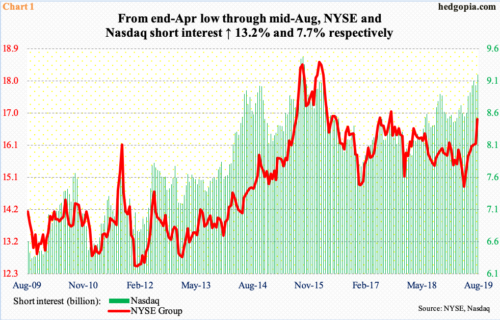

In the two-week period ended mid-August, short interest continued to rise on both NYSE Group and Nasdaq, respectively up 4.4 percent and 1.8 percent period-over-period. In three and a half months, short interest has gone up 13.2 percent and 7.7 percent, respectively. It bottomed at the end of April at 14.9 billion and 8.5 billion, and ended mid-August at 16.8 billion and 9.2 billion. On NYSE, short interest is at the highest since mid-September 2017 and on Nasdaq since mid-October 2015 (Chart 1).

The persistent buildup in short interest points to the dilemma bears are in. From US-China trade war to several geo-political hot spots to decelerating global economy, among others, there is no shortage of issues for them to form a negative bias. At the same time, it is also costing them – for the most part, anyway.

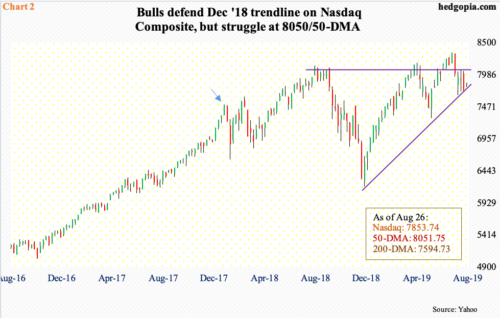

The Nasdaq Composite is 5.8 percent from its record high set on July 26. The NYSE Composite peaked earlier, in January last year, and is 8.2 percent from its record high. The Nasdaq, too, peaked back then (arrow in Chart 2), but managed to subsequently make higher highs, including this July. Along the way, shorts ended up helping the longs, as they were forced to cover.

Bulls would love a squeeze right here. Short interest remains elevated. The Nasdaq (7853.74) has come under pressure this month, but an important support has so far not given way. After losing 8.1 percent intraday in seven sessions, selling stopped early August at a rising trend line from last December’s lows. Since then, bulls defended this support several more times.

At the same time, they have been unable to take out one-year resistance at 8050-ish. The 50-day (8051.75) lies right there. For now, as far as bears are concerned, this probably is the line in the sand. They would probably rethink their bias should bulls succeed in reclaiming this ceiling. Until then, it is bears’ ball to lose; they might even show more aggression if the 200-day (7594.73) is convincingly breached. When it is all said and done, all this can eventually work to bulls’ advantage as short-covering leads to upward pressure, helping form a bottom.

Thanks for reading!