The S&P 500 broke out to a new high Monday. Building on it can prove difficult – at least near term – as sentiment is rather elevated, even as the daily is in overbought territory.

The S&P 500 large cap index (3036.89) broke out to a new high this week. The Nasdaq composite came within a few points of doing so, although the Nasdaq 100 did so last Friday. The Dow Industrial is yet to achieve that feat, meaning even within large-caps the move is not uniform, let alone mid- and small-caps. The latter two are substantially below their highs set in August last year.

The breakout in the S&P 500 can hardly be termed decisive. By Tuesday’s intraday high, the index surpassed the prior high of 3027.98 from July 26 by nearly 20 points, but bulls were not able to hang on to the gains, with the session forming a shooting star (Chart 1). The daily has been in overbought territory for several sessions now.

Shorter-term moving averages are still rising on the S&P 500. The 10-day lies at 3009, and this is the nearest support bulls will have to defend near term. Inability to do so will begin a process of 10-20 cross-down.

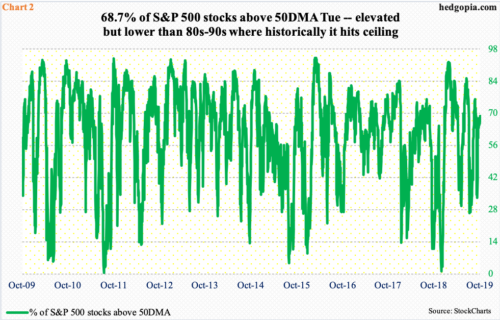

The breakout on the S&P 500 came as 68.7 percent of stocks Tuesday were above their 50-day, which is high. At the same time, one would think a new high in the index would accompany a much higher percentage in this metric. Historically, the green line in Chart 2 tends to peak in 80s-90s. This time around, the last time it even hit 70 percent was on September 25. In other words, participation is narrow, which is not necessarily confidence-boosting, unless the data begins to improve sooner than later. As is the case with the S&P 500, the metric in question is extended as well.

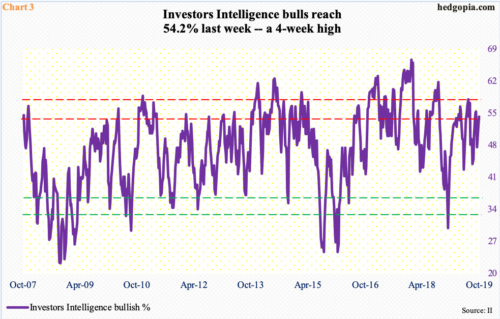

One other sentiment indicator shows similar dynamics in play. Last week, Investors Intelligence bulls were 54.2 percent – a four-week high. In six of the last eight weeks, bulls have been in the 50 percent range. This is not crazy high historically but is high enough bulls can pull in their horns (Chart 3). Pressure could come if they are not able to build on this week’s breakout on the S&P 500.

In this regard, most of the earnings-related push is likely behind us. Ditto with relief – at least near term – related to Brexit woes and US-China trade tensions. The likely path of least resistance is lower near term – if nothing else, just to unwind the daily overbought condition.

Thanks for reading!