Corporate bond issuance continues to surprise on the downside. While some technical factors could be responsible for this, the deceleration comes amidst strong GDP growth.

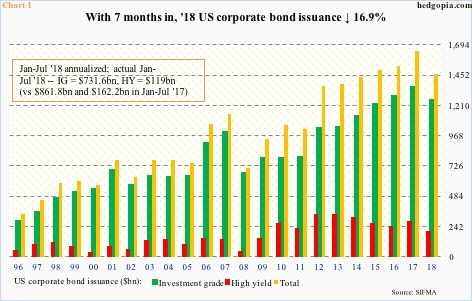

In July, US corporations issued $61 billion in total, made up of $52.5 billion in investment-grade (IG) and $8.5 billion in high-yield (HY). From July last year, total issuance was down 54.3 percent, with IG dropping 58 percent and HY 0.3 percent. (IG companies are the ones with strong balance sheets. High-yield comprises of bonds issued by companies on shakier ground.)

With five more months to go, 2018 issuance is down 16.9 percent; IG and HY are down 15.1 percent and 26.6 percent respectively. If the current trend holds up, issuance this year will total $1.46 trillion, which will be the lowest since 2014 (Chart 1).

The sudden deceleration in issuance is interesting given the US economy continues to hum along. Some technical factors may be in play. Post-tax cuts of last December, US multinationals are preparing to repatriate their offshore profits. As a result, they may very well be parking them in cash, as opposed to buying corporate debt, which was the case previously. Once offshore money comes home, these companies may also not need to issue new debt – or to the extent they did in the past – in order to finance buybacks, etc.

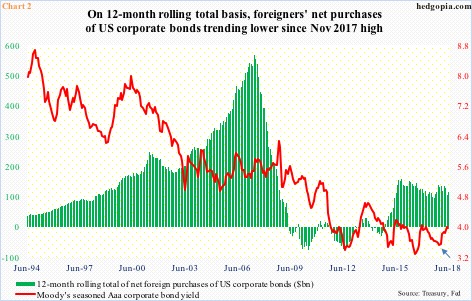

Of late, foreigners have cut back as well. In June, foreign purchases of US corporate bonds totaled $10.2 billion, but momentum has shifted downward in the past several months. On a 12-month running total basis, June purchases were $114.3 billion, versus $137.3 billion last November (Chart 2).

Or, it is possible issuance is beginning to fall under its own weight.

In 1Q18, US non-financial corporate debt stood at $9.1 trillion. In 4Q10, this was $6 trillion. Corporations have added a lot of debt in this recovery. How does this fare against national income? The latter was $17 trillion in 1Q18. So as a percent of national income, non-financial corporate debt comprised 53.2 percent in the quarter! As Chart 3 shows, this is way elevated, and not that far away from the all-time high of 54.3 percent in 1Q09. The red line in the chart has inched lower from 53.3 percent in 3Q17.

The chart also shows bear market in US stocks. Historically, the red line tends to peak inside a bear market – at times well into a bear market has begun. So unless this time is different, the red line may not have peaked. Second-quarter numbers will be out next month, and are worth watching, as is Chart 4.

This year, rates have come under slight upward pressure. Moody’s seasoned Aaa corporate bond yield was 3.92 percent Tuesday. Last December, it was 3.51 percent (arrow in Chart 2). Historically, rates are still very low, which also suggests they have more upside than downside risk – timing notwithstanding.

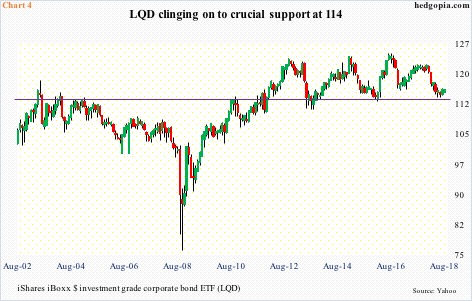

In this regard, LQD (115.72), an investment-grade corporate bond ETF, is worth watching. In May, it fell as low as 113.72 before bouncing. Support at 114 is crucial – goes back at least 15 years. (The ETF began life in July 2002.) This level has been tested several times in the past five years. The ETF is literally hanging by a thread. A breach will reverberate through the corporate debt landscape, not to mention the economy. That is when people will start talking about recession risk.

Thanks for reading!