Major US equity indices posted fresh new highs Monday. For a while now, foreigners have lent a helping hand, although they at the same time have been aggressively selling US Treasury securities. Equity bulls would prefer foreigners to maintain the status quo.

In a seasonally favorable period, bears are pretty much getting gored by bulls. Major US equity indices rose to fresh all-time highs Monday. Since breaking out of 3020s seven weeks ago, the S&P 500 large cap index has added well over five percent. For the year, it is up north of 27 percent! In the process, the index has broken out of one after another resistance – 2800-plus, 2950s, 3020s and 3150s, with the latter short-term and obviously the nearest (Chart 1). With momentum in their hands currently, bulls are not going to give up these levels easily.

Foreigners are lending US bulls a hand.

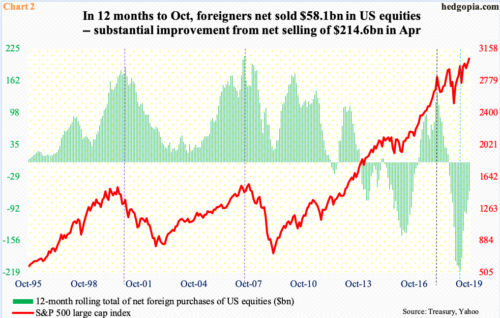

In October, they sold $4.3 billion in US stocks. In the five months to October, they bought $59.4 billion worth and sold $25.3 billion worth. On a 12-month basis, they are still selling, but at a substantially reduced rate.

In the 12 months to October, foreigners sold $58.1 billion worth, which represents a substantial improvement from April when they were selling $214.6 billion in US stocks – a record.

Foreigners’ activity is worth watching, as historically the S&P 500 tends to move hand in hand (Chart 2). In 2000/2001 and then again in 2007, peaks in the index coincided with peaks in foreigners’ buying (violet dashed vertical lines). This again occurred in January last year (black line). The difference this time around was that the S&P 500 soon maintained its uptrend, but foreigners kept selling. It was only in April this year the green bars began to get smaller (blue line). Bulls obviously hope this continues.

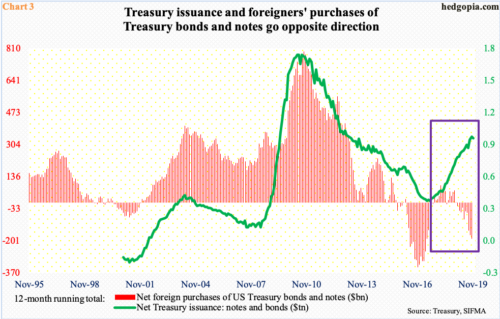

Foreigners’ reduced selling of US stocks coincides with increased selling of US Treasury notes and bonds. On a 12-month basis, foreigners sold $189.4 billion in these securities in October. As recently as last December, they were buying $1.6 billion worth (Chart 3). So, it is possible foreigners are cutting back Treasury purchases to fund purchases of US equities. If true, there is a problem in this – potentially.

The US Treasury has been aggressively selling debt. In the 12 months to November, $918.5 billion was issued, down from $934.5 billion in October, which was the highest since February 2013. The 12-month total of US budget deficit just crossed $1 trillion, so it is all but certain the Treasury will continue to aggressively issue new debt. It will need buyers for those. Foreigners are a good source for that, but they have not cooperated for a while now.

What equity bulls do not want to see happen is foreigners switching their preference – if it can be called that – from US equities to US Treasuries.

Thanks for reading!