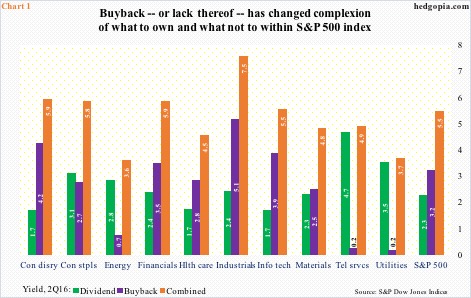

Chart 1 plots dividend yield for the 10 S&P 500 sectors. The data is as of 2Q16, hence financials still include real estate, which last month became a sector within its own right. The chart also includes buyback yield for each of these sectors, which, once combined with dividend yield, is a bit revealing.

The top three dividend yielders are as expected: telecommunications services, 4.7 percent; utilities, 3.5 percent; and consumer staples, 3.1 percent.

These three sectors are considered defensive in nature. Investors tend to gravitate toward them for their income streams and also in a risk-off environment. These days, amid excessive central-bank activism, we can throw another variable in this mix.

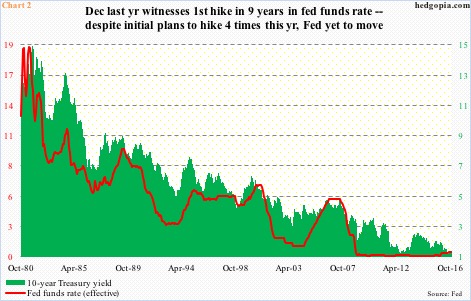

Since the financial crisis, interest rates have persistently headed lower (Chart 2). The Fed funds rate has been kept near zero for nearly eight years now, with the first hike in nine years last December. Early this year, the Fed planned on raising the benchmark rate four more times this year. They are yet to make a move.

Back in 2008, the Fed also deployed three iterations of quantitative easing to push long rates lower. The result is Chart 2. The red line in particular, which has gone flat near zero for eight long years, jumps out.

Hence the resulting high demand for bond proxies. The 10-year Treasury is yielding 1.68 percent, versus, for instance, 4.7 percent for the afore-mentioned telecom services sector. REITs and MLPs yield even higher.

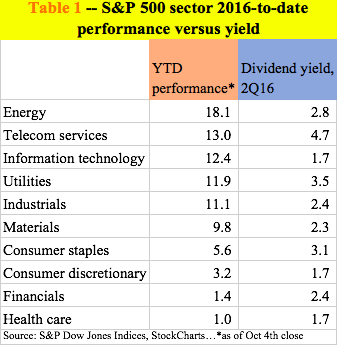

This is evident in how they have rallied year-to-date. In Table 1, of the top four sectors that have been up the most this year, three are energy, telecom services, and utilities. There is one other common theme among these three: the essentially non-existent buyback yield – 0.7 percent, and 0.2 percent each, respectively. This could prove to be important in due course.

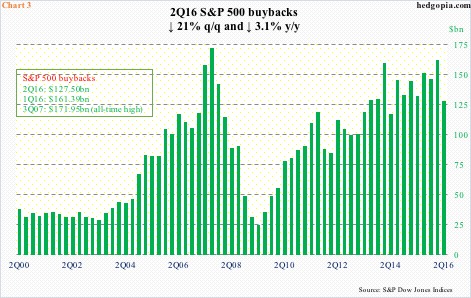

Buybacks have been the hallmark of this bull market, rising from $24.2 billion in 2Q09 to $161.4 billion in 1Q16. The latter was the highest since the all-time high of $172 billion in 3Q07; 2Q16 dropped 21 percent sequentially to $127.5 billion (Chart 3).

Hence the question, have buybacks peaked? Too soon to tell, but signs are pointing that way. On a four-quarter rolling total basis, 2Q16 buybacks were $585.4 billion, just under $589.4 billion, a record, in the prior quarter. In the previous cycle, buybacks peaked at $589.1 billion in 4Q07, before collapsing.

Increasingly, it feels like these companies are simply chewing more than they can bite. In 2Q16, for instance, buybacks and dividends combined totaled $225.8 billion. That was more than the $222.8 billion they took in operating earnings. In fact, this was the fourth consecutive quarter – and fifth out of last six quarters – they spent more on dividends and buybacks than earned out of operations.

This mismatch cannot continue. And between dividends and buybacks, company boards would rather cut buybacks before they tinker with dividends.

In Chart 1, industrials (5.1 percent), consumer discretionary (4.2 percent), information technology (3.9 percent), financials (3.5 percent), and health care (2.8 percent) are the five sectors with the highest buyback yield. In terms of share price performance, industrials and info tech have fared well this year (Table 1), but not the other three.

Despite buybacks, financials this year are up a mere 1.4 percent, health care up one percent, and consumer discretionary up 3.2 percent. In a scenario in which buybacks have peaked and are in deceleration, it is anyone’s guess as to how these sectors would perform.

Along the same lines, telecom services and utilities have the least buyback yield. If buybacks have not helped them, logic would dictate that they would not get hurt when buybacks slow down. That said, precisely because of the bond proxy phenomena, these sectors are not cheap, respectively trading at 13.5x and 17.4x on next year’s earnings (16x and 18.1x on this year’s). But in a world in which buybacks slow down, these two sectors may still end up outperforming their peers that are heavily reliant on buybacks, such as industrials, consumer discretionary, and info tech.

Risk-reward dynamics do not favor buyback-heavy sectors.

Thanks for reading!