There are four more months before 2020 is out, but US corporate bond issuance already set a new record. The Fed’s new policy under which it buys corporate bonds – both investment-grade and high-yield – has lit a fire under this market. The side effect of this is that this helps zombies linger. When it is all said and done, this probably does not bode well for an overleveraged corporate debt market down the line.

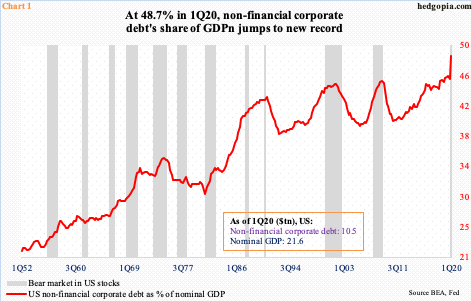

US corporations are leveraged to the gills. As of 1Q20, non-financial corporations were sitting on $10.49 trillion in debt, which has doubled from $5.24 trillion in 4Q05. This far supersedes the 61.7-percent growth in nominal GDP during the period, to $21.56 trillion.

The ratio of corporate debt to nominal GDP in 1Q20 jumped to 48.7 percent in 1Q20 – a new record (Chart 1). The Fed is due to publish the Z.1 report for 2Q on the 21st this month. The ratio is all set to move even higher as nominal GDP tumbled to $19.49 trillion in 2Q.

Despite this already elevated level of leverage, corporations are not letting up. If anything, the pace of debt accumulation has gone up a notch or two this year.

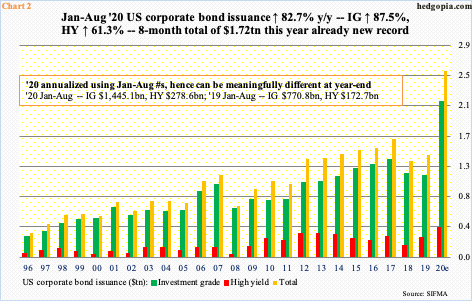

US corporate bond issuance is on course for a new record. In fact, with eight months in, issuance has already totaled $1.72 trillion, surpassing the prior record of $1.64 trillion from 2017. If the 8-month pace continues for the remainder of the year, issuance would have totaled $2.59 trillion this year.

The January-August total this year is made up of $1.44 trillion in investment-grade and $278.6 billion in high-yield, up 87.5 percent and 61.3 percent over the corresponding period last year. The combined total is up 82.7 percent.

Issuance started picking up speed after the Fed announced in March that it would start buying investment-grade corporate bonds, which in April was expanded to include junk bonds. Investors are warming up to these bonds. From the week to March 25 through Wednesday this week, investment-grade corporate funds took in $75.3 billion; similarly, from the week to April 15 through Wednesday this week, high-yield funds gained $47.6 billion (courtesy of Lipper).

The Fed is essentially acting as a backdrop, and this has boosted investor confidence, not to mention prod corporate boards into taking on more leverage. The new policy must be a godsend to those that are otherwise healthy but temporarily fell victim to virus-spurred disruptions; at the same time, it also provides a lifeline to debt-laden zombie companies. Whatever happened to Joseph Schumpeter’s creative destruction!

The current fascination with leverage aside, there is no free meal. The debt pendulum has swung too far to one side. There will be dislocations when it swings the other way – which is a matter of when, not if.

Thanks for reading!