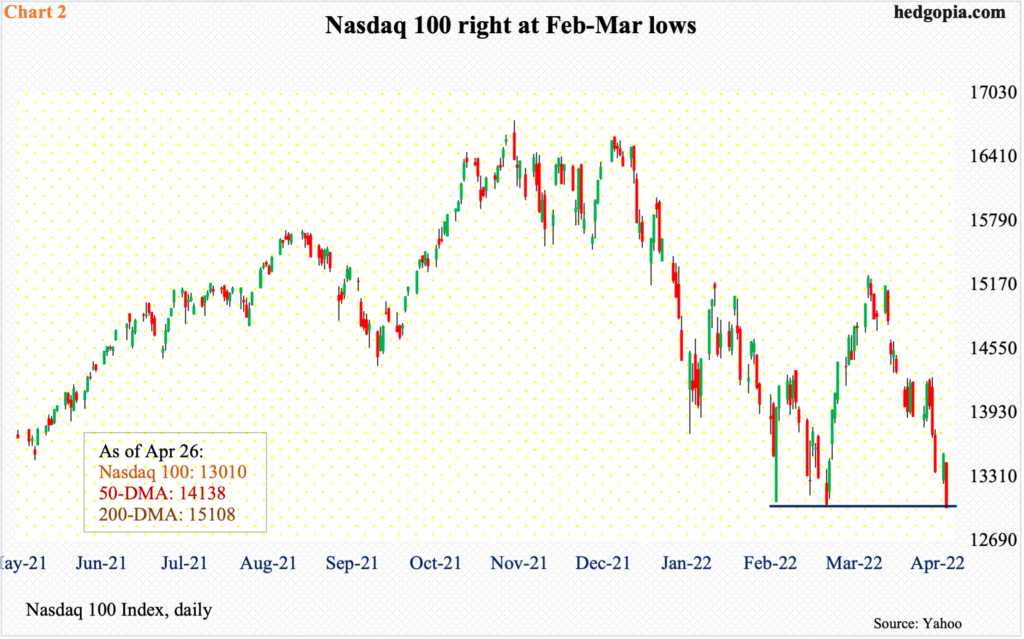

The Nasdaq 100 ended Tuesday at a crucial juncture. This was a week in which five leading tech outfits were slated to report their March quarter. Microsoft (MSFT) and Google owner Alphabet (GOOG) reported yesterday; after-hours, the former was up and the latter down. Facebook owner Meta Platforms (FB) will report later today, and Apple (AAPL) and Amazon (AMZN) are on tap for tomorrow.

The Nasdaq 100 is a market cap-weighted index – as are the S&P 500 and the Nasdaq Composite. As go the leading tech companies, so go these indices.

On Tuesday, the Nasdaq 100 closed at 13010 – testing the February (13065) and March (13020) lows (Chart 2). A decisive breach of this support can very well take out stops, putting the index under more pressure.

Concurrently, the daily is way oversold. All these five companies have been bleeding for a while, with a breach of both the 50- and 200-day moving averages. These results could very well ignite a ‘sell the rumor, buy the news’ phenomenon, raising odds of short-covering. There is plenty of fuel for that to happen; shorts will happily oblige as they are sitting on loads of profit.

Thanks for reading!