The importance of consumers in the U.S. economy cannot be stressed enough. Real personal consumption expenditures (PCE) accounted for 68.6 percent of gross domestic product in the third quarter. Five decades ago, PCE’s share was nine points lower.

Put another way, real GDP was a dud in the third quarter, up a mere 1.5 percent. Yes, inventory subtracted 1.4 percent from growth, but at the same time inventory build has helped goose growth in past quarters.

If there is one consistent theme, it is consumer spending.

PCE contributed 2.2 percent to real GDP growth in the third quarter, 2.4 percent to growth of 3.9 percent in the second quarter, 1.2 percent to growth of 0.6 percent in the first quarter, and 2.9 percent to growth of 2.1 percent in the fourth quarter last year.

Consumers have been doing the heavy lifting as far as the economy goes. It is not all coming from savings and incomes. The personal savings rate in the third quarter was 4.7 percent, versus an average of 8.6 percent going back to 1Q47. Real incomes are stagnant at best.

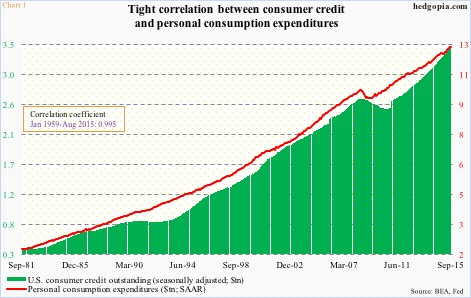

Rather, leverage has played a big role. Going back to 1959, the correlation coefficient between PCE and consumer credit is near perfect (Chart 1). As go the green bars, so does the red line.

Consumer stocks have been a big beneficiary – be it staple or discretionary. The latter in particular is offensive in nature, and responds when the consumer is in a risk-on mode.

XLY’s, the SPDR Consumer Discretionary ETF, top five industries are: media (25 percent), specialty retail (20 percent), internet and catalog retail (15.7 percent), hotels, restaurants & leisure (14 percent), and textiles, apparel & luxury goods (7.2 percent).

Just to throw a couple of data points. Vehicle sales are on pace to 17-plus million units this year. In September, Americans spent $52.7 billion in ‘food services and drinking places’ and $50.6 billion in grocery stores – meaning they are eating out more and more.

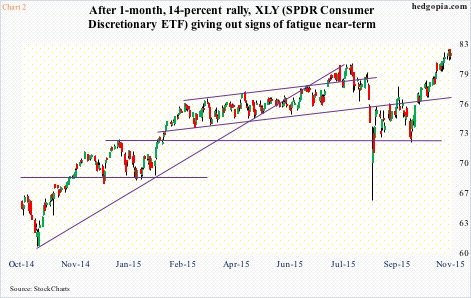

All this is reflected in XLY’s performance. Between the September 29th low and the high on Wednesday, it is up nearly 14 percent (Chart 2).

At the same time, while it has been a losing proposition to bet against the U.S. consumer, stocks consistently offer opportunities both ways – both long and short.

In this respect, XLY’s action on Wednesday could be telling at least in the near-term. Pre-open, ADP reported better-than-expected 182,000 private job gains in October. The ETF opened up slightly, only to give up those gains and then some.

As reflected in that 14-percent, one-month rally, XLY remains grossly overbought – on a daily chart in particular but also on a weekly basis.

AMZN has helped big time. It is assigned a 9.8-percent weighting in the ETF – the highest. In the top five, the other four are DIS (7.4%), HD (6.6%), CMCSA (5.4%), and MCD (4.3%).

Four of the five have reported earnings. Post-earnings, CMCSA shares reacted negatively, MCD positively, and AMZN amazingly. DIS reported yesterday, with a roller-coaster action after-hours, and HD’s is scheduled for the 17th.

AMZN in particular has rallied 16 percent since it reported earnings 10 sessions ago. MCD has stalled. So has CMCSA. HD is hanging in there. And DIS produced a big bearish engulfing candle on Wednesday.

All in all, this is as good a time as any for XLY to begin to unwind its overbought conditions.

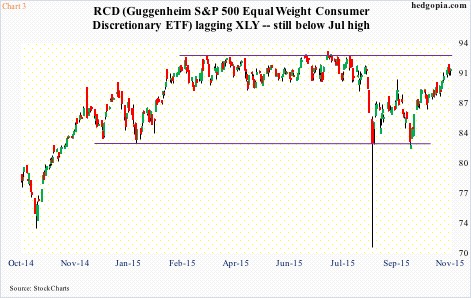

This is particularly so considering the big gulf between how XLY is faring versus RCD, the Guggenheim S&P 500 Equal Weight Consumer Discretionary ETF. XLY took out the August 2015 all-time high 10 sessions ago, RCD is still below its July 2015 high (Chart 3).

In consumer discretionary, large-caps are ruling as far as share performance goes. Hence XLY’s outperformance. RCD has assigned AMZN a 1.37 percent weighting, MCD 1.31 percent, DIS and HD 1.24 percent each, and CMCSA 1.08 percent. AMZN’s 10-session, 16-percent rally does not help RCD. Hence the risk to XLY.

With AMZN the only one holding the fort at the moment, XLY ($81.41) looks vulnerable – if nothing else just to unwind daily overbought conditions.

One way to play this is using options to either go short at a higher price or generate decent income. Hypothetically, November 13th 80.50 calls bring $1.29. These are in-the-money naked calls – willing to go short near recent highs. If called away, it is a short at $81.79.

Thanks for reading!