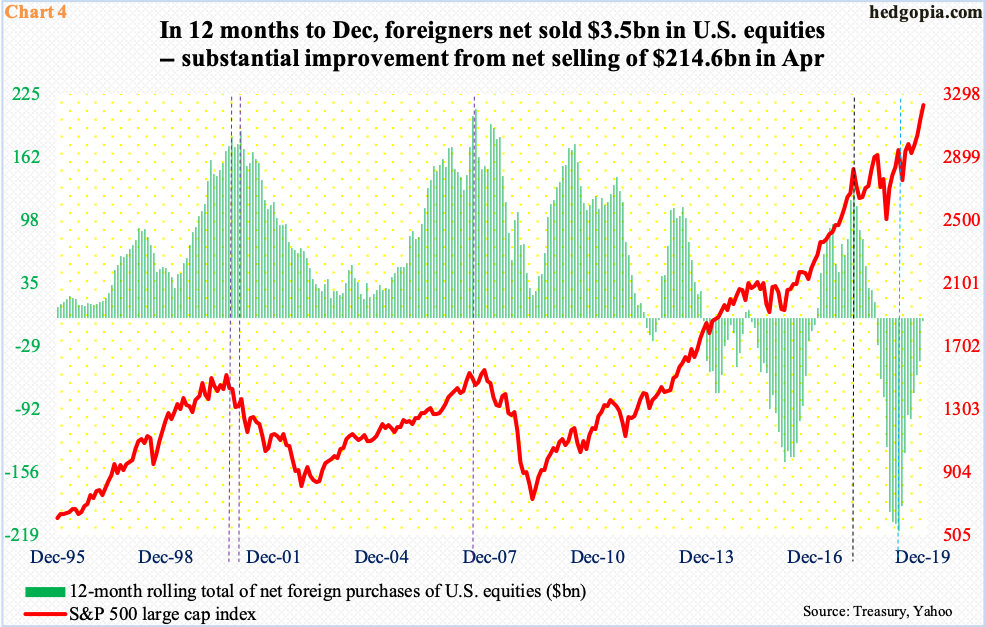

Foreigners, who had been cutting exposure for a while, have been warming up to U.S. stocks of late. Bulls obviously would like this to continue. Historically, foreigners’ activity and the S&P 500 have shown a tendency to move in tandem.

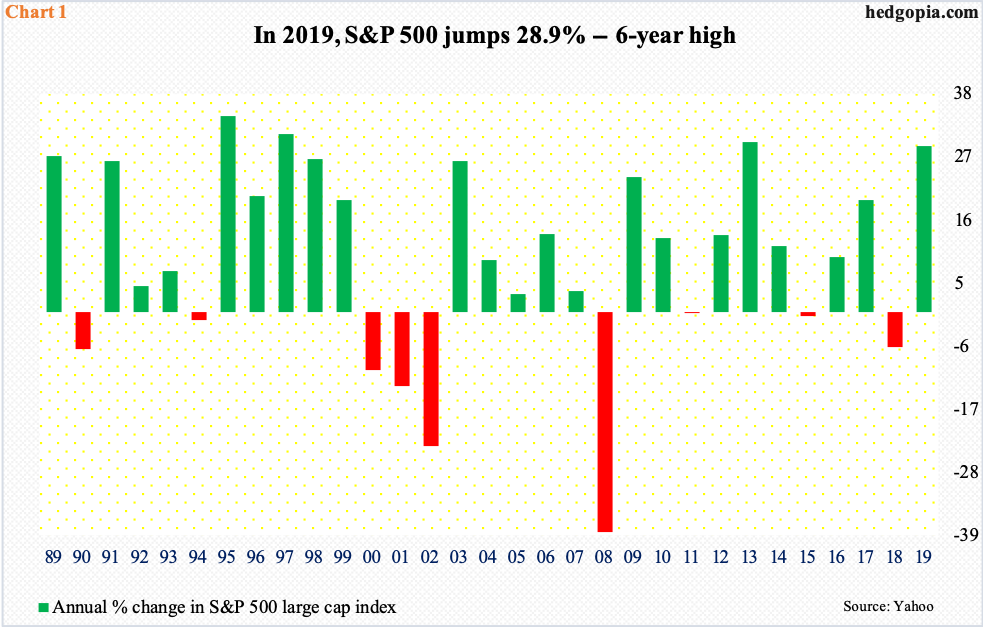

Last year was a bumper year for stock investors in the U.S.

The S&P 500 large cap index rallied just under 29 percent, comparable to 2013’s 29.6 percent, and that was the best year since 1997 when the index jumped 31 percent (Chart 1). In fact, several other indices fared better, such as the Nasdaq 100 index, which surged 38 percent last year.

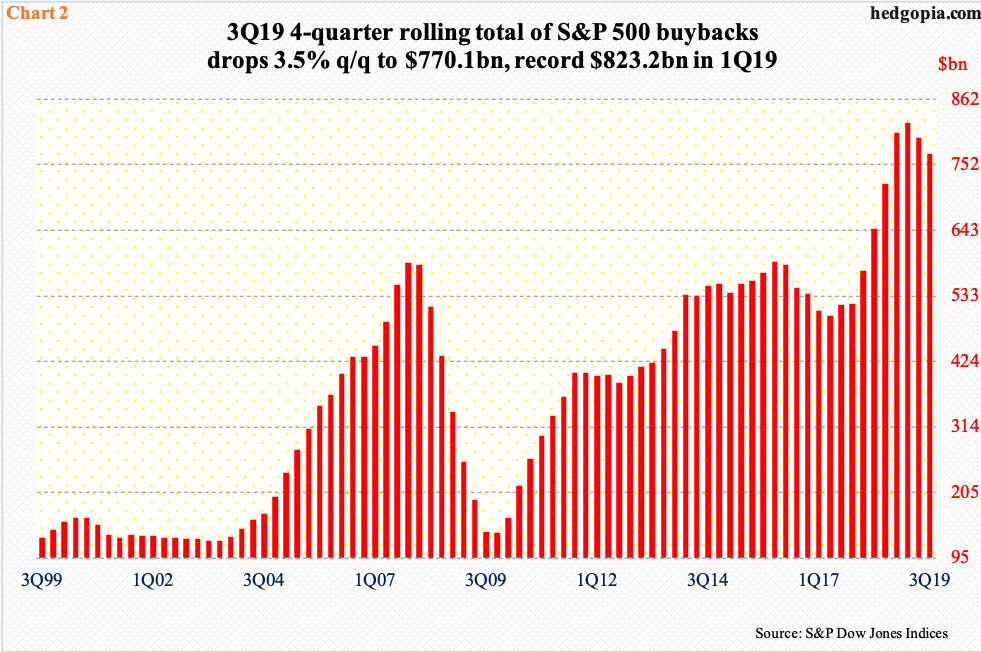

Several things came together in 2019, most prominently corporate buybacks.

Fourth-quarter numbers are not out yet, but in the first three quarters S&P 500 companies spent $547.2 billion in buying back their own shares (Chart 2). In all of 2018, $806.4 billion was spent, which was a record. When it is all said and done, 2019 will probably not set a new record but is destined to become the second highest.

Interestingly, since 2010, buybacks have consistently exceeded dividends. In the first three quarters last year, S&P 500 companies doled out $359.1 billion in dividends. The emphasis on buybacks has helped reduce the share count. In 3Q19, nearly 23 percent of these companies reduced their share count by at least four percent. This is a significant EPS tailwind.

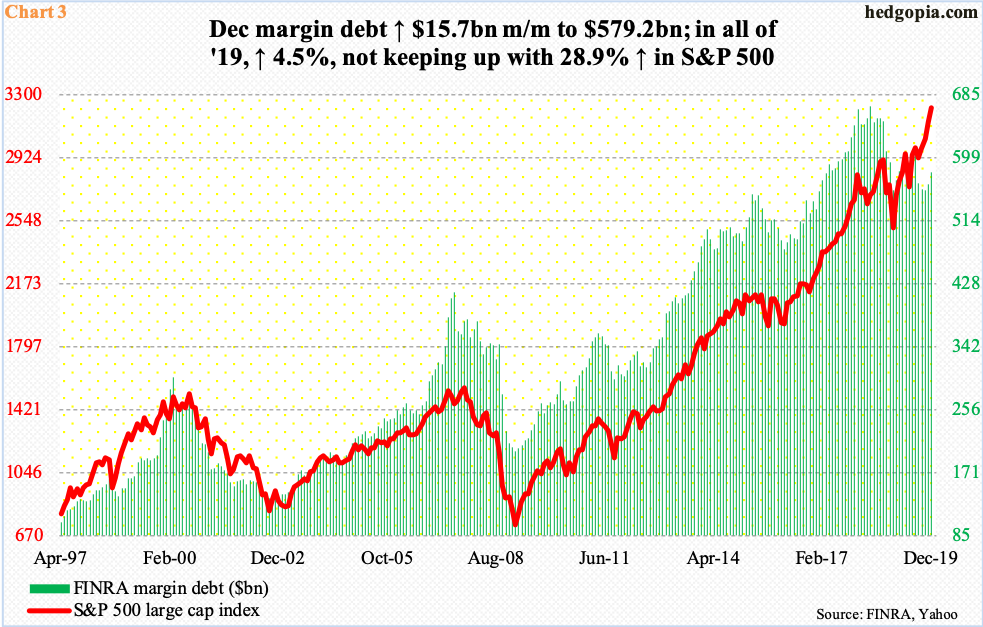

But there were headwinds as well. In the midst of this rip-roaring rally in stocks, money-market funds continued to accumulate (more on this here). Margin debt disappointed as well.

In 2019, FINRA margin debt increased by $24.9 billion to $579.2 billion. As a matter of fact, until October it was about flat for the year. Stocks bottomed early that month and rallied vigorously the rest of the year. Despite this, bulls were not quite willing to significantly add to leverage. In fact, margin debt peaked as far back as March 2018 at $668.9 billion, diverging with the S&P 500 (Chart 3). Just using this metric as a gauge, there is caution in the air.

Until last April, this was also the case with foreigners. In the 12 months through that month, they sold $214.6 billion in U.S. stocks – a record. They had been reducing U.S. exposure since January 2018 when 12-month net purchases peaked at $135.6 billion (black dashed vertical line in Chart 4). Stocks did peak in that month for a brief correction but recovered quickly before rallying to new – and newer – highs. But foreigners kept shying away – until last April when the green bars bottomed. Their 12-month net selling in December contracted to merely $3.5 billion. The bars are itching to go positive.

Historically, the S&P 500 and foreigners’ activity tend to move together, and, from bulls’ perspective, the latter is going in the right direction. The tailwind will get a lot stronger should money-market funds and margin debt begin to cooperate as well. The icing on the cake will be if – big if – shorts begin to leave in frustration (more on this here).

Thanks for reading!