On Thursday morning, February’s CPI will be published. Consumer inflation has gone vertical the past couple of years. Businesses have pricing power, as was evident in Tuesday’s NFIB report. A record 68 percent of small-business owners were able to raise prices last month.

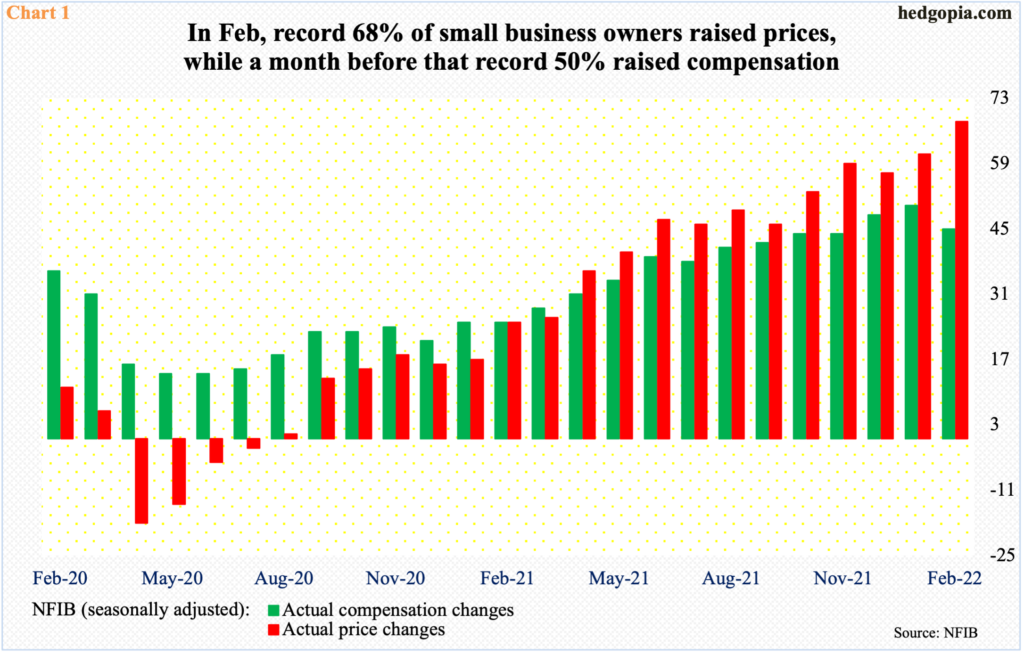

February’s NFIB (National Federation of Independent Business) report, out Tuesday, opens a window into what is transpiring in the areas of compensation and pricing.

This survey encompasses small businesses, which create the most jobs in the US. In February, the main index, known as the optimism index, slid 1.4 points month-over-month to 95.7. Its all-time high of 108.8 was posted in August 2018, with a post-pandemic bottom at 90.9 in April 2020. The index has more or less been trending lower since hitting 102.5 last June.

Concurrently, several other sub-indexes are at/near fresh highs. Job openings, for instance, rose a point m/m in February to 48, with a record high 51 last September.

Along the same lines, 45 percent of the survey takers reported raising compensation in February. This was down five points m/m, but January’s 50 percent was a record (Chart 1). Even more alarmingly from the inflation perspective, a record 68 percent of owners were able to raise average selling prices last month, up a full seven points from January; for some perspective, this metric was minus 18 in April 2020 and stayed in the negative territory for four straight months before persisting higher.

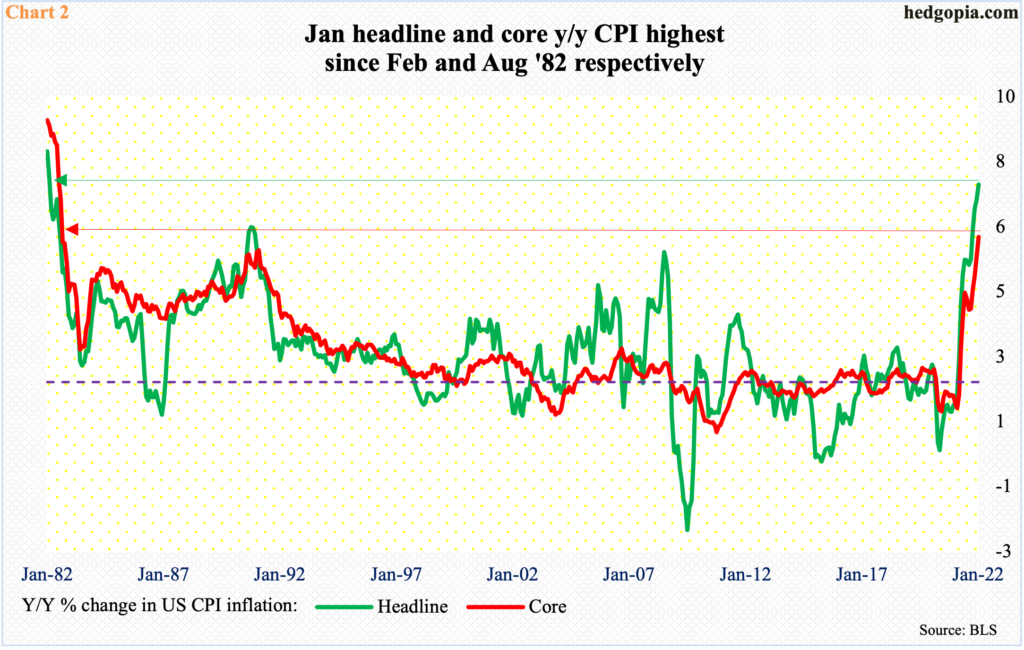

Back then, that is in the early months of 2020, as the global economy ground to a halt because of Covid-19, consumer inflation barely grew. In the 12 months to May that year, headline CPI (consumer price index) edged up 0.1 percent, with the core rising 1.2 percent. Fast forward to January (this year), they respectively grew at a rate of 7.5 percent and six percent – the steepest price rise since February and August 1982. We are talking four-decade highs (Chart 2).

Thursday morning, February’s CPI will be published. Jerome Powell, Federal Reserve chair, told Congress last week that he expects a quarter-point hike next week. Tomorrow’s CPI, regardless how hot or cold, is not going to change this outlook. The uncertainty arising out of Ukraine has thrown policymakers a curve ball – or has given them an excuse to go soft.

At the same time, the fact remains that commodities have gone through the roof, which has the potential to not only exacerbate inflation further but also adversely impact global growth. The West Texas Intermediate crude is up over 29 percent so far this month, and February’s CPI report will not have captured this.

Interesting times lie ahead. The Fed has a task of threading a very small needle. Putting the inflation genie back into the bottle without forcing the economy to meaningfully decelerate, or even contract, will prove tough.

Thanks for reading!