The 1Q19 earnings season is upon us. Expected growth has softened. The bar is low. The sell-side expects growth to pick up speed in the second half. Operating earnings of S&P 500 companies are expected to grow 9.1 percent this year and 12.7 percent next year! This, after a 21.7-percent jump last year.

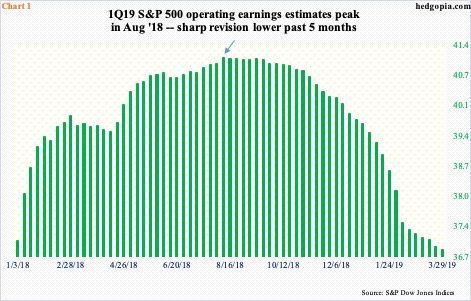

The 1Q19 earnings season starts in earnest next week. The sell-side has done its bit. At the end of March, operating earnings estimates for S&P 500 companies were $36.85 – revised lower from $39.66 when the quarter began. In fact, the downward revision trend has been in place for a while. Estimates peaked early August last year at $41.12 (arrow in Chart 1).

The downward revision trend is not some recent phenomenon. The sell-side routinely lowers the bar as the time to report approaches. In 4Q18, these analysts expected $42.14 when the quarter began. By the time the quarter was over, estimates got lowered to $40.42.

At $36.85, growth would have crawled to a stop in 1Q19; in 1Q18, these companies earned $36.54. In comparison, 4Q18 earnings were $35.03 versus $33.85 in 4Q17. Similarly, 3Q18 brought in $41.38 versus $31.33 in 3Q17. Or, take $38.65 in 2Q18 versus $30.51 in 2Q17.

Analysts expect earnings momentum to pick back up in the second half this year. It is a risky assumption.

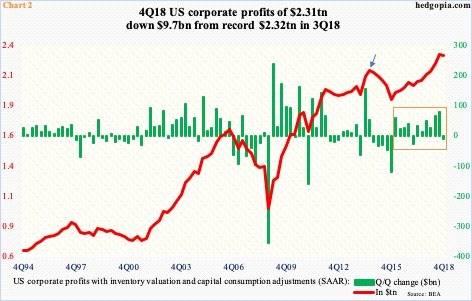

Three years ago, even though the US economy was still chugging along, corporations witnessed a profit recession. For five quarters through 4Q15, corporate profits fell sequentially. Back then, profits peaked at $2.19 trillion in 3Q14 (arrow in Chart 2). They bottomed at $1.94 trillion in 4Q15, followed by steady gains, to an all-time high $2.32 trillion in 3Q18.

In the 12 quarters through 4Q18, there have only been two quarters in which profits fell sequentially, one of which was last quarter when they contracted by $9.7 billion (box). It is possible this is the beginning of another profit recession.

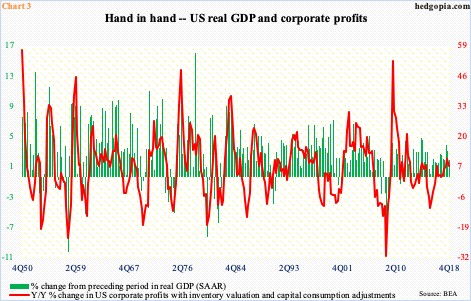

Corporate profits obviously track GDP (Chart 3).

The economy has softened. Real GDP grew 4.2 percent in 2Q18, followed by 3.4 percent in 3Q and 2.2 percent in 4Q. As of Tuesday, the Atlanta Fed’s GDPNow model was forecasting 2.1 percent growth in 1Q19.

Other data points point to similar deceleration. In March, the ISM manufacturing index rose 1.1 points month-over-month to 55.3. February’s 54.2 was the lowest since November 2016. Last August’s 60.8 was the highest since 61.4 in May 2004.

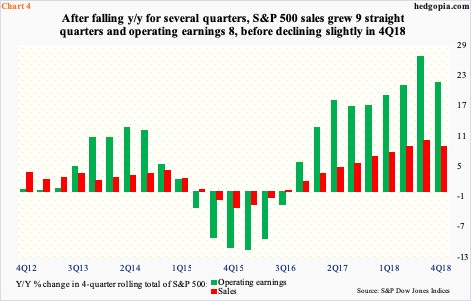

If the trend continues, 3Q18 could turn out to be a peak for a while in both earnings and sales.

Chart 4 uses a four-quarter rolling total of operating earnings and sales of S&P 500 companies. Both performed very well last year. In 3Q18, operating earnings jumped as high as 26.9 percent year-over-year and sales 10.2 percent, before decelerating slightly to 21.8 percent and 9.1 percent in 4Q18. They have now had eight and nine consecutive positive quarters, in that order. After this kind of torrid growth, mean-reversion is not uncommon, particularly so as the tailwind from the tax cuts of December 2017 gradually wears off.

Here is the rub.

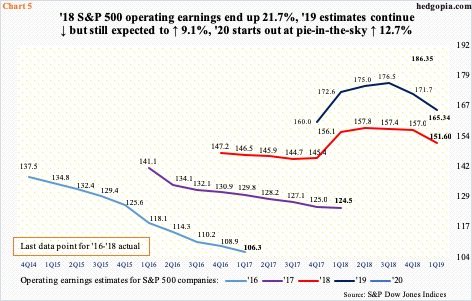

In 2018, earnings came in at $151.60. The downward revision trend was also evident last year, with expectations of $158.26 in November last year. But thanks to the tax cuts, earnings jumped 21.8 percent. Before this, earnings grew 17.2 percent in 2017.

Current estimates for this year are $165.34. This is down substantially from August last year when these companies were expected to earn $177.13. Nevertheless, if $165.34 is realized, 2019 would have grown 9.1 percent. This, at a time when economic activity is in deceleration. The sell-side is beginning to realize this, hence sharper revision downward in first-half estimates. In all probability, second-half estimates will meet the same fate in weeks/months to come.

Ironically, the sell-side has penciled in $186.35 for 2020! Habitually, they tend to start out optimistic and cut estimates as time progresses. At the current level, earnings next year would have grown 12.7 percent, which at this stage of the growth cycle can only be described as pie-in-the-sky optimism.

Thanks for reading!