Tactical shorts in XLF (SPDR financial sector ETF) have a decision to make.

The ETF has essentially gone sideways the past couple of weeks. The bulls are staying put, having defended the 10-day moving average last Friday.

Things can always turn out differently this year, but seasonally this tends to be a good time for stocks.

In less than three weeks, financials start reporting 4Q earnings. JP Morgan (JPM), Wells Fargo (WFC) and PNC Bank (PNC) will report on January 12, followed by Citigroup (C) on the 16th, and Bank of America (BAC) and Goldman Sachs (GS) on the 17th.

It is always possible, leading up to earnings, the bulls continue to hang in there and even force a breakout. That is the risk facing the shorts. Post-presidential election last year, the bulls have had their share of breakouts.

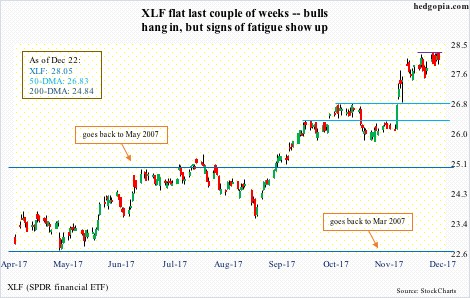

In November 2016, XLF broke out of just under 20, followed by a major one mid-September this year, when resistance at 25 going back to May 2007 was taken out. Then came a mini break out of 26.80 late November. (The chart above uses prices adjusted for dividends. Unadjusted, the ETF peaked at 38.15 in May 2007.)

The bulls obviously enjoy tons of support, but at the same time this does not mean there would not be tactical opportunities for the bears. A retest of 26.80 breakout will mean a drop of 4.5 percent.

This is not a scenario that can be brushed off easily. Yes, XLF is yet to break down, but signs of fatigue are showing up.

On the weekly chart, last week produced a doji, although it was up 0.9 percent and rose to a new all-time high of 28.25 (once again, adjusted for dividends). This followed back-to-back spinning top candles in the prior two weeks.

On the daily, the MACD in particular just had a bearish cross-under, raising the odds that XLF in the very near term could very well be on its way to unwinding some of the overbought condition it is in.

In this scenario, risk-reward dynamics favor staying short the underlying. One other alternative is to deploy short puts, as was done in a hypothetical example last week.

On December 14, XLF was shorted intraday at 27.84. Then on the 19th, weekly 28 puts were sold for $0.16. Last Friday, XLF closed at 28.05, and the puts expired worthless. The short position is now $0.05 in the hole.

Another weekly short put is possible, but 28 puts only bring in $0.10. This can potentially raise the shorted price to 28.10, but will also mean the position gets covered for $0.10 profit should the underlying come under pressure this week and closes sub-28. Probably not worth trying considering the underlying looks tired.

Thanks for reading!