Small-cap profit trend took a decisive step lower last month. This is taking place even as operating earnings estimates for both this year and next have peaked; yet, next year’s may not have fully priced in this year’s interest-rate hikes, including the coming ones.

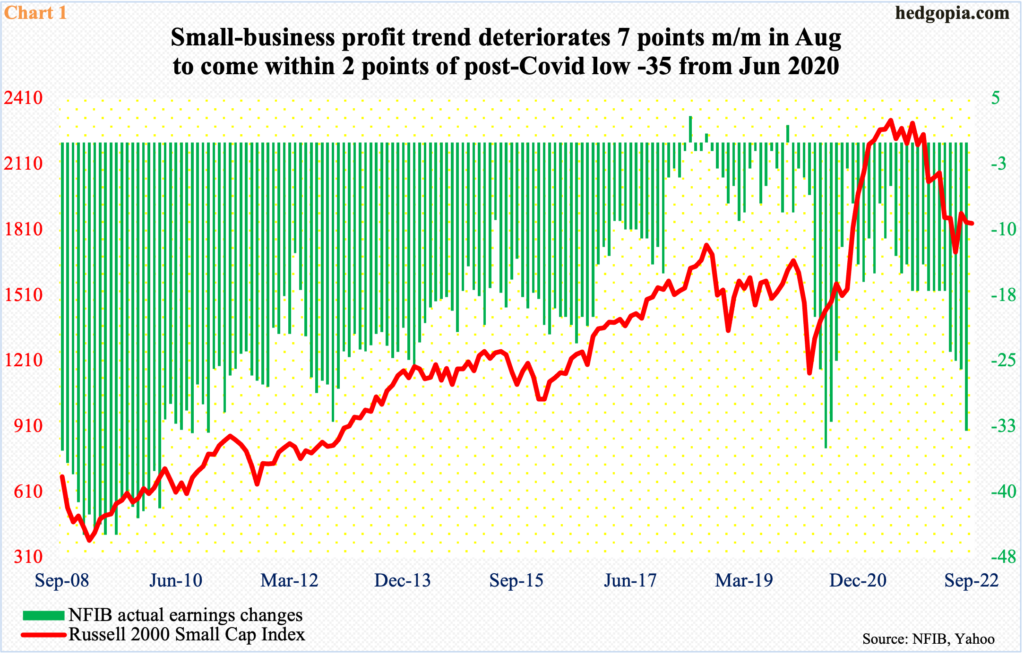

In August, US small-business profit trend deteriorated seven points month-over-month to -33, which is merely a couple of points from the post-Covid low -35 posted in June 2020.

Back then, the Russell 2000, on an absolute basis, was much lower versus where it is currently trading, but the fact remains that the 33.2-percent plunge between last November and this June took place from a much higher level.

Besides the October 2020 high of -3, the NFIB ‘actual earnings changes’ sub-index seriously retreated after reaching -5 in June last year (Chart 1).

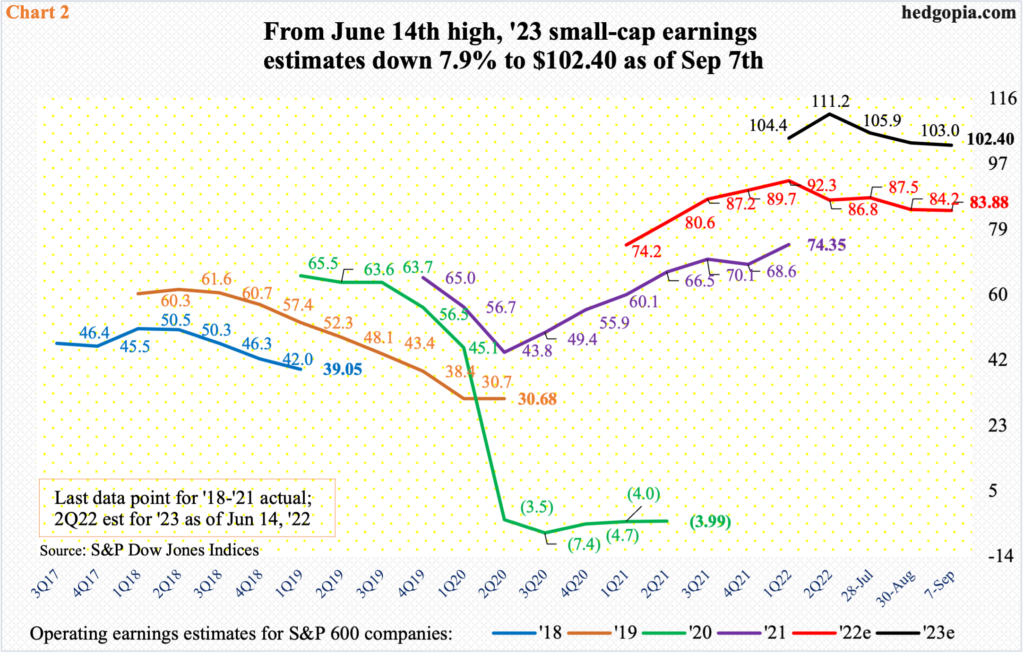

This coincided with the peak in next year’s operating earnings estimates for S&P 600 companies. As of June 14, the sell-side expected $111.23 for 2023. This year’s estimates peaked earlier at $92.70 as of April 12. As of the 7th (this month), these estimates were $102.40 and $83.88 respectively.

Next year, earnings are still expected to jump 22 percent. Investors are hardly buying it. This is reflected in how the Russell 2000 – or the S&P 600 – are behaving.

The Russell 2000 peaked as far back as last November, the same month the Nasdaq 100 crested but much earlier than the S&P 500 which peaked in January this year.

By nature, small-caps have larger exposure to the domestic economy than their larger-cap cousins. So, their behavior can be taken as a reflection on which way investors think the US economy is headed.

Mid-January, the Russell 2000 broke down, dropping out of 2080s; for 10 months before that, the small cap index went back and forth between 2080s and 2350s, followed by a seesaw action between 2080s and 1900 and between 1900 and 1700 after that. Earlier in November 2020, it broke out of 1700, which was successfully defended between mid-June and mid-July this year.

From the June-July lows, the Russell 2000 rallied strong to tick 2030 mid-August, but rallies have proven hard to sustain. The subsequent drop bottomed just under 1800 last week, followed by rejection this Monday just north of 1900, closing Wednesday at 1838.

The point in all this is that the rangebound action continues, with bulls buying support and bears defending resistance. In other words, the majority neither fears a hard-landing nor does it expect the economy to accelerate.

That said, from the perspective of earnings, the risk is to the downside with the full impact of all the hikes in interest rates, including the imminent ones, yet to filter through to the economy.

Thanks for reading!