It increasingly looks like the market wants to move higher – at least in the near-term. The past several days, it has been choppy, a lot of back-and-forth, marked by dojis (on a chart). Today was no exception – opens high, begins to sell off within half an hour as the Ukraine headline hits, falls hard and then begins to find footing mid-day.

It increasingly looks like the market wants to move higher – at least in the near-term. The past several days, it has been choppy, a lot of back-and-forth, marked by dojis (on a chart). Today was no exception – opens high, begins to sell off within half an hour as the Ukraine headline hits, falls hard and then begins to find footing mid-day.

The stability came as the Nasdaq came a hair breadth away from testing its 200-day moving average. The index has not tested that average since late-2012, and these things are not supposed to crack at the very first try – especially since it has not been tested for that long.

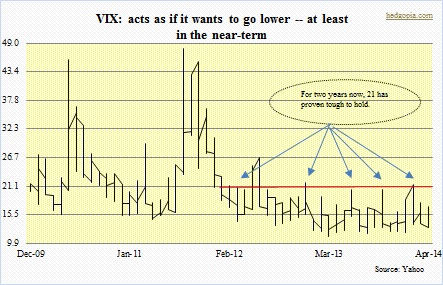

Interestingly, the VIX is flashing as if it wants to go lower. As the accompanying chart shows, for two years now, VIX has not been able to stay above 20-21 (the exception was June of that year when it spiked to 26). There are a lot of people waiting for VIX to hit that level and then pull the trigger (on the long side, of course).

In the intermediate term, they will probably be right. Technically, despite the recent sell-off, indices are not completely done unwinding the overbought conditions they are in. However, in the near-term, things are beginning to look a little oversold. That is probably why buyers are emerging. Short interest is very high – 14.5bn on NYSE and 8.3bn on Nasdaq. Bulls sure hope there is a squeeze. (I will include the short-interest chart some other time.)

For now, I am a nervous long – bought some ETFs (small-caps and financials) this AM – with one foot out the door.