- Despite escape-velocity meme, yield curve continues to tighten

- Message of belly/long end of curve to short-end: be careful what you ask for

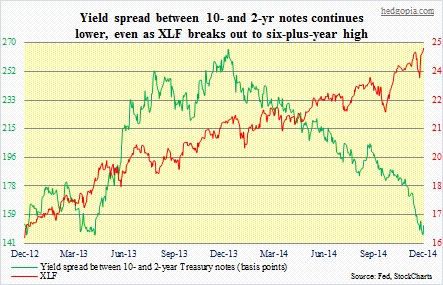

- Financials diverge from 10-2 spread, perhaps setting up as shorting opportunity next month

One of the contrarian themes on this blog has been that there would be no rate hike (s) next year. Incoming data are bifurcated at best. Yesterday saw a blockbuster revision in 3Q14 GDP (rear-view mirror), even as durable-goods data was disappointing, not to mention much-weaker-than-expected housing numbers (windshield view).

But then again it does not hurt pondering what if Chair Yellen does indeed move in 1Q/1H next year. What if the FOMC decides to focus on the positives and fill its monetary quiver with arrows while the going is good? What would that do to the yield curve, which is already tightening?

Year-to-date, yield on the 10-year is down 78 basis points, while the two-year is up 36 bps. Particularly since the middle of May, the two-year has doubled (to 0.74 percent), even as the 10-year has tightened by 25 bps (to 2.26 percent).

The long end of the curve keeps attracting bids. But it is not in agreement with the message coming out of the short end. The belly and the long end are essentially saying to the short end, be careful what you ask for. The economy probably would not be able to cope with sustained (any?) rate hikes. Yes, the curve is far from inversion, which in the past tended to portend recession. But this time around, that may not necessarily be the case, as rates are artificially suppressed. Housing is a prime example. What would higher rates do to a sector that cannot get going when rates are this low?

Let us assume the FOMC does indeed move next year. In the very short term, in an odd way, it can even spur things up, as on-the-sidelines buyers jump into action in fear of higher rates. And that will probably be the extent of any pent-up demand out there.

One of the memes out there is how a steepening yield curve is healthy for financials. True, if the curve is steep. These companies borrow short and lend long. So it makes sense for their stocks to track the 10-2 spread. Nonetheless, for nearly a year now, they have diverged. The obvious hope is that the curve will eventually steepen. The message coming out of the yield curve is different. Jefferies last week reported its 4Q numbers (ends in November, so gives a glimpse into what might lie ahead for peers that have December quarters). Numbers were not good. Being polite here.

Financials have had a nice run, technically are beginning to get overbought, and could be setting up as a shorting opportunity, perhaps as early as next month. Wait and watch for now.