With one session to go this week, VIX shot up in the cash market. In futures, non-commercials are still heavily net short the volatility index. In the past, the cash has tended to peak only when these traders are either net long or have substantially cut back their net shorts. Holdings as of Tuesday will be out later today and will be a tell as to whether or not the cash will have fuel left for more upside.

Later today, the CFTC publishes non-commercials’ holdings in VIX futures. This will be as of this Tuesday. Last Tuesday, VIX closed at 14.83, just under the 200-day moving average but above the 50-day. The volatility index began to rally Thursday, with Monday this week beginning with a gap-up (Chart 1). Tuesday, VIX closed at 27.85, and surged to 39.16 by Thursday. It will be interesting to find out if despite the massive rally in the cash during the reporting period these traders were staying put.

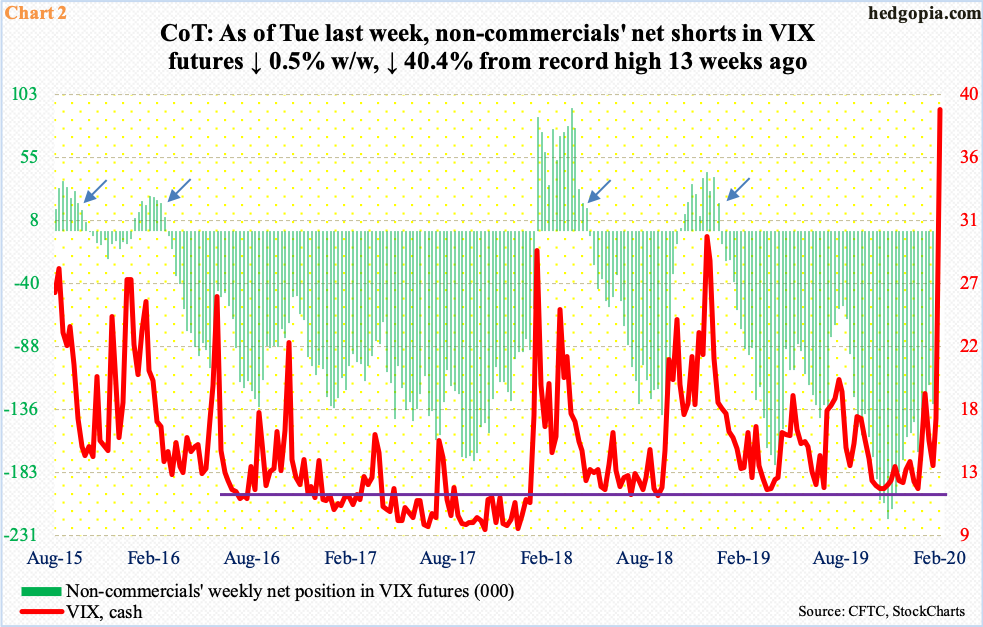

Several times in the past, the cash has shown a tendency to peak when non-commercials either go net long or have substantially reduced their net shorts in VIX futures (arrows in Chart 2). As of Tuesday last week, they were net short 130,229 contracts, which is down from the record high 218,362 from the week to November 19, but remain sizable. Equity bulls would want to see these traders begin to give up on their bearish volatility thesis and cover. The longer they stay bearish and fight the rally in the cash, the more potential fuel for the cash.

Thanks for reading!