The US dollar index has rallied strongly in the past five weeks. This can potentially have consequences for US inflation, exports, economy, earnings and what not. But was the rise enough for FOMC members to discuss in the March meeting?

“Inflation on a 12-month basis is expected to run near the Committee’s symmetric 2 percent objective over the medium term.”

The above is from the May 1-2 FOMC statement.

Later this afternoon, minutes for that meeting will be published. Markets will be keenly focused on if members would expand on that word ‘symmetric’.

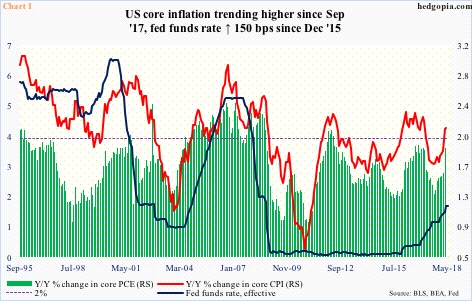

Core inflation has trended higher since last September, with core PCE rising 1.88 percent in the 12 months to March, up from 1.3 percent last August, and core CPI increasing 2.14 percent in the 12 months to April, versus 1.68 percent last August (Chart 1).

How they view where inflation is headed can influence their interest-rate outlook.

Since December 2015, the Fed funds rate has gone up by 150 basis points to a range of 150 to 175 basis points, including a hike this March.

Another thing to watch out for in the minutes is if the members care to comment on the US dollar’s strength the past five weeks. The FOMC statement was mum on the topic.

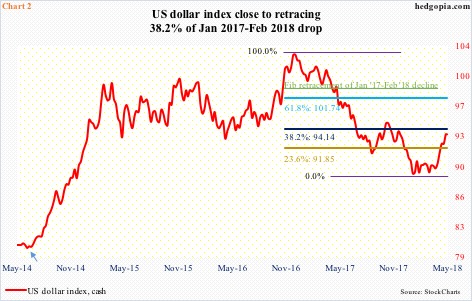

After persistent defense of long-term support at 88-89, the US dollar index broke out of a symmetrical triangle a month ago, followed by a sharp rally. From an intraday low on April 17 of 88.94 to this Monday’s high of 93.96, it jumped 5.6 percent.

This preceded a 15-percent, 13-month decline. From 103.82 on January 3 last year, the dollar index (93.53) dropped all the way to 88.15 on February 16 this year. A 38.2-percent Fibonacci retracement of this lies at 94.14 (Chart 2). This is important resistance, and also approximates horizontal resistance. In a long-legged doji session Monday, it rose to 93.96, before retreating. The daily chart is extended, and likely comes under pressure near term.

Medium- to long-term, how the currency behaves will reverberate through a whole host of assets, not to mention the US economy. In general, a decline in the value of the dollar tends to raise the price of imported goods, hence contributes to inflation. That said, of late both crude oil, which is priced in dollars, and the dollar index are rallying.

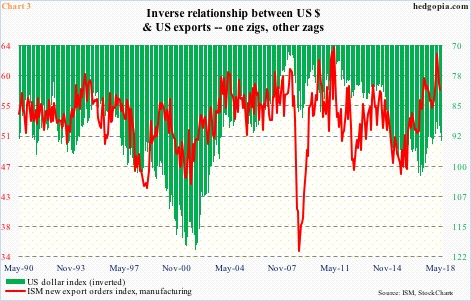

Further, coincidence or not, US exports are already weakening. The ISM manufacturing new export orders index in February reached a seven-year high 62.8, and has come under pressure since. April was 57.7, down a point month-over-month. In Chart 3, the export index is plotted against the dollar index. The two more or less move in tandem, inversely of course.

The role of exports in the economy needs no explanation.

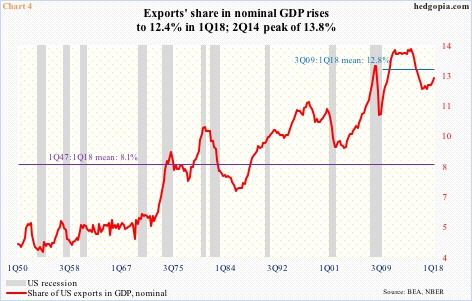

In 1Q18, exports’ share in nominal GDP was 12.4 percent. The red line in Chart 4 has trended higher since bottoming at 11.8 percent in 1Q16. It reached an all-time high of 13.8 percent in 2Q14, before losing two percentage points in the next seven quarters. The greenback likely played a role.

Before the dollar index peaked early last year, it pretty much went sideways beginning March 2015. This was preceded by a nine-month, 27-percent surge that began in July 2014 (arrow in Chart 2). This took a toll on exports.

Not surprisingly perhaps, corporate earnings adjusted for inventory and capital consumption peaked at a seasonally adjusted annual rate of $2.23 trillion in 4Q14. By 4Q15, profits dropped to $1.98 trillion, before recovering. In 4Q17, profits were $2.21 trillion.

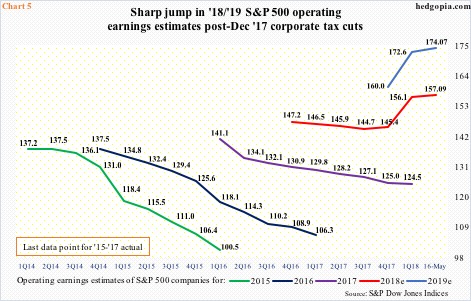

Thus the significance of Chart 5.

Post-tax cuts of last December, operating earnings estimates of S&P 500 companies took off. The Tax Cuts and Jobs Act of 2017 was signed into law on December 22. On December 21, the sell-side expected $145.31 for this year. As of last Wednesday, this stood at $157.09 (was $157.65 two weeks prior). At $174.07, 2019 was at a new high.

These heady expectations assume a lot of things going just right, not the least of which is acceleration in the economy. In this scenario, the Fed can go more than what the markets currently anticipate.

The FOMC’s dot plot foresees two more 25-basis-point hikes this year. June (12-13) is a lock, with 100-percent odds of a hike in the futures market. A raise is also priced in in the September (25-26) meeting, with December (18-19) a coin toss. Two more hikes this year will put the fed funds rate between 200 and 225 basis points. If the dollar index follows along, how would that impact corporate earnings, or exports or the economy?

Today’s minutes will not provide direct answers to these questions, but a wink and a nod will suffice to move the currency, and by default other assets.

Thanks for reading!